Asia-Pacific High Purity Alumina Market Size, Share, and COVID-19 Impact Analysis, By Product (4N, 5N 6N), By Application (LED Bulbs, Semi-conductor, Phosphor, Others), By Country (China, South Korea, Taiwan, Japan, Others), and Asia-Pacific High Purity Alumina Market Insights Forecasts 2023 – 2033

Industry: Chemicals & MaterialsAsia-Pacific High Purity Alumina Market Insights Forecasts to 2033

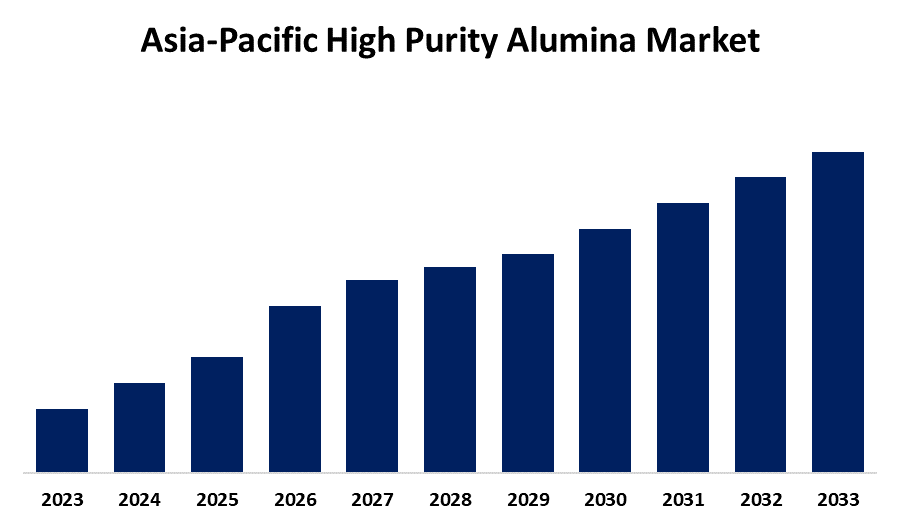

- The Market Size is Growing at a CAGR of 15.88% from 2023 to 2033.

- The Asia-Pacific High Purity Alumina Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The Asia-Pacific High Purity Alumina Market Size is expected to hold a significant Share by 2033, at a CAGR of 15.88% during the forecast period 2023 to 2033.

Market Overview

High-purity alumina (HPA) are high-quality non-metallurgical alumina products. It is an extremely pure form of aluminum oxide, with a purity. Alumina, also known as aluminum oxide (Al2O3), is the primary raw material used to produce metallic aluminum. High-purity alumina is the highest form of aluminum oxide and is used as a base material in the manufacture of sapphire substrates. High-purity alumina has several properties, including high brightness, corrosion resistance, high mechanical strength, good thermal conductivity, and high electrical and insulation resistance. They are primarily used in the electronics and semiconductor industries, specifically in light-emitting diodes (LEDs), LCDs, electronic storage systems, and photovoltaic cells. Furthermore, high-purity alumina is widely used in infrastructure projects such as highways and roads, smartphone applications, and the automotive industry. The demand for semiconductors is primarily influenced by underlying applications such as communication and consumer electronics, with data processing accounting for a significant share of applicability in personal computers, gaming consoles, televisions, iPods, and servers. As a consequence, rising demand for high-definition display screens are going to boost expansion in the Asia-Pacific high-purity alumina market during the forecast period.

Report Coverage

This research report categorizes the market for the Asia-Pacific high-purity alumina market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia-Pacific high-purity alumina market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia-Pacific high-purity alumina market.

