Global ATM Managed Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Cash Management, ATM Monitoring, ATM Maintenance, ATM Replenishment, and Others), By ATM Type (Onsite ATMs, Offsite ATMs, Worksite ATMs, Mobile ATMs), By End-User (Banks and Financial Institutions, Independent ATM Deployers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal ATM Managed Services Market Insights Forecasts to 2033

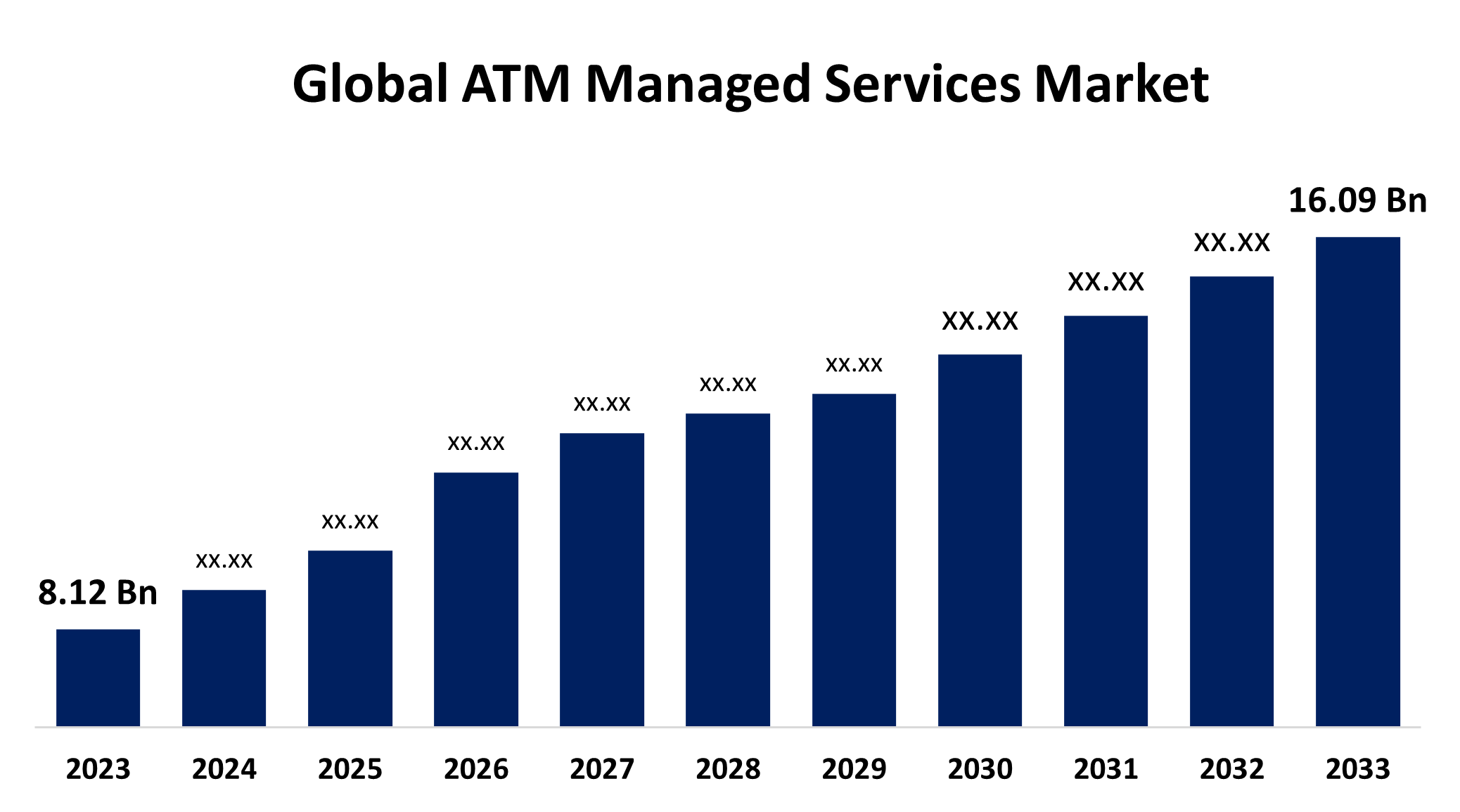

- The Global ATM Managed Services Market Size Was Estimated at USD 8.12 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 7.08% from 2023 to 2033

