Global Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Asset Type (Digital and In-Transit Equipment), By Application (Aviation, Infrastructure, Enterprise, and Healthcare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Asset Management Market Insights Forecasts to 2033

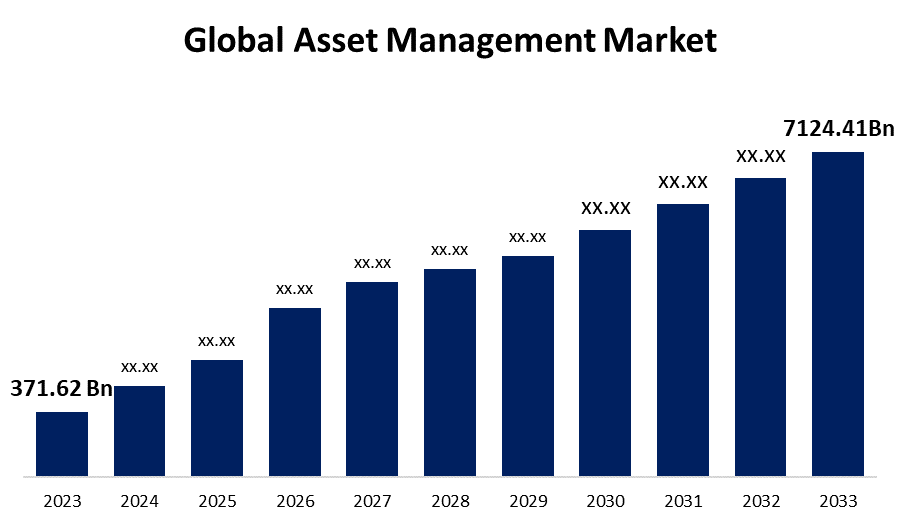

- The Global Asset Management Market Size was Valued at USD 371.62 Billion in 2023

- The Market Size is Growing at a CAGR of 34.36% from 2023 to 2033

- The Worldwide Asset Management Market Size is Expected to Reach USD 7124.41 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Asset Management Market Size is Anticipated to Exceed USD 7124.41 Billion by 2033, Growing at a CAGR of 34.36% from 2023 to 2033.

Market Overview

Asset management is the technique of purchasing, disposing of, and managing investments following particular risk tolerances to increase wealth gradually. This service is provided to clients by asset management specialists. They could also be referred to as financial advisors or portfolio managers. While some are self-employed, others are employed by investment banks, asset management firms, or other financial institutions. Asset management firms compete to meet institutional and individual investors' needs. Financial institutions, like banks, frequently grant check-writing rights, credit cards, debit cards, margin loans, and brokerage services to their account holders. Asset managers use various methods to manage investments, including asset allocation, risk management strategies, and market analysis. To meet their clients' goals, they also utilize a variety of investment vehicles, including exchange-traded funds (ETFs), mutual funds, and alternative investments. Keeping an eye on customers' investments, making trading choices, and carrying out trades falls to a group of portfolio managers and financial analysts. To ensure that asset managers provide the greatest service and protect the interests of their clients, the asset management sector is highly competitive and regulated. A growing requirement for optimum asset use has prompted firms to look for efficient asset management solutions, which has enlarged the global asset management market. Furthermore, businesses can benefit from increased flexibility, scalability, and accessibility owing to the growing popularity of cloud-based IT asset management systems.

Report Coverage

This research report categorizes the market for the global asset management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global asset management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global asset management market.

Global Asset Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 371.62 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 34.36% |

| 2033 Value Projection: | USD 7124.41 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 290 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Asset Type, By Application |

| Companies covered:: | BlackRock, The Vanguard Group, State Street Global Advisors, Fidelity Investments, Allianz Global Investors, J.P. Morgan Asset Management, Capital Group Companies, Amundi Asset Management, Legal & General Investment Management, Franklin Templeton Investments, Invesco Ltd, T. Rowe Price Group, Northern Trust Corporation, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Technological advancements, the industry's efforts at test asset management, and the quick evolution of the digital landscape are all credited with the market's rise. Expanding industry growth requires demonstrating a positive cycle of leadership visions, including a strong talent model, employee resilience, operational improvements, stakeholder alignment, and culture strengthening. Owing to digitalization, organizations have a lot of opportunities to improve customer-centric connections. The asset-intensive company has to contend with enhanced competitiveness and dependence on the performance of the companies under their administration. Additionally, asset management plays a critical role in maximizing the life cycle of assets, from purchase to disposal, by methodically identifying the optimal investments to make to ensure portfolio growth. The desire to reduce maintenance downtime, the requirement for effective asset tracking and management, and the growing demand for optimal asset usage are driving the global asset management market.