Asia-Pacific High Purity Alumina Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.88% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Country |

| Companies covered:: | Altech Chemicals Limited, Nippon Light Metal Company Limited, Sumitomo Chemical Co. Ltd., Sasol Ltd, PSB INDUSTRIES SA, Zibo Xinfumeng Chemicals Co. Ltd., UC RUSAL, China Hongqiao Group Limited, Xuancheng Jingrui New Materials Co. Ltd, Hebei Pengda Advanced Materials Technology Co. Ltd., Kosan Aluminium Extrusion SDN BHD, Aluminum Corp. of China (China), Shandong Xinfa (China), Emirates Global Aluminum, China Power Investment, East Hope Group, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Recent developments in the automotive industry, rapidly growing LED lighting and synthetic sapphire demand, new potential uses of aluminum as an alternative to copper in the power industry, and other factors are expected to drive the growth of the high-purity alumina (HPA) market in Asia-Pacific. Furthermore, the high-purity alumina market continues to grow in the semiconductor industry, as the product is a novel industrial-use material used in the fabrication of semiconductor devices. Applications include communication and consumer electronics, as well as data processing, which is widely used in personal computers, gaming consoles, televisions, iPods, and servers. As such, rising demand for high-definition display screens is expected to drive growth in the Asia-Pacific high-purity alumina market over the forecast period.

Restraining Factors

Superior purity the alumina market is highly capital intensive, making it difficult for new players to enter it. If production costs are high, end products will be expensive and profitability will be low.

Market Segment

- In 2023, the 4N segment accounted for the largest revenue share over the forecast period.

Based on product, the Asia-Pacific high-purity alumina market is segmented into 4N, 5N, 6N. Among these, the 4N segment has the largest revenue share over the forecast period. Alumina is the 4N subcategory of HPA, with a purity level of 99.99%. When compared to other types of HPA, the 4N category is the least expensive. The Asia-Pacific market for lithium-ion batteries, specialty glass, and LED lighting is expected to demand an enormous rise in 4N HPA. Other important applications for 4N HPA include the production of sapphire glass for smartphone screens, lithium-ion battery coatings, optical windows, and watch lenses. One of the market's key segments, 4N HPA, is expected to experience major quantities and margin improvement demand.

- In 2023, the LED Bulbs segment is witnessing significant growth over the forecast period.

Based on application, the Asia-Pacific high-purity alumina market is segmented into LED Bulbs, semi-conductors, phosphors, others. Among these, the LED Bulbs segment is witnessing significant growth over the forecast period. LED bulbs are made from artificial sapphire substrates formed using HPA. Sapphire ingots are cored and cut into thin slices to make the wafers used to manufacture LEDs. In comparison to traditional incandescent lighting, the demand for LED bulbs has skyrocketed. Implementing strict laws increases the market penetration of LEDs for energy-efficient lighting in Asia-Pacific. Furthermore, a government campaign promoting the use of LED lights by the public to reduce energy consumption is expected to increase demand for LED bulbs.

- In 2023, the China segment accounted for the largest revenue share over the forecast period.

Based on region, the China has the largest revenue share over the forecast period. Since its increasing use in LED lighting, semiconductors, lithium-ion batteries, photovoltaic cells, plasma display screens, phosphor, optical lenses, and smartphone sapphire glass, among other things. Furthermore, the high-purity alumina market continues to grow in the semiconductor industry, as the product is a novel industrial-use material used in the fabrication of semiconductor devices. In addition, the demand for semiconductors is primarily influenced by underlying applications such as communication and consumer electronics, as well as data processing, which accounts for an important proportion of the applicability in personal computers, gaming consoles, televisions, iPods, and servers. As a consequence, rising demand for high-definition display screens is expected to drive growth in the China high-purity alumina market over the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia-Pacific high-purity alumina market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Altech Chemicals Limited

- Nippon Light Metal Company Limited

- Sumitomo Chemical Co. Ltd.

- Sasol Ltd

- PSB INDUSTRIES SA

- Zibo Xinfumeng Chemicals Co. Ltd.

- UC RUSAL

- China Hongqiao Group Limited

- Xuancheng Jingrui New Materials Co. Ltd

- Hebei Pengda Advanced Materials Technology Co. Ltd.

- Kosan Aluminium Extrusion SDN BHD

- Aluminum Corp. of China (China)

- Shandong Xinfa (China)

- Emirates Global Aluminum

- China Power Investment

- East Hope Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Asia-Pacific high purity alumina market based on the below-mentioned segments:

Asia-Pacific High Purity Alumina Market, By Product

- 4N

- 5N

- 6N

Asia-Pacific High Purity Alumina Market, By Application

- LED Bulbs

- Semiconductor

- Phosphor

- Others

Asia-Pacific High Purity Alumina Market, By Country

- China

- South Korea

- Taiwan

- Japan

- Others

Need help to buy this report?