Australia Burial Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Simplified Issue, Guaranteed Issue, and Pre-need Insurance), By Age of End User (Over 50, Over 60, Over 70, and Over 80), and by Australia Burial Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialAustralia Burial Insurance Market Insights Forecasts to 2033

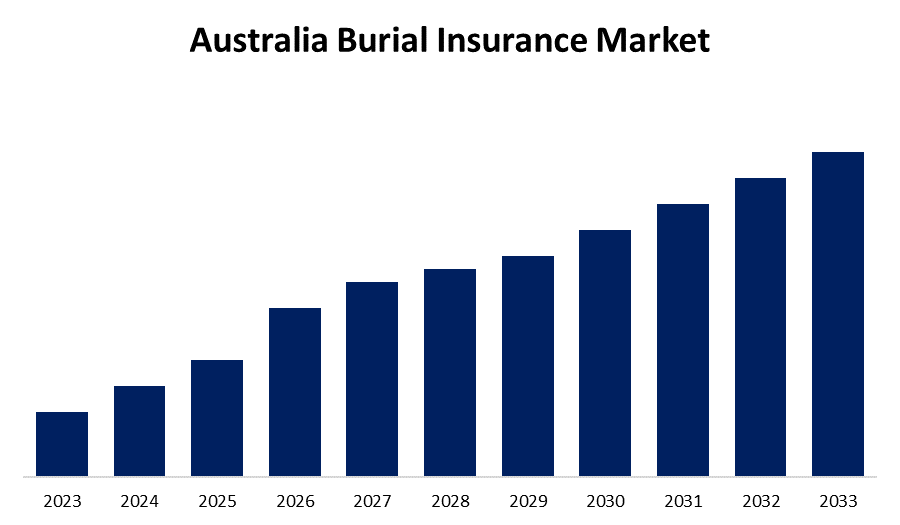

- The Market is Growing at a CAGR of 5.4% from 2023 to 2033

- The Australia Burial Insurance Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The Australia Burial Insurance Market is anticipated to reach a significant share by 2033, growing at a CAGR of 5.4% from 2023 to 2033.

Market Overview

The Australia burial insurance industry refers to the section of the Australian life insurance industry that specifically insures individuals financially for the cost of their burial or funeral payments upon death. Such insurance coverages are often aimed at paying for funeral costs, which include the cost of caskets, cremation procedures, ceremony charges, transportation, and other expenses related to them. Burial coverage is typically sold as final expense insurance, an amount of relatively low life insurance designed to cover the cost so that family members and loved ones are not stuck with the cost at a critical time. The burial insurance premiums tend to be cheaper than standard life insurance policies, and in some cases, they do not need medical examinations, which means they are within reach for elderly people or individuals with existing medical conditions. The Australian burial insurance market has been expanding as the awareness of funeral expenses has become more prevalent, as well as an aging population that is concerned with making arrangements for their final expenses to be paid.

Report Coverage

This research report categorizes the market for the Australia burial insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia burial insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia burial insurance market.

Australia Burial Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.4% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Age of End User |

| Companies covered:: | TAL Life AIA Australia Zurich Australia MLC Life Insurance MetLife Insurance Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An aging population is a key factor, as the number of older Australians is increasing, creating a greater demand for financial products that can help fund end-of-life costs. Most people in this age group are seeking solutions to reduce the burden on their families when they pass away. Second, rising funeral expenses have prompted most Australians to seek burial insurance because funerals can be costly, and families would find it difficult to pay for the funeral without help.

Restraining Factors

The complexity of the insurance products is also a hindrance, as some people are unable to deal with the different terms, conditions, and options and thus avoid buying such policies altogether.

Market Segmentation

The Australia burial insurance market share is classified into type and age of end user.

- The simplified issue segment accounted for the leading revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The Australia burial insurance market is segmented by type into simplified issue, guaranteed issue, and pre-need insurance. Among these, the simplified issue segment accounted for the leading revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The growth in the segment is due to its comparatively lower premium rates and the assurance of peace of mind it provides policyholders with, knowing their families will be economically taken care of with funeral and burial costs. The simplified issue policies are favored since they offer a less complicated and faster application process than regular life insurance.

- The over 50 segment accounted for the largest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The Australia burial insurance market is segmented by age of end user into over 50, over 60, over 70, and over 80. Among these, the over 50 segment accounted for the largest market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven due to several factors. The growth in this segment is driven because people in this age range are usually just starting to consider more seriously end-of-life planning and might be more cognizant of the rising expense of funerals. Meanwhile, they are usually still relatively healthy, so they are more likely to shop for burial insurance at a reasonable price.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia burial insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TAL Life

- AIA Australia

- Zurich Australia

- MLC Life Insurance

- MetLife Insurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, The Australian government is set to introduce a groundbreaking initiative offering free funeral insurance to all citizens aged 55 and older. This policy aims to ease the financial strain faced by seniors and their families, ensuring dignified funeral services when needed

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia burial insurance market based on the below-mentioned segments:

Australia Burial Insurance Market, By Type

- Simplified Issue

- Guaranteed Issue

- Pre-need Insurance

Australia Burial Insurance Market, By Age of End User

- Over 50

- Over 60

- Over 70

- Over 80

Need help to buy this report?