- The Worldwide ATM Managed Services Market Size is Expected to Reach USD 16.09 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global ATM Managed Services Market Size was valued at USD 8.12 billion in 2023 and is expected to reach USD 16.09 Billion by 2033, Growing at a CAGR of 7.08% from 2023 to 2033. The global market of ATM managed services is expanding due to the widespread availability of ATMs in both urban and rural areas, combined with the increasing intricacies of operations, emphasizing the need for robust ATM management services.

Market Overview

ATM managed services describe a complete range of outsourced solutions offered to banks and financial entities, in which a third-party firm assumes full accountability for the installation, upkeep, operation, and oversight of their ATM networks. This encompasses duties such as cash restoration, network monitoring, technical support, security management, and facilitating seamless customer transactions, enabling the bank to focus on its primary business activities while delegating the daily routine ATM operations to the service provider.

The increasing need for short-time cash transactions, and rising demands for efficient and secure transaction procedures. Financial institutions effectively leverage outsourcing ATM management to lower operational costs and improve customer service. The market encompasses various services from fundamental maintenance to comprehensive outsourcing, where the factors of ATM operation, software, hardware, and cash management services are managed by service providers.

Additionally, the widespread availability of ATMs enhances their easiness of consumer approach with high efficiency, According to RBI data, in 2024, there were 21500 ATMs serving across the India region, it became the cornerstone for modern banking by providing seamless access to financial services anytime, anywhere. Which helps to boost the security in the transaction and banking sector while demanding ATM management services.

Report Coverage

This research report categorizes the global ATM managed services market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ATM-managed services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ATM managed services market.

Global ATM Managed Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.12 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.08% |

| 023 – 2033 Value Projection: | USD 16.09 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Service Type, By ATM Type, |

| Companies covered:: | AGS Transact Technologies Ltd., Cashlink Global Systems Pvt. Ltd., NCR Corporation, Fujitsu Limited, Cardtronics, Fiserv, Inc., GRG Banking Equipment Co., Ltd., CMS Info Systems Ltd., Euronet Worldwide, Inc., Hitachi-Omron Terminal Solutions, Corp., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread presence of ATMs in urban and rural regions, along with the growing complexity of operations, highlights the necessity for strong ATM management services. In this context, ensuring adherence to regulatory standards is vital, requiring attentive oversight and proficient management. These services simplify processes, improve security, and guarantee reliable access, addressing the varied needs of the community. Additionally, financial institutions are progressively motivated by the necessity to reduce operational expenses linked to ATMs while concurrently improving customer experience. By enhancing ATM upkeep and administration, they can greatly reduce costs. Advanced technologies and effective service models help lower costs while providing smooth, user-friendly experiences. These enhancements guarantee that customers can easily access their money, enhancing satisfaction and loyalty to the institution. This can be accomplished by utilizing the skills of managed service providers who introduce efficiency and technological innovations to ATM functions.

Moreover, an increase in ATM networks in developing economies. As financial inclusion efforts increase, results in a significant growth in the installation of ATMs in rural and semi-urban regions to offer banking services to the unbanked community. This has generated a growing need for ATM-managed services to guarantee operational efficiency and availability. Additionally, the growing inclination towards cashless payments and digital banking options has not reduced the importance of ATMs, which still serve a crucial function in cash withdrawal and various financial services.

