Australia Battery Market Size, Share, and COVID-19 Impact Analysis, By Technology (Li-Ion Battery, Lead-Acid Battery, and Others), By Application (SLI Batteries, Industrial Batteries, Portable Batteries, Automotive Batteries, and Others), and Australia Battery Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerAustralia Battery Market Insights Forecasts to 2033

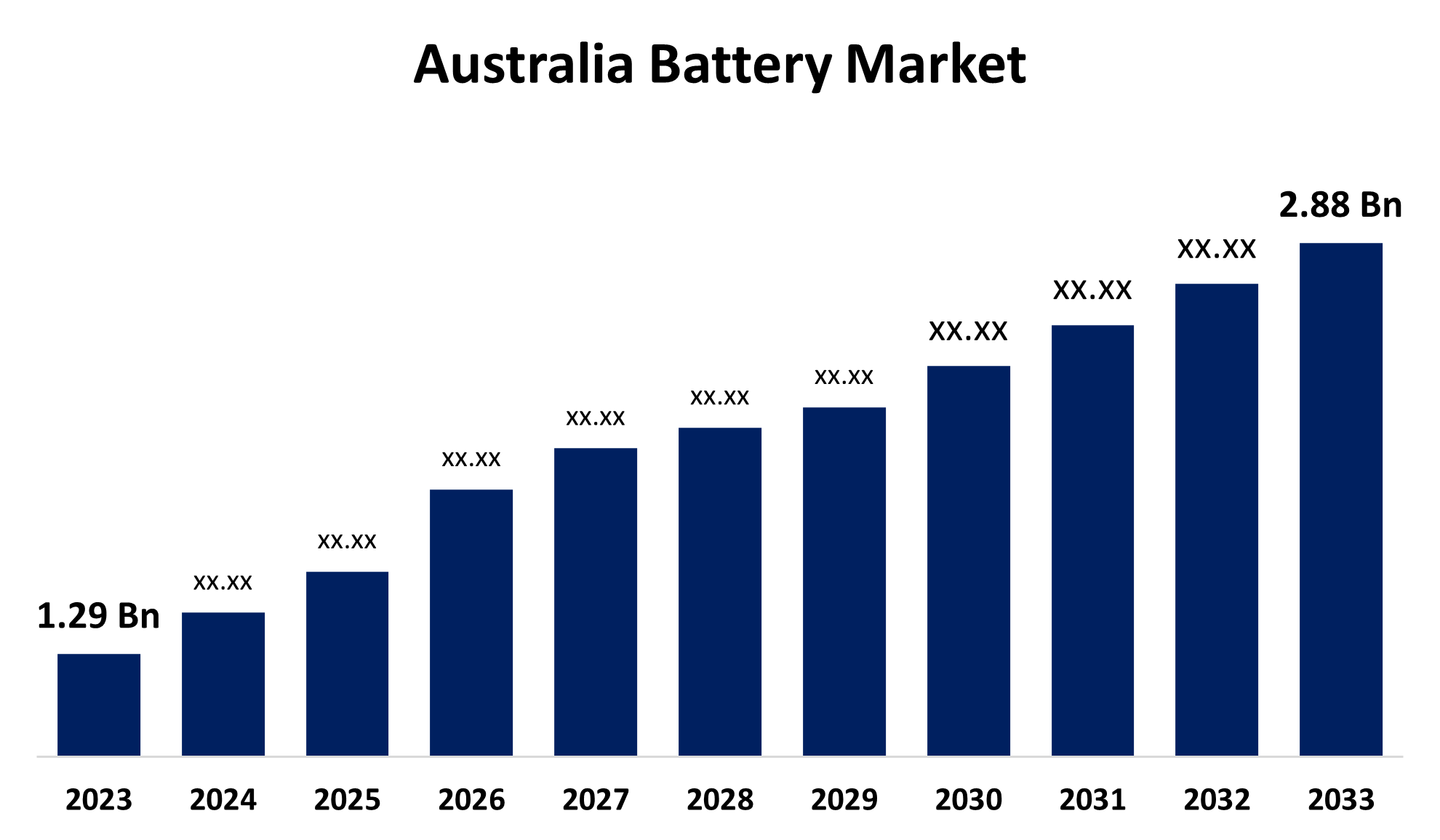

- The Australia Battery Market Size was valued at USD 1.29 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.36% from 2023 to 2033

