Australia Architectural Coatings Market Size, Share, and COVID-19 Impact Analysis, By Technology (Solventborne and Waterborne), By End User (Commercial and Residential), and Australia Architectural Coatings Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsAustralia Architectural Coatings Market Insights Forecasts to 2033

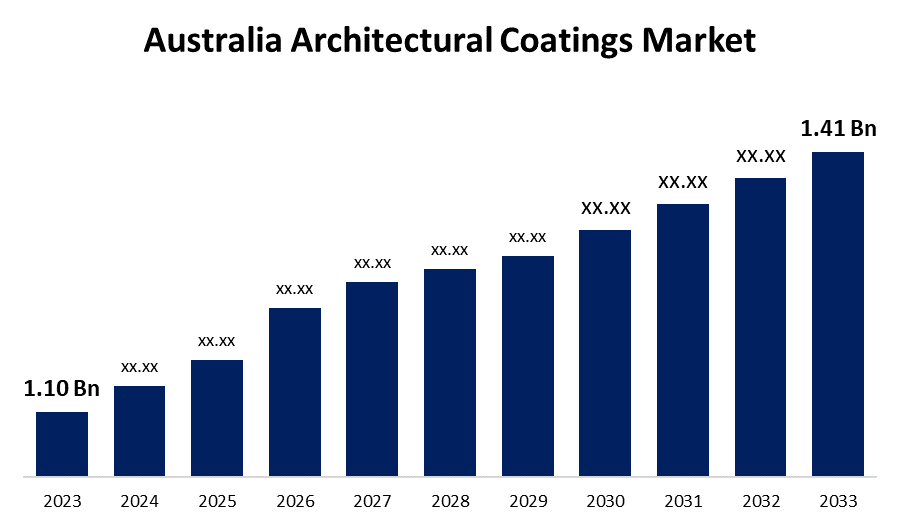

- The Australia Architectural Coatings Market Size was valued at USD 1.10 Billion in 2023.

- The Market is Growing at a CAGR of 2.51% from 2023 to 2033

- The Australia Architectural Coatings Market Size is Expected to Reach USD 1.41 Billion by 2033

Get more details on this report -

The Australia Architectural Coatings Market is Anticipated to exceed USD 1.41 Billion by 2033, growing at a CAGR of 2.51% from 2023 to 2033.

Market Overview

The paint, coating, and finish market for residential, commercial, and industrial buildings' exterior and interior surfaces is known as the Australia architectural coatings market. Building performance is improved, surfaces are shielded from environmental elements, and aesthetic appeal is increased, all of which are achieved by these coatings. Production, distribution, and consumption of coatings for use in architecture and construction are all included in the Australia architectural coatings market. Sustainability efforts and changing consumer preferences are driving a major transition in the Australian architectural coatings market. Intense competition between local and foreign competitors defines the Australia architectural coatings market, where businesses place a strong focus on developing innovative products and environmentally friendly solutions. The construction boom in Australia, particularly in the nation's rising economies, is driving the demand for architectural coatings.

Report Coverage

This research report categorizes the market for the Australia architectural coatings market based on various segments and regions, forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia architectural coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia architectural coatings market.

Australia Architectural Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.10 Billio |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 2. 51% |

| 023 – 2033 Value Projection: | USD 1.41 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Technology, By End User |

| Companies covered:: | PPG Industries, Inc. Hempel A/S Jotun Resene Group Nippon Paint Holdings Co., Ltd. Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by shifting consumer tastes and rising public awareness of architectural coating safety and volatile organic compound (VOC) emissions. One of the key factors driving the Australia architecture coatings market is the construction industry. The market for Australia architectural coatings is being driven by the desire for refurbishment, particularly in the residential sector. The market for Australia architectural coatings has grown significantly, mostly due to factors including external and interior wall paints. The market is also driven by the expansion of the construction industry, which creates a need for architectural coatings as a result of urbanization, population increase, and infrastructure development.

Restraining Factors

The Australia architectural coatings market can be restricted by the strict government laws prohibiting the release of dangerous volatile organic compounds released by specific architectural coatings.

Market Segmentation

The Australia architectural coatings market share is classified into technology and end user.

- The waterborne segment accounted for the largest share of the Australia architectural coatings market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of technology, the Australia architectural coatings market is divided into solventborne and waterborne. Among these, the waterborne segment accounted for the largest share of the Australia architectural coatings market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Australia's strict environmental laws, which encourage low-VOC coatings, are the main factor driving waterborne segmental growth. Particularly for exterior, interior, and ceiling architectural coatings, waterborne architectural coatings have become increasingly popular in both residential and commercial settings.

- The residential segment accounted for the largest share of the Australia architectural coatings market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of end user, the Australia architectural coatings market is divided into commercial and residential. Among these, the residential segment accounted for the largest share of the Australia architectural coatings market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Large-scale house restoration projects and active housing building in major cities like Sydney, Melbourne, and Brisbane are driving the residential segmental growth. House paint and interior architectural coatings are in high demand in the residential sector due to the growing trend of do-it-yourself home remodeling projects, especially with the switch to remote work.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia architectural coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PPG Industries, Inc.

- Hempel A/S

- Jotun

- Resene Group

- Nippon Paint Holdings Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2021, world-leading coatings manufacturer Hempel A/S signed a purchase agreement for the acquisition of Wattyl, one of Australia and New Zealand’s leading and highly distinguished manufacturers of paint for the decorative and protective segments with a turnover of EUR 150 million and 750 employees.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia architectural coatings market based on the below-mentioned segments:

Australia Architectural Coatings Market, By Technology

- Solventborne

- Waterborne

Australia Architectural Coatings Market, By End User

- Commercial

- Residential

Need help to buy this report?