Australia Compound Feed Market ,Size, Share, and COVID-19 Impact Analysis, By Animal Type (Ruminant, Poultry, Swine, Aquaculture, and Others), By Ingredient (Cereals, Cakes and Meals, By-Products, and Supplements), and Australia Compound Feed Market Insights, Industry Trend, Forecasts to 2033.

Industry: AgricultureAustralia Compound Feed Market Insights Forecasts to 2033

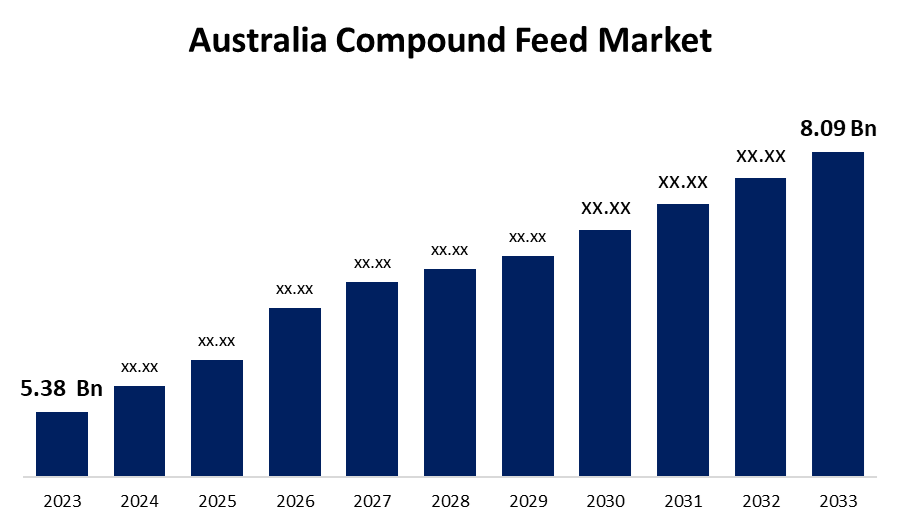

- The Australia Construction Machinery Market Size was valued at USD 5.38 Billion in 2023.

- The Australia Compound Feed Market is Growing at a CAGR of 4.16% from 2023 to 2033

- The Australia Compound Feed Market Size is Expected to Reach USD 8.09 Billion by 2033

Get more details on this report -

The Australia Compound Feed Market is Expected to exceed USD 8.09 Billion by 2033, growing at a CAGR of 4.16% from 2023 to 2033. The need for premium animal protein and technological developments is driving the Australian compound feed market, which has creative compositions that improve animal productivity and health.

Market Overview

The industry that produces and distributes compound animal feed, a specially blended blend of materials used to feed cattle, poultry, and other animals, is known as the Australia compound feed market. Production of feed formulations that include grains, proteins, vitamins, and minerals in order to satisfy the nutritional requirements of different species is included in the Australia compound feed market. It covers a range of feed kinds, including aquaculture, cattle, and poultry feed. Demands from agriculture, technology developments, and growing worries about food safety and animal health are driving the Australia compound feed market. A worldwide trend toward sustainable and effective animal production is consistent with the compound feed market's explosive growth in Australia. Australia is addressing the environmental issues of animal husbandry while satisfying consumer expectations through government backing and a drive for improvements in agriculture and feed. The animals are given a balanced diet that promotes their development, well-being, and production due to the meticulous selection and processing of the components.

Report Coverage

This research report categorizes the market for the Australia compound feed market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia compound feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia compound feed market.

Australia Compound Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.38 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.16% |

| 2033 Value Projection: | USD 8.09 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Animal Type, By Ingredient, By Ingredient. |

| Companies covered:: | Cargill Inc., Alltech Inc., Land O Lakes, Archer Daniels Midland, Charoen Pokphand Foods, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Australia's meat consumption rate has gone up as people become more conscious of and consume more healthful, high-protein foods. The Australia compound feed market is expected to be driven by these factors. High-quality animal feed is needed to improve livestock output in Australia due to rising consumer demand for meat and dairy products. A trend toward feeds that are more nutrient-dense and environmentally friendly is also propelling the Australia compound feed market. The expansion of the aquaculture industry in Australia has been driven by rising seafood demand and a steady supply of fish feed.

Restraining Factors

The high cost and unpredictability of raw materials used in feed manufacturing are two of the biggest challenges to the Australia market's adoption of compound feed. Prices for commodities including cereals, proteins, and essential additives fluctuate due to climate change, drought, and interruptions in the global supply chain.

Market Segmentation

The Australia compound feed market share is classified into animal type and ingredient.

- The poultry segment accounted for the largest share of the Australia compound feed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of animal type, the Australia compound feed market is divided into ruminant, poultry, swine, aquaculture, and others. Among these, the poultry segment accounted for the largest share of the Australia compound feed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The country's meat consumption has significantly increased during the past several years, coinciding with the poultry segment's population and economic growth. Chicken is the most eaten animal protein in Australia, with each person consuming 47.46 kg of it each year, more than beef and lamb.

- The cereals segment accounted for the largest share of the Australia compound feed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of ingredient, the Australia compound feed market is divided into cereals, cakes and meals, by-products, and supplements. Among these, the cereals segment accounted for the largest share of the Australia compound feed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Cereals used in Australia's animal feed business provide a range of nutritional components, including 18% to 22% crude fat, 12% to 16% crude protein, and 21% to 27% total dietary fiber.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia compound feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Inc.

- Alltech Inc.

- Land O Lakes

- Archer Daniels Midland

- Charoen Pokphand Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, ADM expanded their range of functional aquafeeds to cater to the Asia-Pacific market, which includes Australia. Asia is an important region for ADM, as seen by the development of a new functional fish feed that is centered on seasonal fluctuations, and six feed mills that serve all aqua species.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia compound feed market based on the below-mentioned segments:

Australia Compound Feed Market, By Animal Type

- Ruminant

- Poultry

- Swine

- Aquaculture

- Others

Australia Compound Feed Market, By Ingredient

- Cereals

- Cakes and Meals

- By-products

- Supplements

Need help to buy this report?