Asia Pacific Vegan Tuna Market Size, Share, and COVID-19 Impact Analysis, By Product (Frozen and Canned), By End-User (Household and Foodservice), and Asia Pacific Vegan Tuna Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesAsia Pacific Vegan Tuna Market Insights Forecasts to 2033

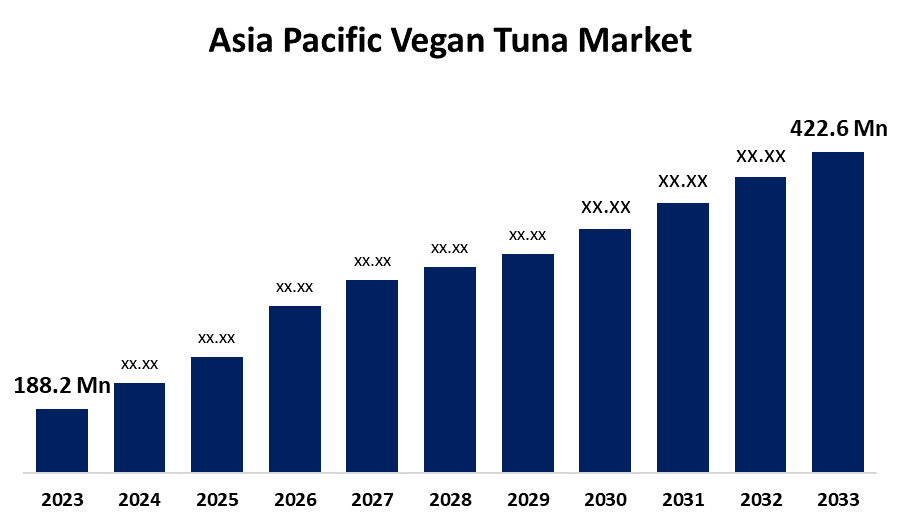

- The Asia Pacific Vegan Tuna Market Size was valued at USD 188.2 Million in 2023.

- The Market Size is Growing at a CAGR of 8.43% from 2023 to 2033

- The Asia Pacific Vegan Tuna Market Size is Expected to Reach USD 422.6 Million by 2033

Get more details on this report -

The Asia Pacific Vegan Tuna Market Size is Anticipated to Reach USD 422.6 Million by 2033, Growing at a CAGR of 8.43% from 2023 to 2033

Market Overview

The Asia Pacific vegan tuna market is a sector of the food market that focuses on plant-based alternatives to traditional tuna. Vegan tuna, which is primarily made from soy, seaweed, and other plant proteins, offers a sustainable, cruelty-free alternative to traditional seafood. It caters to customers who are searching for healthier, environmentally friendly food as well as those following a vegan, vegetarian, or flexitarian diet. The Asia Pacific vegan tuna market is growing due to several factors. Growing environmental concerns, such as overfishing and ocean pollution, have increased demand for seafood products made from plants. People are choosing more sustainable products, such as vegan tuna, as they become more conscious of the environmental costs of their food consumption. The market is expanding as a result of consumers' growing health consciousness, which makes them favor foods with lower fat and no cholesterol. The demand for plant-based seafood products is also rising as a result of the flexitarian movement, which encourages people to consume less meat but not entirely give it up. Governments across the Asia Pacific region are promoting plant-based food items like vegan tuna to promote sustainable consumption and reduce the food industry's ecological footprint. Policies and incentives, coupled with rising consumer demand for plant-based substitutes, are driving the growth of the vegan tuna market.

Report Coverage

This research report categorizes the market for the Asia Pacific vegan tuna market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Asia Pacific vegan tuna market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Asia Pacific vegan tuna market.

Asia Pacific Vegan Tuna Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 188.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.43% |

| 2033 Value Projection: | USD 422.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Unlimeat, Vgarden, Yumeat, Century Pacific Food (CNPF), Ocean Hugger Foods, Eat Just (formerly Hampton Creek), and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Growing consumer concerns about sustainability and health are the primary factors influencing the Asia Pacific vegan tuna market. Growing concerns about pollution, ocean depletion, and overfishing are driving consumers to look for plant-based seafood substitutes. Environmental activists are paying more and more attention to vegan tuna because it is a cruelty-free and environmentally friendly substitute for regular tuna. The market is also driven by rising health-conscious consumption, which places a focus on foods that are lower in fat, cholesterol, and vegetables. The region's need for vegan tuna is also greatly influenced by the flexitarian trend of eating less meat while occasionally consuming animal products.

Restraining Factors

The vegan tuna market faces limiting factors, including its premium price, evolving flavor and texture, limited accessibility in Asia Pacific markets, and competition from other vegetable-based seafood options, which may limit its popularity among price-conscious consumers and dilute customer demand.

Market Segmentation

The Asia Pacific vegan tuna market share is classified into product and end-user.

- The canned segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Asia Pacific vegan tuna market is segmented by product into frozen and canned. Among these, the canned segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Vegetarian canned tuna is popular due to its convenience, long life span, and taste compared to original canned tuna. It's a popular choice for plant-based consumers, and its simplicity in storage and portability contributes to its popularity in the convenience food trend.

- The household segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the Asia Pacific vegan tuna market is divided into household and foodservice. Among these, the household segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. With more consumers turning to plant-based diets and healthier, more sustainable food choices, vegan tuna is now a top choice for home preparation. Households are the main users of vegan tuna, as it is simple to prepare, versatile, and an easy alternative to traditional tuna in a range of dishes like salads, sandwiches, and sushi.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Asia Pacific vegan tuna market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unlimeat

- Vgarden

- Yumeat

- Century Pacific Food (CNPF)

- Ocean Hugger Foods

- Eat Just (formerly Hampton Creek)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2023, three vegan tuna products were added to Unlimeat's portfolio from South Korea. These products contain plant-derived DHA, an omega-3 fatty acid commonly present in traditional tuna, and are made from soy protein, wheat fiber, and oat fiber. Red pepper tuna, vegetable tuna, and original tuna are among the product varieties.

Market Segment

This study forecasts revenue at Asia Pacific, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Asia Pacific vegan tuna market based on the below-mentioned segments:

Asia Pacific Vegan Tuna Market, By Product

- Frozen

- Canned

Asia Pacific Vegan Tuna Market, By End-User

- Household

- Foodservice

Need help to buy this report?