Australia Bottled Water Market Size, Share, and COVID-19 Impact Analysis, By Water Source (Natural Mineral Water, Spring Water, Purified Water, Artesian Water, and Glacier Water), By Packaging Type (Polyethylene Terephthalate (PET) Bottles, Glass Bottles, Cartons and Pouches, and Cans), By Product Varieties (Still Water, Carbonated Water, Flavored Water, Functional Water, Vitamin-Enhanced Water, Alkaline Water, and Electrolyte Water), By Pack Sizes (Individual-Serve Bottles, Multi-Serve Bottles, and Bulk Packaging), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Vending Machines, Wholesalers, and Distributors) and Australia Bottled Water Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesAustralia Bottled Water Market Insights Forecasts to 2033

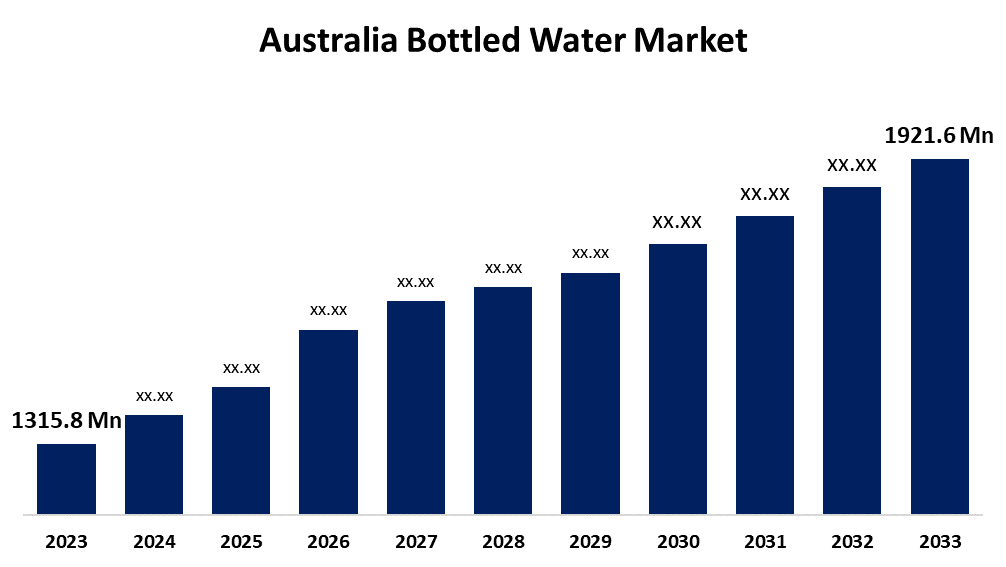

- The Australia Bottled Water Market Size was valued at USD 1315.8 Million in 2023.

- The Market Size is Growing at a CAGR of 3.86% from 2023 to 2033

- The Australia Bottled Water Market Size is Expected to Reach USD 1921.6 Million by 2033

Get more details on this report -

The Australia Bottled Water Market Size is Anticipated to Reach USD 1921.6 Million by 2033, Growing at a CAGR of 3.86% from 2023 to 2033

Market Overview

Bottled water refers to packaged drinking water in glass or plastic bottles. Bottled water is available in a range of sizes from large carboys for water coolers to 250 ml bottles for single portions. In addition, bottled water is available in a wide variety, including groundwater, purified water, mineral water, hydrogen water, and others. Because of the process undergoing rigorous filtering and purification, it is free from chemicals, microorganisms, and other pollutants, which assures one of a clean experience. It is ideal for both outdoor and office or gym use because of its convenience. The demand for purity is the main factor expanding Australia's market on bottled water. There is an increasing demand for bottled water in Australia as a source of potable water. The high nutritional concentration and mineral presence in bottled water also factor in the growth of the bottled water market in Australia due to health consciousness. As per a recent United Nations report, Australians, in 2021, spent an average of $580 on 504 liters of bottled water.

Report Coverage

This research report categorizes the market for the Australia bottled water based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia bottled water market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia bottled water market.