Restraints & Challenges

As ATM machines are becoming part of banking operations, they are increasingly experiencing concerns related to cyber-attacks, thefts, cybercrimes, and other negative activities. Due to the continuous tough nature of cyber threats and fraud, banks and financial institutions are becoming worried and investing in security services. Therefore, financial institutions need to heavily invest in sophisticated security measures and ongoing surveillance to safeguard ATM operations. The major expenses and activities linked to these safeguards may discourage service providers, hindering industry growth. Moreover, security incidents and breaches can dent customer trust, making it crucial to tackle these problems to realize the industry’s full potential.

Market Segmentation

The global ATM managed services market share is classified into service type, ATM type, and end-user.

- The cash management segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the service type, the global ATM managed services market is classified into cash management, ATM monitoring, ATM maintenance, ATM replenishment, and others. Among these, the cash management segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance is attributed due to the essential activities for optimal ATM functioning. These services are involved with cash forecasting, collection, and optimization, ensuring ATMs have sufficient cash to meet demands while minimizing excess holdings. The growing complexity of cash logistics and the need for efficient cash-handling processes drive demand for these services. Advanced technology in ATM networks, such as smart cash management systems and real-time monitoring, further enhances cash utilization and cost reduction, solidifying this segment's prominence.

- The offsite ATMs segment dominates the market in 2023 and is expected to grow at a notable CAGR during the forecast period.

Based on the ATM type, the global ATM managed services market is categorized into onsite ATMs, offsite ATMs, worksite ATMs, and mobile ATMs. Among these, the offsite ATM segment dominates the market in 2023 and is expected to grow at a notable CAGR during the forecast period. This is due to, their lower overhead costs and greater scalability, making them attractive to financial institutions. These ATMs can be strategically placed in high-traffic locations like shopping malls, airports, and convenience stores, with minimal infrastructure requirements, which appeals to independent operators. Offsite ATMs extend banking services beyond branch walls, catering to a wide customer base. Their strategic placement enhances customer convenience and supports bank outreach efforts. Efficient managed services ensure their availability and performance, maximizing reach while controlling costs.

- The banks and financial institutions segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period.

Based on the end-user, the global ATM managed services market is divided into banks and financial institutions, independent ATM deployers, and others. Among these, the banks and financial institutions segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period. This segmental growth is driven by their dependency on cash withdrawal by a large customer base sifting towards ATMs machines this well-developed infrastructure and widespread network offers banking services to their customer. This reliance is driven by operational efficiency, enhanced security, improved customer satisfaction, scalability, and regulatory compliance. These services optimize ATM operations, reduce costs, ensure security, and enhance customer experience, making them crucial for these institutions. Scalability and compliance also support their extensive ATM networks, which are significant factors for influencing their investment in ATM-managed services.

Regional Segment Analysis of the Global ATM Managed Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