- The Australia Battery Market Size is Expected to Reach USD 2.88 Billion by 2033

Get more details on this report -

The Australia Battery Market Size is Anticipated to exceed USD 2.88 Billion by 2033, growing at a CAGR of 8.36% from 2023 to 2033. The increasing adoption of electric vehicles, integration of renewable energy & concerns about energy security, and large-scale energy storage systems requirements in the region are driving the expansion of Australia battery market.

Market Overview

The industry in Australia that produces, distributes, and uses different kinds of batteries, with a focus on those used in energy storage solutions, is known as the "Australia battery market." Lead-acid, lithium-ion, nickel-cadmium, solid-state, flow, and other cutting-edge technologies are among the various battery types available in the Australia battery market. The need for consumer electronics, electric vehicles, and energy storage solutions is contributing to the fast expansion of the Australia battery market. Australia's strategic position as the world's largest supplier of hard-rock lithium spodumene is driving a substantial revolution in the country's battery market. The use of cutting-edge battery technologies in a range of applications, from industrial machinery to consumer electronics, keeps spurring innovation and market growth. Growth in the sector is also being accelerated by the growing number of foreign alliances and investments in the Australia battery market.

Report Coverage

This research report categorizes the market for the Australia battery market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia battery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia battery market.

Australia Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.29 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.36% |

| 2033 Value Projection: | USD 2.88 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Century Yuasa Batteries Pty Ltd, Enersys Australia Pty Ltd, Sonnen Australia Pty Limited, Exide Technologies, Robert Bosch (Australia) Pty Ltd, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Australia battery market growth is mostly being driven by the growing popularity of electric and hybrid electric vehicles (HEVs and EVs). The adoption of electric vehicles, the integration of renewable energy, and concerns about energy security are all driving a rapid growth of the Australia battery market. The market is expanding rapidly due to several significant factors that highlight the growing importance of batteries in many different industries. The Australia battery market is also driven by the region's requirement for large-scale energy storage systems to support the production of renewable energy.

Restraining Factors

High manufacturing prices, a shortage of raw materials, environmental concerns, inefficient battery performance, difficulties with recycling, limited infrastructure, and unclear regulations are some of the restrictions of the Australia battery market.

Market Segmentation

The Australia battery market share is classified into technology and application.

- The lead-acid battery segment accounted for the largest share of the Australia battery market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of technology, the Australia battery market is divided into li-Ion battery, lead-acid battery, and others. Among these, the lead-acid battery segment accounted for the largest share of the Australia battery market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The low cost, great performance, and established recycling infrastructure of lead-acid batteries whose materials are almost entirely recyclable help them maintain their significant market growth.

- The SLI batteries segment accounted for the largest share of the Australia battery market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of application mode, the Australia battery market is divided into SLI batteries, industrial batteries, portable batteries, automotive batteries, and others. Among these, the SLI batteries segment accounted for the largest share of the Australia battery market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The large usage of starting, lighting, and ignition (SLI) batteries in traditional automobiles for powering starter motors, lights, ignition systems, and other internal combustion engines that demand long-term performance is the main reason for their extensive use.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia battery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Century Yuasa Batteries Pty Ltd

- Enersys Australia Pty Ltd

- Sonnen Australia Pty Limited

- Exide Technologies

- Robert Bosch (Australia) Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, Tesla has inked a memorandum of understanding (MoU) with the Western Australian government to develop a battery re-manufacturing facility in Collie, home of Neoen’s 2.2GWh battery energy storage system (BESS).

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia battery market based on the below-mentioned segments:

Australia Battery Market, By Technology

- Li-Ion Battery

- Lead-acid Battery

- Other Technologies

Australia Battery Market, By Application

- SLI Batteries

- Industrial Batteries

- Portable Batteries

- Automotive Batteries

- Others

Need help to buy this report?