Australia Automotive Camera Market Size, Share, and COVID-19 Impact Analysis, By Camera Type (Rear-View Camera, Front-View Camera, 360-Degree Camera, Surround-View Camera, Driver Monitoring Camera, Driver Monitoring Camera, and Blind Spot Camera), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Electric Vehicles (EVs), and Autonomous Vehicles), and Australia Automotive Camera Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationAustralia Automotive Camera Market Insights Forecasts to 2033

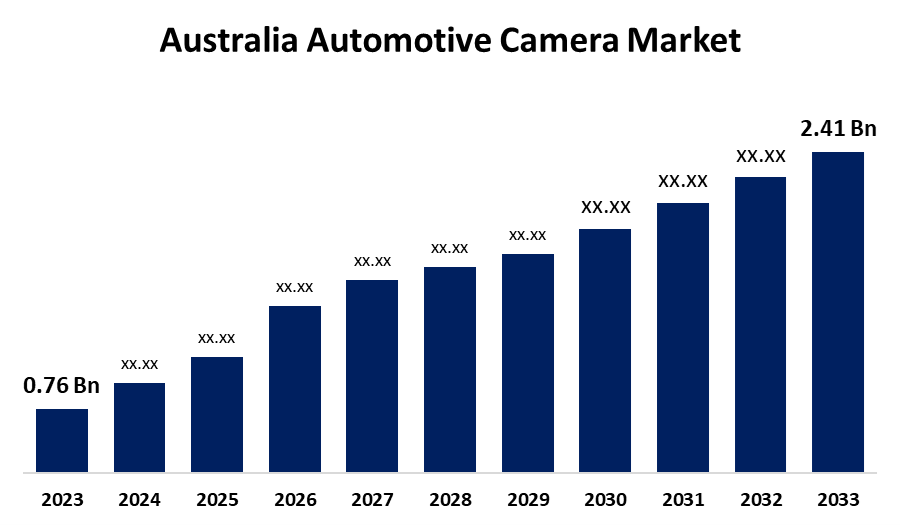

- The Australia Automotive Camera Market Size was valued at USD 0.76 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.23% from 2023 to 2033

- The Australia Automotive Camera Market Size is Expected to Reach USD 2.41 Billion by 2033

Get more details on this report -

The Australia Automotive Camera Market is Anticipated to exceed USD 2.41 Billion by 2033, growing at a CAGR of 12.23% from 2023 to 2033. The Australian automotive camera market is mostly driven by the rising demand for Advanced Driver-Assistance Systems (ADAS).

Market Overview

An electronic imaging device installed in cars to improve overall driving pleasure, safety, and driver assistance is called the Australia automotive camera market. These cameras provide vital input for advanced driver assistance systems (ADAS) by capturing visual information about the vehicle's environment in real time. To increase road safety, the Australian government has been aggressively encouraging the installation of ADAS in automobiles. Automotive cameras use accurate visual perception and situational awareness to continuously monitor the environment, which lowers accident rates, increases vehicle safety, and supports new autonomous driving technologies. Furthermore, the opportunities in the Australia automotive camera market are changing due to several trends and advances, such as the incorporation of safety features like rearview cameras in cars. Improved image processing algorithms in the cars are one example of how technology can be integrated to increase the efficiency and performance of automobile camera systems. One of the main factors driving the Australia automotive camera market is the rising demand for Advanced Driver-Assistance Systems (ADAS).

Report Coverage

This research report categorizes the market for the Australia automotive camera market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia automotive camera market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia automotive camera market.

Australia Automotive Camera Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.76 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.23% |

| 2033 Value Projection: | USD 2.41 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Camera Type, By Vehicle Type and COVID-19 Impact Analysis |

| Companies covered:: | Continental Ltd, Panasonic Corporation, Garmin Ltd, Magna International Inc, Boch Mobility Solutions, and Other key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased demand for cars, growing consumer concerns about safety, governmental regulations, technological advancements, the quick uptake of ADAS, and the accessibility of inexpensive parking cameras and sensors in the aftermarket are some of the main factors driving the automotive camera market's expansion. Australia's strict car safety laws necessitate the use of technology that improves road safety. New rules requiring rearview cameras in all new cars were put into driven by the Australian government. Due to OEMs and manufacturers being compelled to include these safety systems in their cars, the market for automotive cameras has grown as a result.

Restraining Factors

The module's exorbitant price has been marginally restricting Australia automotive camera market expansion. The installation of three to six cameras on the car is necessary for ADAS such as Automatic Emergency Braking (AEB), Forward Collision Warning System (FCWS), and Adaptive Cruise Control (ACC). It is difficult to enter the market since these car cameras cost about eight times as much as the module in a mobile phone camera.

Market Segmentation

The Australia automotive camera market share is classified into by camera type and vehicle type.

- The driver monitoring camera segment accounted for the largest share of the Australia automotive camera market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of vehicle type, the Australia automotive camera market is divided into rear-view camera, front-view camera, 360-degree camera, surround-view camera, driver monitoring camera, driver monitoring camera, and blind spot camera. Among these, the driver monitoring camera segment accounted for the largest share of the Australia automotive camera market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Growing safety laws and advanced driver assistance systems (ADAS) are the driving forces behind the driver monitoring camera. Stricter safety regulations, advances in automotive imaging technology, and consumer desire for improved car safety features are driving the market's expansion.

- The passenger vehicles segment accounted for the largest share of the Australia automotive camera market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of type, the Australia automotive camera market is divided into passenger vehicles, commercial vehicles, electric vehicles (EVs), and autonomous vehicles. Among these, the passenger vehiclessegment accounted for the largest share of the Australia automotive camera market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Growing safety requirements and consumer desire for cutting-edge driver assistance systems are driving the passenger vehicle market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia automotive camera market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Continental Ltd

- Panasonic Corporation

- Garmin Ltd

- Magna International Inc

- Boch Mobility Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, A new range of cutting-edge car cameras from Valeo was launched with the goal of improving driver assistance systems. In response to the growing demand for advanced safety features in the Australian automotive market, this introduction demonstrates the company's dedication to automation and safety in automobiles.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia automotive camera market based on the below-mentioned segments:

Australia Automotive Camera Market, By Camera Type

- Rear-View Camera

- Front-View Camera

- 360-Degree Camera

- Surround-View Camera

- Driver Monitoring Camera

- Driver Monitoring Camera

- Blind Spot Camera

Australia Automotive Camera Market, By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Autonomous Vehicles

Need help to buy this report?