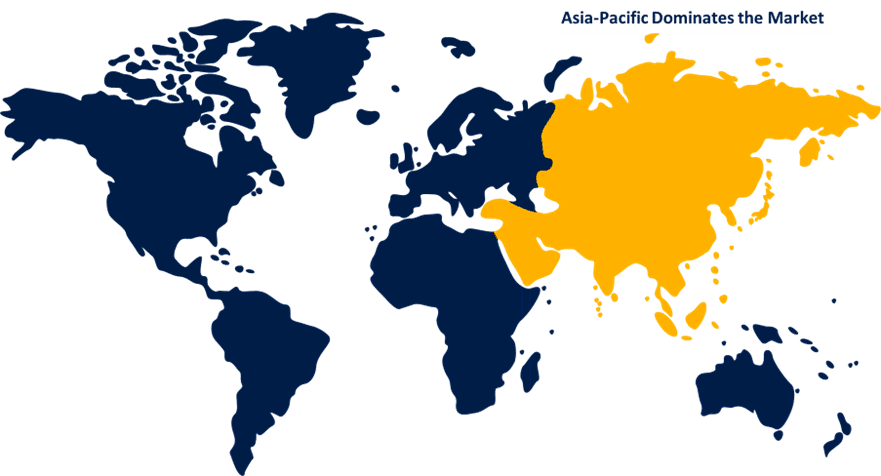

Asia-Pacific is projected to hold the dominant share of the global ATM-managed services market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the dominant share of the global ATM managed services market over the predicted timeframe. This regional dominance is attributed to the increasing urbanization along with the rise in the need for ATM services. this rapid urbanization is fuelled by, the arrival of migrants to urban areas, and this population growth significantly boosts the demand for ATM services. As urban populations grow, financial institutions are deploying more ATMs to cater to the increasing need for convenient cash access. The rise in residential and commercial developments necessitates accessible banking facilities. Also, the arrival of migrants to urban areas increases the demand for ATMs, ensuring that both existing residents and newcomers have easy access to their financial needs. This trend underscores the critical role of ATMs in urbanized regions.

Additionally, the growth of digital banking across the Asia-Pacific region is playing a major role in the ATM services in the banking industry by providing digital payment services According to the statistical data by RBI, there were 67,224 ATMs operating across the urban cities of India during 2024. Whereas, cash remains important in the rest part of the region excluding urban areas, particularly in rural areas with limited banking access. This necessitates efficient currency management, replenishment, and incident management to keep ATMs operational and accessible. Which is fuelling regional dominance.

The North American ATM managed services market is expected to grow with a significant CAGR during the forecasting period. This segmental growth is attributed to its well-established banking infrastructure and high ATM density, representing a developed market. This growth is driven by the need to advance existing infrastructure, enhance security, and adopt advanced technologies. The presence of a well-developed ATM network in the U.S. allows to adoption of restoration and maintenance services of ATM machines, perceiving financial institutions optimizing operations through managed services. Moreover, The increasing adoption of these services and the presence of major market players such as Paragon Application Systems, ATOS, Toshiba TEC, Cardtronics, Fiserv, and Euronet Worldwide, further fuel regional growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ATM managed services market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AGS Transact Technologies Ltd.

- Cashlink Global Systems Pvt. Ltd.

- NCR Corporation

- Fujitsu Limited

- Cardtronics

- Fiserv, Inc.

- GRG Banking Equipment Co., Ltd.

- CMS Info Systems Ltd.

- Euronet Worldwide, Inc.

- Hitachi-Omron Terminal Solutions, Corp.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, AGS Transact Technologies Limited renewed its ATM management contract with a leading private sector bank, introducing a hybrid fee model projected to generate Rs 30 crore annually. This model, combining transaction-based and fixed fees, showcases AGS Transact's adaptability and leadership in the ATM/CRM outsourcing industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global ATM managed services market based on the below-mentioned segments:

Global ATM Managed Services Market, By Service Type

- Cash Management

- ATM Monitoring

- ATM Maintenance

- ATM Replenishment

- Others

Global ATM Managed Services Market, By ATM Type

- Onsite ATMs

- Offsite ATMs

- Worksite ATMs

- Mobile ATMs

Global ATM Managed Services Market, By End-User

- Banks and Financial Institutions

- Independent ATM Deployers

- Others

Global ATM Managed Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global ATM managed services market over the forecast period?The global ATM managed services market size was estimated at USD 8.12 billion in 2023 and is expected to reach USD 16.09 billion by 2033, growing at a CAGR of 7.08% from 2023 to 2033.

-

2. Which region holds the largest share of the global ATM managed services market?Asia-Pacific is estimated to hold the largest share of the global ATM managed services market over the predicted timeframe.

-

3. Who are the top key players in the global ATM managed services market?AGS Transact Technologies Ltd., Cashlink Global Systems Pvt. Ltd., NCR Corporation, Fujitsu Limited, Cardtronics, Fiserv, Inc., GRG Banking Equipment Co., Ltd., CMS Info Systems Ltd., Euronet Worldwide, Inc., Hitachi-Omron Terminal Solutions, Corp., and Others.

Need help to buy this report?