Australia Dairy Alternatives Market Size, Share, and COVID-19 Impact Analysis, By Category (Non-Dairy Butter, Non-Dairy Cheese, Non-Dairy Ice Cream, Non-Dairy Milk, and Non-Dairy Yogurt), By Distribution Channel (Off-Trade and On-Trade), and Australia Dairy Alternatives Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesAustralia Dairy Alternatives Market Insights Forecasts to 2033

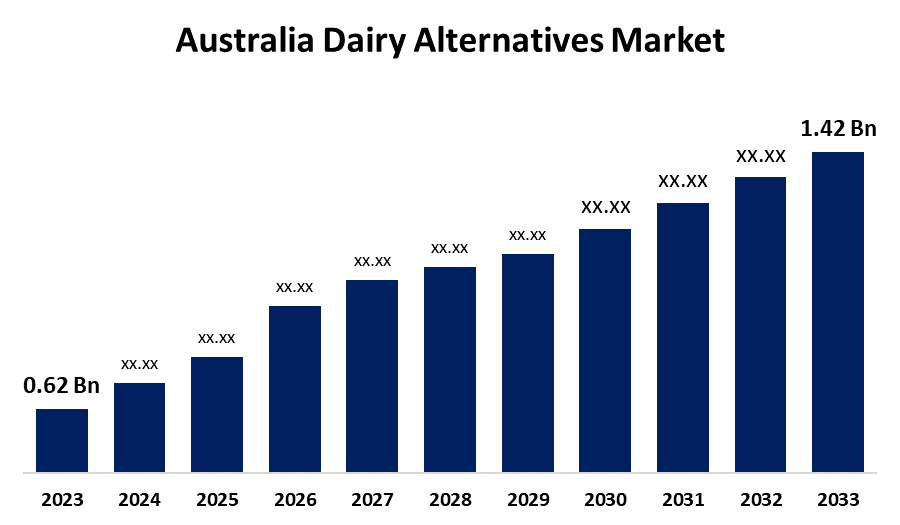

- The Australia Dairy Alternatives Market Size was valued at USD 0.62 Billion in 2023.

- The Market is Growing at a CAGR of 8.64% from 2023 to 2033

- The Australia Dairy Alternatives Market Size is Expected to Reach USD 1.42 Billion by 2033

Get more details on this report -

The Australia Dairy Alternatives Market Size is Anticipated to exceed USD 1.42 Billion by 2033, Growing at a CAGR of 8.64% from 2023 to 2033. A number of factors, including health consciousness, environmental concerns, ethical considerations, and the availability of a wide range of cutting-edge products, are driving the growth of Australia dairy alternatives market.

Market Overview

The industry in Australia that deals with the manufacture, sale, and consumption of non-dairy products as substitutes for conventional dairy products is known as the "Australia Dairy Alternatives Market." Rice, coconut, oats, almonds, soy, and other plant-based substances are commonly used to make these substitutes in the Australia dairy alternatives market. Soy, almond, oats, coconut, rice, cashews, and other plant-based components are commonly used to make these products. Growing consumer demand for plant-based functional ingredients, environmental consciousness, and animal welfare concerns are driving the dairy substitute business in Australia. The trend toward vegetarian and flexitarian diets is the main factor behind the growth of the dairy substitute industry in Australia. Opportunities in the Australia dairy alternatives market are presented by rising consumer demand for healthier options, sustainable product innovation, developing distribution systems, and growing knowledge of the nutritional, ethical, and environmental advantages of dairy substitutes.

Report Coverage

This research report categorizes the market for the Australia dairy alternatives market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia dairy alternatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia dairy alternatives market.

Australia Dairy Alternatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.62 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.64% |

| 2033 Value Projection: | USD 1.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Category, By Distribution Channel |

| Companies covered:: | PureHarvest, Danone SA, Vitasoy International Holdings Ltd, Nestlé SA, Sanitarium Health and Wellbeing Company, and Others. |

| Pitfalls & Challenges: | COVID-19 impact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for dairy substitutes is largely driven by people who are lactose intolerant. The growing demand for plant-based compounds with functional properties is driving the market. The demand for dairy substitutes in the nation is driven by consumers' growing preference for wholesome and healthier food options. Furthermore, the business is expanding as environmental sustainability becomes a greater priority. The increase in the number of dairy product allergies and the increased knowledge of lactose intolerance and its associated issues supported the growth of dairy alternatives market.

Restraining Factors

The market for dairy substitutes is severely restricted by allergy cross-contamination, especially with common allergens like soy and nuts that can trigger severe allergic reactions, putting customers at risk and making production more difficult.

Market Segmentation

The Australia dairy alternatives market share is classified into category and distribution channel.

- The non-dairy milk segment accounted for the largest share of the Australia dairy alternatives market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of category, the global Australia dairy alternatives market is divided into non-dairy butter, non-dairy cheese, non-dairy ice cream, non-dairy milk, and non-dairy yogurt. Among these, the non-dairy milk segment accounted for the largest share of the Australia dairy alternatives market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Growing consumer awareness about the health advantages of milk substitutes such as almond, soy, and oat milk which also have longer shelf lives than regular dairy milk is what is driving the non-dairy milk segment.

- The off-trade segment accounted for a substantial share of the Australia dairy alternatives market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of distribution channel, the Australia dairy alternatives market is divided into off-trade and on-trade. Among these, the off-trade segment accounted for a substantial share of the Australia dairy alternatives market in 2023 and is anticipated to grow at a rapid pace during the projected period. The growing popularity of specialized shops and internet retail channels, which give customers a wide range of selections and the ease of home delivery, is another factor contributing to the off-trade segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia dairy alternatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PureHarvest

- Danone SA

- Vitasoy International Holdings Ltd

- Nestlé SA

- Sanitarium Health and Wellbeing Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Vitasoy International Holdings Ltd. planned to purchase the shares from National Food Holdings Ltd., a joint venture company of Bega Cheese, in order to grow its dairy alternative business.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia dairy alternatives market based on the below-mentioned segments:

Australia Dairy Alternatives Market, By Category

- Non-Dairy Butter

- Non-Dairy Cheese

- Non-Dairy Ice Cream

- Non-Dairy Milk

- Non-Dairy Yogurt

Australia Dairy Alternatives Market, By Distribution Channel

- Off-Trade

- On-Trade

Need help to buy this report?