Asia Pacific Fertilizer Market Size, Share, and COVID-19 Impact Analysis, By Type (Organic, Inorganic), By Form (Dry, Liquid), By Application (Agriculture, Horticulture, Gardening, Others), By Country (China, Japan, India, South Korea, Taiwan, Rest of Asia Pacific), and Asia Pacific Fertilizer Market Insights Forecasts to 2032

Industry: AgricultureAsia Pacific Fertilizer Market Insights Forecasts to 2032

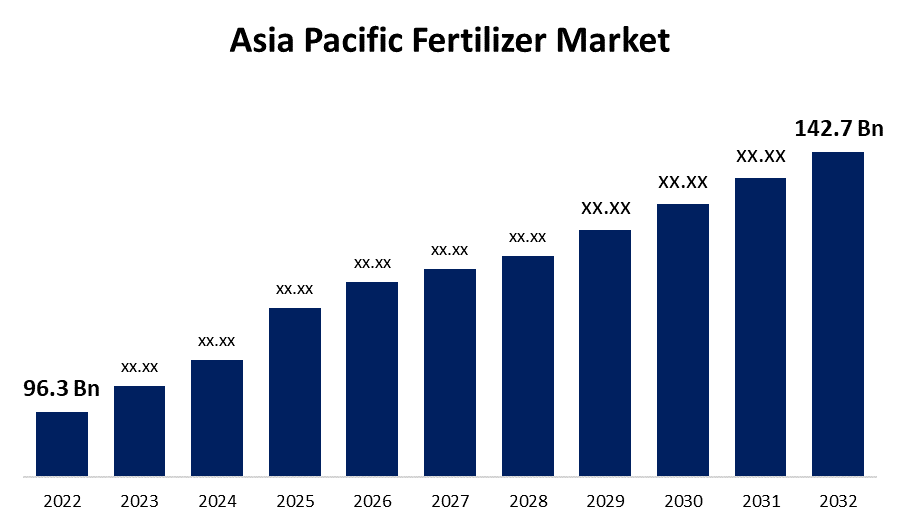

- The Asia Pacific Fertilizer Market Size was valued at USD 96.3 Billion in 2022.

- The Market is Growing at a CAGR of 3.9% from 2022 to 2032.

- The Asia Pacific Fertilizer Market Size is expected to reach USD 142.7 Billion by 2032.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Asia Pacific Fertilizer Market Size is expected to reach USD 142.7 Billion by 2032, at a CAGR of 6% during the forecast period 2022 to 2032.

Market Overview

Given the region's huge agricultural base and vital position in global food production, the Asia Pacific Fertilizer Market is a dominant force in the worldwide agricultural industry. Fertilizers, which are essential for increasing soil fertility and crop productivity, are in great demand in this region, which is home to some of the world's most populous countries. With huge agrarian landscapes in nations such as India and China, there is a significant demand for fertilizers to support high-yield crops. The fertilizer industry includes a wide range of products, from organic fertilizers like compost to synthetic fertilizers like urea, potash, and phosphates. Given the variety of climatic conditions and soil types, there is a constant drive for research and development to create region-specific fertilizer blends. To maintain affordability and food security, governments around the region frequently subsidize fertilizer costs or boost indigenous production. While several of the region's countries are large producers, there is also significant inter-region trade, with countries buying certain fertilizer types based on soil demands. Furthermore, as sustainable agriculture gains prominence, there is an increasing preference for bio-fertilizers and other organic alternatives.

Report Coverage

This research report categorizes the market for Asia Pacific Fertilizer Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific Fertilizer Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Asia Pacific Fertilizer Market.

Asia Pacific Fertilizer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 96.3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6% |

| 2032 Value Projection: | USD 142.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Form, By Application, By Country and COVID-19 Impact Analysis |

