Australia Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Product (Anhydrous Ammonia and Aqueous Ammonia), By Application (Fertilizers, Textiles, Refrigerant Gases, Medicines, Domestic and Industrial Cleaning, and Others), and Australia Ammonia Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsAustralia Ammonia Market Insights Forecasts to 2033

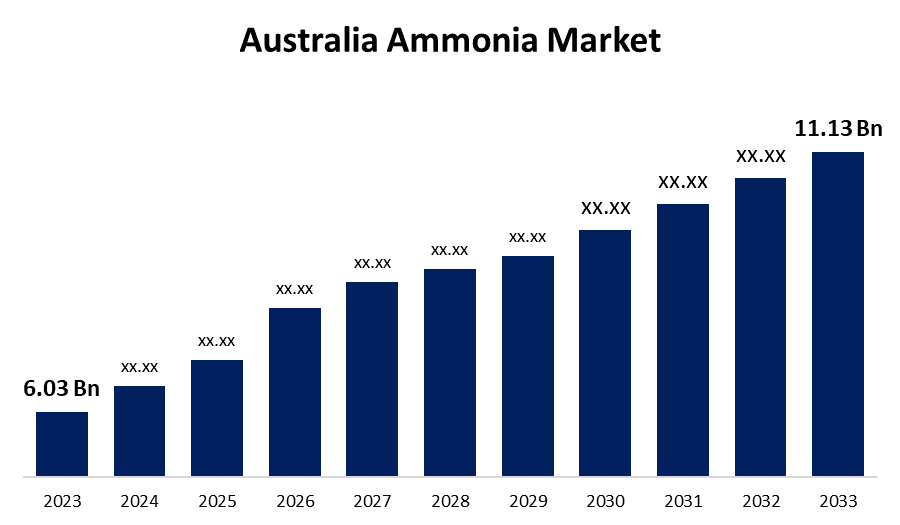

- The Australia Ammonia Market Size was valued at USD 6.03 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.32% from 2023 to 2033

- The Australia Ammonia Market Size is Expected to Reach USD 11.13 Billion by 2033

Get more details on this report -

The Australia Ammonia Market Size is Anticipated to Reach USD 11.13 Billion by 2033, Growing at a CAGR of 6.32% from 2023 to 2033.

Market Overview

Ammonia is one of the nitrogenous compounds that belong to the formula NH3. It is a pungent, colorless gas with a strongly characteristic bitter smell. It can be viewed as common natural air, plants, soil, and animals, including humans, but it can also be manufactured. In the human body, the synthesis of ammonia occurs during metabolism, as the body breaks down food especially protein into amino acids and then converts the ammonia into urea. Household ammonia is also referred to as ammonium hydroxide; this chemical is a mixture mainly used in various cleaning products for breaking down stains such as cooking grease and other stains. Australia's ammonia ecosystem has complex soils influenced by the availability of natural gas and agricultural demand. The region relies on the extraction of natural gas for the production of ammonia, mainly used to produce fertilizers in agriculture.

Report Coverage

This research report categorizes the market for the Australia ammonia based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia ammonia market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia ammonia market.

Australia Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.03 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.32% |

| 2033 Value Projection: | USD 11.13 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application. |

| Companies covered:: | Incitec Pivot Limited, Yara International ASA, Orica Limited, Wesfarmers Chemicals, Energy & Fertilisers, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The use of ammoniated fertilizers in agriculture in mainland Australia on a large scale in order to improve yield and face the increasing demand for food. Ammonia's increased percentage in household cleaners is a good asset for household cleaners, and it is used for household cleaning products like window cleaners, bathroom purifiers, drains, toilet cleaning, and refinery furnaces. Increased generation of income and better standards for life are the other major factors that are anticipated to boost the growth of the ammonia market during the whole of the forecasted period. The industrial wash towards sustainable practices has made ammonia increasingly important in green technologies used in renewable energy, such as hydrogen production. Trends in the industry include a shift to sustainability with a focus on environmental reduction. Based on geographical location and heavy trade ties, Australia has great relevance in the ammonia industry, and it impacts the development of technology and exports.

Restraining Factors

The Australian agricultural sector heavily relies on crop imports from China and other countries, impacting the sales of ammonia for crop production in regions like Queensland and Victoria. This dependence is expected to limit the growth of Australia's ammonia market during the forecast period. Additionally, the use of ammonia as a refrigerant poses health risks, including freezing over body parts and causing thermal injuries, skin irritation, and respiratory distress, further constraining market expansion in Australia.

Market Segmentation

The Australia ammonia market share is classified into product and application.

- The anhydrous ammonia segment is expected to hold the largest market share through the forecast period.

The Australia ammonia market is segmented by product into anhydrous ammonia and aqueous ammonia. Among these, the anhydrous ammonia segment is expected to hold the largest market share through the forecast period. It is relatively easy to use and accessible to growers. However, NH3 can be dangerous if not handled properly. This is attributed to its simplicity in application and availability to farmers. The use of NH3-based nitrogenous fertilizers increases yields, crop protection, and crop cycles. Dehydrated fertilizers are highly used in agriculture due to their nitrogenous content of 82%. However, it is more effective in tropical than tropical climates.

- The fertilizer segment is expected to dominate the Australia ammonia market during the forecast period.

Based on the application, the Australia ammonia market is divided into fertilizers, textiles, refrigerant gases, medicines, domestic and industrial cleaning, and others. Among these, the fertilizers segment is expected to dominate the Australia ammonia market during the forecast period. NH3 is an ammonium nitrate fertilizer that provides nitrogen, a nutrient that promotes growth in grass and crop production. Farmers are key consumers of crops for high-quality crops and soils. Organic fertilizers with essential nutrients like selenium, boron, and zinc increase yields. An increase in population and food consumption will lead to greater demand for fertilizers to increase crop yields. The two main drivers behind the market are the development of high-tech agricultural techniques and the extensive use of bio-fertilizers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia ammonia market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Incitec Pivot Limited

- Yara International ASA

- Orica Limited

- Wesfarmers Chemicals

- Energy & Fertilisers

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia ammonia market based on the below-mentioned segments:

Australia Ammonia Market, By Product

- Anhydrous Ammonia

- Aqueous Ammonia

Australia Ammonia Market, By Application

- Fertilizers

- Textiles

- Refrigerant Gases

- Medicines

- Domestic And Industrial Cleaning

- Others

Need help to buy this report?