Asia Pacific Industrial Diamond Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Diamond and Synthetic Diamond), By Application (Cutting, Grinding, Polishing, Drilling, Machining, Lapping, and Honing), and by Asia Pacific Industrial Diamond Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsAsia Pacific Industrial Diamond Market Insights Forecasts to 2033

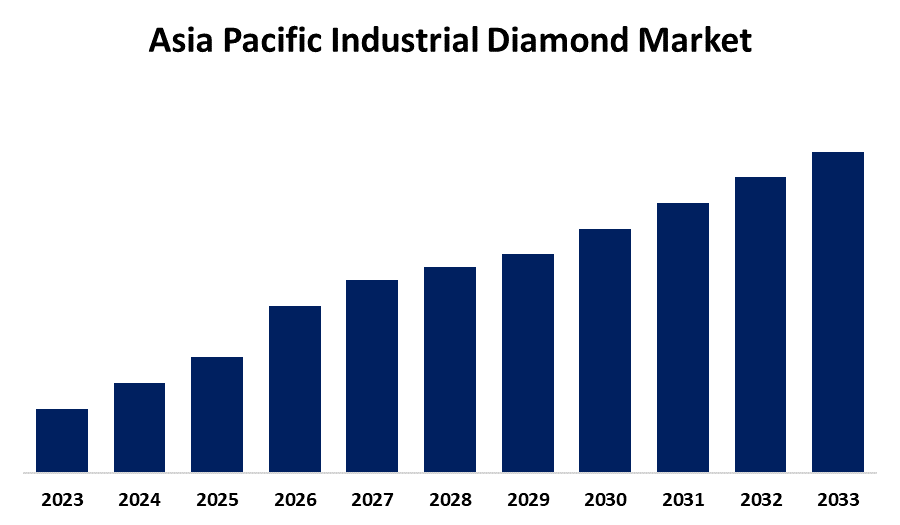

- The Asia Pacific Industrial Diamond Market Size is growing at a CAGR of 4.1% from 2023 to 2033

- The Asia Pacific Industrial Diamond Market Size is Expected to Hold a Significant Share By 2033

Get more details on this report -

The Asia Pacific Industrial Diamond Market Size is Anticipated to Hold a Significant Share By 2033, Growing at a CAGR of 4.1% from 2023 to 2033.

Market Overview

The Asia Pacific industrial diamond market refers to the regional market for diamonds that are primarily used for industrial applications, such as cutting, grinding, drilling, and polishing. Industrial diamonds are synthetic or natural diamonds with properties that make them ideal for various abrasive processes. This market includes demand across sectors like manufacturing, automotive, electronics, and construction, where high-performance materials are essential for precision and efficiency. Several factors drive the growth of the Asia Pacific industrial diamond market. The rapid industrialization and increasing manufacturing activities in countries like China and India are significant contributors. Additionally, the rising demand for high-precision tools in industries such as automotive, electronics, and construction continues to bolster market expansion. The growing trend of technological advancements in manufacturing, including the use of industrial diamonds for advanced machinery, is also a key factor. Government initiatives play a crucial role in shaping the market's trajectory. Policies aimed at boosting manufacturing capabilities, particularly in countries like China and India, have led to increased demand for high-quality industrial materials, including diamonds. Furthermore, regulatory frameworks focusing on sustainable mining practices and environmental considerations influence the supply chain and drive innovation in synthetic diamond production.

Report Coverage

This research report categorizes the market for the Asia Pacific industrial diamond market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific industrial diamond market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific industrial diamond market.

Asia Pacific Industrial Diamond Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Quality Engineered Products, Diagem, Sumitomo Electric Industries, Asahi Diamond Industrial, CG International, Palmqvist, Hitachi Chemical, De Beers Industrial Diamond Division, Tobu Diamond Products, HYPRES, TOMEI, Smith International, Royal DSM, Element Six, Nippon Diamond Industrial, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the Asia Pacific industrial diamond market is driven by several key factors. Rapid industrialization and infrastructure development, particularly in countries like China and India, are increasing demand for industrial diamonds in cutting, grinding, and drilling applications. The expansion of the electronics and semiconductor industries further fuels market growth, as industrial diamonds are essential for precision machining. Advancements in synthetic diamond production enhance cost efficiency and supply stability. Additionally, rising investments in mining, oil & gas, and automotive sectors contribute to demand. Favorable government policies supporting manufacturing and technological advancements also play a significant role in market expansion.

Restraining Factors

The Asia Pacific industrial diamond market faces restraints such as high production costs, fluctuating raw material prices, and environmental concerns related to mining. Limited availability of natural diamonds, regulatory restrictions, and competition from alternative superabrasives further hinder market growth and expansion.

Market Segmentation

The Asia Pacific industrial diamond market share is classified into type and application.

- The synthetic diamonds segment is expected to hold the largest market share through the forecast period.

The Asia Pacific industrial diamond market is segmented by type into natural diamonds and synthetic diamonds. Among these, the blood pressure cuffs segment is expected to hold the largest market share through the forecast period. This dominance is driven by cost-effectiveness, consistent quality, and advancements in manufacturing technologies. Synthetic diamonds offer superior hardness, thermal conductivity, and durability, making them ideal for industrial applications such as cutting, grinding, and drilling.

- The cutting segment dominates the market with the largest market share over the predicted period.

The Asia Pacific industrial diamond market is segmented by application into cutting, grinding, polishing, drilling, machining, lapping, and honing. Among these, the cutting segment dominates the market with the largest market share over the predicted period. Industrial diamonds are extensively used in cutting applications across various industries, including construction, automotive, aerospace, and electronics, due to their exceptional hardness and wear resistance. The growing demand for precision cutting tools in manufacturing and infrastructure development further drives this segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific industrial diamond market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Quality Engineered Products

- Diagem

- Sumitomo Electric Industries

- Asahi Diamond Industrial

- CG International

- Palmqvist

- Hitachi Chemical

- De Beers Industrial Diamond Division

- Tobu Diamond Products

- HYPRES

- TOMEI

- Smith International

- Royal DSM

- Element Six

- Nippon Diamond Industrial

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-added resellers (VARs)

Market Segment

This study forecasts revenue at the Asia Pacific, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Asia Pacific industrial diamond market based on the below-mentioned segments:

Asia Pacific Industrial Diamond Market, By Type

- Natural Diamond

- Synthetic Diamond

Asia Pacific Industrial Diamond Market, By Application

- Cutting

- Grinding

- Polishing

- Drilling

- Machining

- Lapping

- Honing

Need help to buy this report?