Australia Aviation Market Size, Share, and COVID-19 Impact Analysis, By Aircraft Type (Military Aviation, General Aviation, and Commercial Aviation), By Service Type (Charter Services, Cargo Services, and Passenger Services), and Australia Aviation Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseAustralia Aviation Market Insights Forecasts to 2033

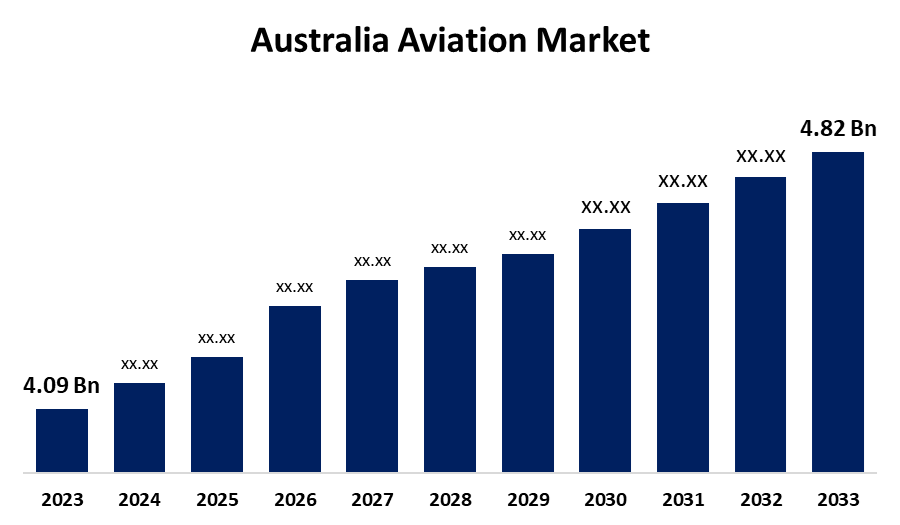

- The Australia Aviation Market Size was estimated at USD 4.09 billion in 2023.

- The Market Size is Growing at a CAGR of 1.66% from 2023 to 2033

- The Australia Aviation Market Size is Expected to Reach USD 4.82 billion by 2033

Get more details on this report -

The Australia Aviation Market Size is Expected to Reach USD 4.82 billion by 2033, growing at a CAGR of 1.66% from 2023 To 2033

Market Overview

The infrastructure, regulatory framework, and network of air transportation services that facilitate the flow of people, goods, and aircraft both inside and outside of Australia are together referred to as the Australia aviation market. The market growth is mostly driven by the growing tourism industry, more corporate travel, and the substantial presence of low-cost airlines that serve consumers on a tight budget. In addition, continuous market growth has been facilitated by the demand for more flight frequencies and extended service routes, which have been highlighted by high air traffic volumes, particularly between major Australian cities. The market for Australian airlines is dominated by major cities like Sydney, Melbourne, and Brisbane since they serve as the main hubs for both domestic and international flights. Due to their closeness to popular Asia-Pacific routes and Brisbane's appeal for tourists, Sydney and Melbourne are essential for the demand for air travel. These cities are crucial centres in Australia's aviation network because of their advanced airport infrastructure and connectivity to other regions.

Report Coverage

This research report categorizes the market for the Australian aviation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australian aviation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia aviation market.

Australia Aviation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.09 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.66% |

| 2033 Value Projection: | USD 4.82 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Aircraft Type, By Service Type and COVID-19 Impact Analysis |

| Companies covered:: | Airbus SE, Bombardier Inc., Lockheed Martin Corporation, The Boeing Company, General Dynamics Corporation, and other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Australian aviation industry is driven by the ongoing expansion of Australia's economy, and the rising demand for air freight from consumers and businesses is the primary driver of air freight growth. Additionally, the expansion of the Australian GDP is aided by rising domestic spending and improved industrial sector growth. In addition, with deliberate investments in facilities and route networks, the industry's infrastructure keeps developing to support the aviation sector's long-term expansion. Furthermore, Australia is home to many aviation schools in the Asia-Pacific region, making it a major center for aviation training. Its strong infrastructure draws in international students and offers a consistent supply of skilled workers, which promotes industry expansion.

Restraining Factors

Australia's aviation market faces significant constraints due to fuel prices, maintenance costs, and airport fees, which are some of the elements that make operating in Australia's aviation sector extremely expensive. Airlines' profitability and capacity to grow their service offerings may be impacted by these exorbitant expenses.

Market Segmentation

The Australian aviation market share is classified into the aircraft type and the service type.

- The commercial aviation segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the aircraft type, the Australia aviation market is divided into military aviation, general aviation, and commercial aviation. Among these, the commercial aviation segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to the strong recovery in both domestic and international air passenger traffic, which has risen to pre-pandemic levels, this market position is noteworthy. In addition, the strength of the category is further strengthened by the ongoing fleet expansion and modernization projects of major airlines such as Virgin Australia and Qantas. Furthermore, the focus on narrow-body aircraft purchase in the commercial aviation segment is especially noteworthy since it satisfies the expanding demands of the domestic aviation market.

- The passenger services segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the service type, the Australian aviation market is divided into charter services, cargo services, and passenger services. Among these, the passenger services segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expansion because of the increased demand for both business and pleasure travel. Additionally, the dominance of passenger services is supported by the substantial tourism industry and the high volume of both domestic and international travel. In addition, the dominance of this category has been further reinforced by the increased accessibility and affordability brought about by low-cost carriers and the frequency of flights between major cities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia aviation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus SE

- Bombardier Inc.

- Lockheed Martin Corporation

- The Boeing Company

- General Dynamics Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia aviation market based on the below-mentioned segments:

Australia Aviation Market, By Aircraft Type

- Military Aviation

- General Aviation

- Commercial Aviation

Australia Aviation Market, By Service Type

- Charter Services

- Cargo Services

- Passenger Services

Need help to buy this report?