| Companies covered:: | Haifa Group, Coromandel International Limited, Bunge Limited, Nutrien Ltd., Wengfu Group, Indian Farmers Fertiliser Cooperative Limited, Israel Chemicals Ltd., Syngenta Group, Sumitomo Chemical Company, Ltd., Sinofert Holdings Limited, Tata Chemicals Ltd., Luxi Chemical Group, China BlueChemical Ltd., Yara International ASA, National Fertilizers Ltd., Xinyangfeng Agricultural Science and Technology Co., Ltd., and others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Asia Pacific region utilizes the most fertilizers internationally, with nations such as China and India among the top consumers. This rising demand has been fueled by the need to increase crop yields in order to feed the world's growing population. Countries such as China are not only large consumers of fertilizer but also big producers and exporters. This multiple purpose has consequences for global fertilizer pricing and trade behavior. Additionally, the use of technologies to enhance fertilizer application is increasing. Drones, IoT devices, and data analytics are being used to help ensure that crops receive adequate nutrition. With changing climatic conditions and the challenges of shrinking arable land, there is a constant push for development into more effective and environmentally friendly fertilizers. Furthermore, as people become more conscious of sustainable agricultural techniques and the health implications of chemical residues in food, there is an increasing trend toward organic farming, which is influencing the fertilizer industry.

Market Segment

- In 2022, the inorganic segment is expected to hold the largest share of Asia Pacific Fertilizer market during the forecast period.

Based on the type, the Asia Pacific Fertilizer Market is classified into organic and inorganic. Among these, the inorganic segment is expected to hold the largest share of the Asia Pacific Fertilizer market during the forecast period. Inorganic fertilizers have been formulated to offer a specified nutrient ratio, allowing for tailored treatments based on the demands of the plant. They also provide a quick nutrient boost, making them helpful for boosting growth in a short period of time. Given the high population density in many Asia Pacific countries, the agricultural sector is under enormous pressure to maximize yields in order to fulfill food demands. Inorganic fertilizers provide a faster remedy to nitrogen deficits, which is critical for many of the region's fast-growing crops. Furthermore, many farmers are better comfortable with organic goods and application rates.

- In 2022, the liquid segment is witnessing the highest CAGR growth over the forecast period.

On the basis of form, the Asia Pacific Fertilizer Market is segmented into dry and liquid. Among these segments, the liquid segment is witnessing the highest CAGR growth over the forecast period. Water-soluble fertilizers that can be applied directly to plants or soil are known as liquid fertilizers. They are suitable for use as foliar feeds, drip irrigation, and other irrigation systems. When used as foliar feeds, liquid fertilizers provide rapid nutrient absorption. They enable precise application, ensuring that plants receive the precise amount of nutrients they require. Furthermore, they can be easily blended with other liquid solutions, allowing farmers to apply insecticides and nutrients simultaneously.

- In 2022, the agriculture segment accounted for the largest revenue share of more than 62.3% over the forecast period.

On the basis of application, the Asia Pacific Fertilizer Market is segmented into agriculture, horticulture, gardening, and others. Among these, the agriculture segment dominates the market with the highest revenue share of 62.3% over the forecast period. Agriculture is the growing of crops for food, fodder, fiber, and fuel. This industry is the backbone of many Asia Pacific economies. The necessity for increased yields to meet the region's increasing food demand has resulted in the widespread usage of fertilizers in agriculture. With its large span of fertile land and diverse climatic zones, the region produces a wide range of crops, each of which necessitates a unique set of nutritional inputs. Because of the high population density in nations such as China, India, Indonesia, and Bangladesh, the agricultural industry is constantly under pressure to maximize production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific Fertilizer Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Haifa Group

- Coromandel International Limited

- Bunge Limited

- Nutrien Ltd.

- Wengfu Group

- Indian Farmers Fertiliser Cooperative Limited

- Israel Chemicals Ltd.

- Syngenta Group

- Sumitomo Chemical Company, Ltd.

- Sinofert Holdings Limited

- Tata Chemicals Ltd.

- Luxi Chemical Group

- China BlueChemical Ltd.

- Yara International ASA

- National Fertilizers Ltd.

- Xinyangfeng Agricultural Science and Technology Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Asia Pacific Fertilizer Market based on the below-mentioned segments:

Asia Pacific Fertilizer Market, By Type

- Organic

- Inorganic

Asia Pacific Fertilizer Market, By Form

- Dry

- Liquid

Asia Pacific Fertilizer Market, By Application

- Agriculture

- Horticulture

- Gardening

- Others

Asia Pacific Fertilizer Market, By Country

- China

- Japan

- India

- South Korea

- Taiwan

- Rest of the Asia Pacific

Need help to buy this report?