Restraining Factors

The high cost of deploying new asset management systems is one of the primary obstacles. This can be particularly significant for small and medium-sized enterprises with tight budgets. Additionally, businesses often need help integrating the new asset management systems with their current IT setup. An additional obstacle is the maintenance expenses linked with asset management systems, as they necessitate consistent maintenance to ensure their efficient operation, thus enhancing the system's total cost. Furthermore, it could be challenging for businesses to find and keep skilled workers who can maintain and run these systems.

Market Segmentation

The global asset management market share is segmented into component, asset type, and application.

- The solutions segment dominates the market with the largest market share through the forecast period.

Based on the component, the global asset management market is segmented into solutions and services. Among these, the solutions segment dominates the market with the largest market share through the forecast period. Global digitalization is accelerating, and the GPS segment's revenues will be driven by the availability of more data and images through global information networks. The efficiency, upkeep, and development of assets are all increased when GPS is integrated into enterprises or organizations. The segment will grow as a result of an increase in the use of asset management solutions in the manufacturing, IT, energy, healthcare, and transportation sectors. The introduction of advanced technologies like AI, sensors, telematics, and others into these solutions is fostering a favorable atmosphere for market expansion.

- The digital segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the asset type, the global asset management market is segmented into digital and in-transit equipment. Among these, the digital segment is anticipated to grow at the fastest CAGR growth through the forecast period. Businesses are embracing digital services and solutions at a rapid pace to standardize processes and reduce overall operating costs. For vendors of digital products and services, the ongoing trend of digitization is positive. The need for digital solutions is anticipated to increase during the forecast period due to growing quantities and densities of digital assets across businesses. Businesses are being pushed to expand their use of digital asset management solutions by the growing amount of digital data and assets in their companies.

- The aviation segment accounted for the largest revenue share through the forecast period.

Based on the application, the global asset management market is segmented into aviation, infrastructure, enterprise, and healthcare. Among these, the aviation segment accounted for the largest revenue share through the forecast period. The commercial airline operators' greater focus on growing their service offerings in response to the growing demand for aerial commercial and in-flight passenger transportation can be attributed to an increase in asset management in the aviation market. The major airlines operating in commercial airspace are looking for methods to contract out asset management. GR-aware software suites, tracking systems, and predictive and prescriptive maintenance solutions are a few important aviation management solutions that are being used more and more.

Regional Segment Analysis of the Global Asset Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global asset management market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global asset management market over the predicted timeframe. Organizations in North America including insurance firms, foundations, pension funds, endowments, and government agencies depend heavily on asset management services. To meet the distinct investment goals of their clients, institutional asset managers oversee enormous investment portfolios that include a variety of asset types, including stocks, bonds, real estate, and alternative assets. Through gradual capital accumulation, these services aim to provide retirement security. The expansion of the asset management market in North America is being driven by investment management, wealth management, and retirement.

Asia Pacific is expected to grow at the fastest CAGR growth of the global asset management market during the forecast period. This is attributed to the people in the area are becoming more conscious of and knowledgeable about financial products and investment opportunities. Consequently, the demand for asset management services has increased as traditional savings strategies have been replaced by investments in mutual funds, stocks, and other asset classes. Therefore, the acceptance and expansion of the asset management sector are driven by the rise of the middle class, pensions, and retirement savings, as well as rising institutional investor engagement.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global asset management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BlackRock

- The Vanguard Group

- State Street Global Advisors

- Fidelity Investments

- Allianz Global Investors

- J.P. Morgan Asset Management

- Capital Group Companies

- Amundi Asset Management

- Legal & General Investment Management

- Franklin Templeton Investments

- Invesco Ltd

- T. Rowe Price Group

- Northern Trust Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Siemens and IBM collaborated to accelerate sustainable product development and operations.The two companies are developing a new systems engineering and asset management combined software solution to support traceability and sustainable product development – linking domains including mechanical, electronics, electrical, and software engineering.

- In January 2022, To maximize profits and cut expenses, Ambit Asset Management launched the "Ambit TenX Portfolio" for high-net-worth investors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global asset management market based on the below-mentioned segments:

Global Asset Management Market, By Component

- Solutions

- Services

Global Asset Management Market, By Asset Type

- Digital

- In-Transit Equipment

Global Asset Management Market, By Application

- Aviation

- Infrastructure

- Enterprise

- Healthcare

Global Asset Management Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

• Which are the key companies that are currently operating within the market?BlackRock, The Vanguard Group, State Street Global Advisors, Fidelity Investments, Allianz Global Investors, J.P. Morgan Asset Management, Capital Group Companies, Amundi Asset Management, Legal & General Investment Management, Franklin Templeton Investments, Invesco Ltd, T. Rowe Price Group, Northern Trust Corporation, and Others.

-

• What is the size of the global asset management market?The Global Asset Management Market Size is Expected to Grow from USD 371.62 Billion in 2023 to USD 7124.41 Billion by 2033, at a CAGR of 34.36% during the forecast period 2023-2033.

-

• Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global asset management market over the predicted timeframe.

Need help to buy this report?