Australia Bottled Water Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1315.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.86% |

| 2033 Value Projection: | USD 1921.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Water Source, By Packaging Type, By Product Varieties, By Pack Sizes, By Distribution Channel |

| Companies covered:: | AAA Bottled Water Pty Ltd, Eneco Refresh Ltd, Beloka Water, Neverfail Springwater Proprietary Ltd., Asahi Holdings Pty. Ltd., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth in Australia bottled water market is relatively driven by a mix of lifestyle preferences, environmental concerns, and healthy consumer choices. Getting awareness about the need for hydration to achieve good health has led to increasing demand for bottled, clean, and convenient sources of drinking water, thus positioning bottled water as a healthy choice amid a trend away from sugary drinks. The strong lifestyle culture of activity benefits the bottled water market at higher levels, particularly in cities where hydration is integral to a busy lifestyle. Thus, bottled water becomes the rational choice for Australians with demanding lifestyles, and the demand for containers that can be taken anywhere supports its sales.

Restraining Factors

Variances in consumer preferences, energy drinks, flavored beverages, and functional drinks led to competing with each other in Australia. A health-conscious customer may opt for natural fruit juices or herbal infusions as a healthier alternative. More importantly, the market has become saturated with innovations like vitamin-enriched water.

Market Segmentation

The Australia bottled water market share is classified into water source, packaging type, product varieties, pack sizes, and distribution channel.

- The purified water segment is expected to hold the largest market share through the forecast period.

The Australia bottled water market is segmented by water source into natural mineral water, spring water, purified water, artesian water, and glacier water. Among these, the purified water segment is expected to hold the largest market share through the forecast period. Increasing demand for clean and processed water in Australia has dominated the segment in the bottled water market.

- The polyethylene terephthalate (PET) bottles segment is expected to dominate the Australia bottled water market during the forecast period.

Based on the packaging types, the Australia bottled water market is divided into polyethylene terephthalate (PET) bottles, glass bottles, cartons and pouches, and cans. Among these, the polyethylene terephthalate (PET) bottles segment is expected to dominate the Australia bottled water market during the forecast period. It is attributed to their lightness, portability, and recyclability while satisfying consumer demands for sustainability and convenience, that these forms dominate the markets.

- The functional water segment is expected to hold the largest market share through the forecast period.

The Australia bottled water market is segmented by product varieties into still water, carbonated water, flavored water, functional water, vitamin-enhanced water, alkaline water, and electrolyte water. Among these, the functional water segment is expected to hold the largest market share through the forecast period. This will lead to the expected vast growth of the market, in which consumers seek bottled water with additional health benefits, vitamins, and minerals designed for specific nutritional requirements.

- The multi-serve bottles segment is expected to dominate the Australia bottled water market during the forecast period.

Based on the pack sizes, the Australia bottled water market is divided into individual-serve bottles, multi-serve bottles, and bulk packaging. Among these, the multi-serve bottles segment is expected to dominate the Australia bottled water market during the forecast period. Multi-serve bottles comprise the bottles ranging from larger size bottles to 250ml small bottles. Larger-size bottles are on high demand which are often suitable for home or shared consumption.

- The supermarkets & hypermarkets segment is expected to hold the largest market share through the forecast period.

The Australia bottled water market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online retail, vending machines, wholesalers, and distributors. Among these, the supermarkets & hypermarkets segment is expected to hold the largest market share through the forecast period. This segment reflects the importance that these retail establishments play vital role in meeting consumer demand for bottled water, especially considering that they are accessible and far-reaching.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia bottled water market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AAA Bottled Water Pty Ltd

- Eneco Refresh Ltd

- Beloka Water

- Neverfail Springwater Proprietary Ltd.

- Asahi Holdings Pty. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, the National Water Initiative (NWI) was first launched in 2004 in an attempt to address water security. According to the Productivity Commission report on climate change and fluctuating water demand.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia bottled water market based on the below-mentioned segments:

Australia Bottled Water Market, By Water Source

- Natural Mineral Water

- Spring Water

- Purified Water

- Artesian Water

- Glacier Water

Australia Bottled Water Market, By Packaging Type

- Polyethylene Terephthalate (PET) Bottles

- Glass Bottles

- Cartons And Pouches

- Cans

Australia Bottled Water Market, By Product Varieties

- Still Water

- Carbonated Water

- Flavored Water

- Functional Water

- Vitamin-Enhanced Water

- Alkaline Water

- Electrolyte Water

Australia Bottled Water Market, By Pack Sizes

- Individual-Serve Bottles

- Multi-Serve Bottles

- Bulk Packaging

Australia Bottled Water Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Vending Machines

- Wholesalers

- Distributors

Need help to buy this report?