Australia Distilled Spirits Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Whiskey, Vodka, Rum, Gin, Tequila, Brandy, and Others), By Distribution Channel (Supermarkets, Hypermarkets, Specialty Stores, Drug Stores, Online, and Others), and Australia Distilled Spirits Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesAustralia Distilled Spirits Market Insights Forecasts to 2033

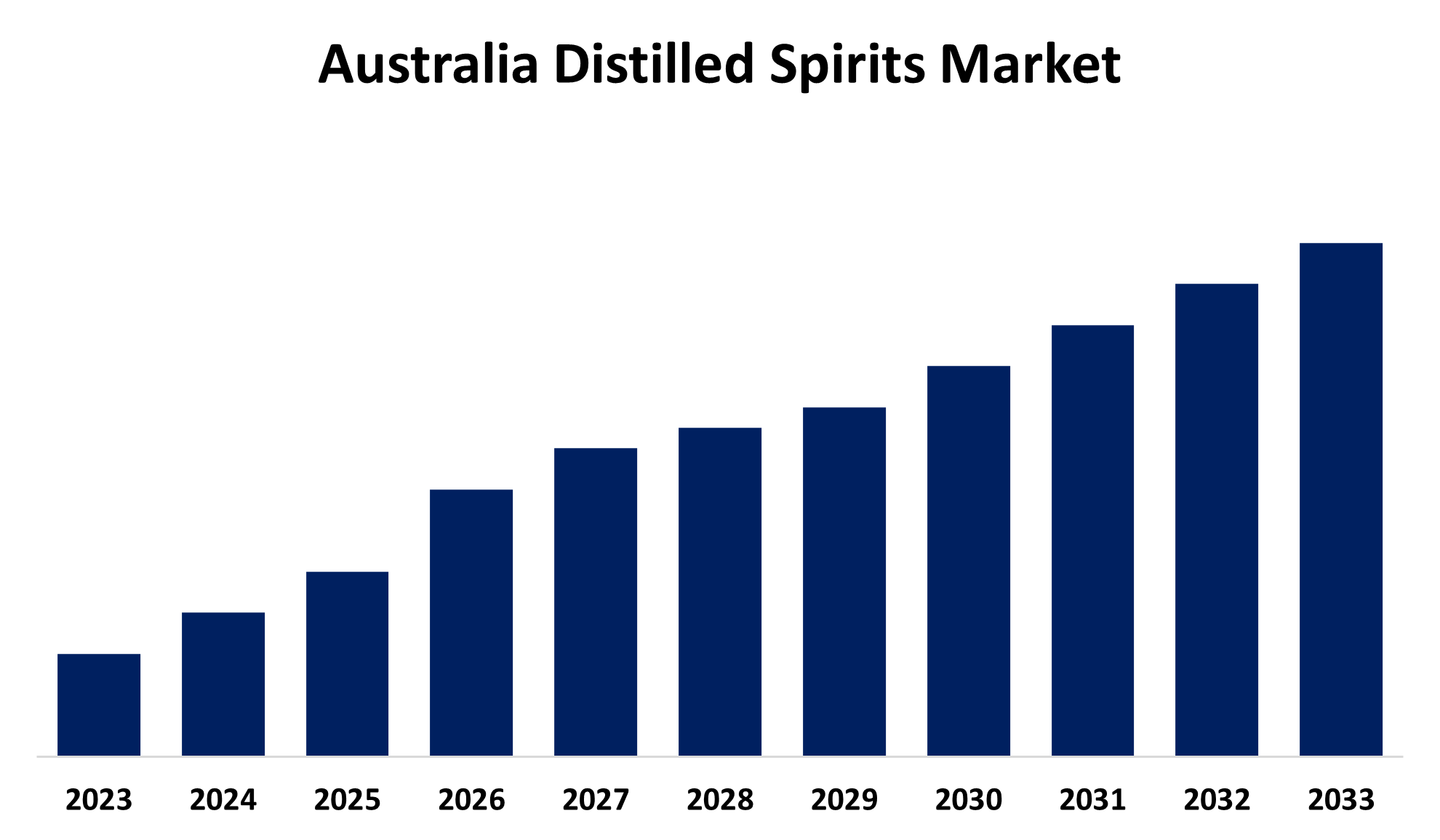

- The Australia Distilled Spirits Market Size is Growing at a CAGR of 3.94% from 2023 to 2033

- The Australia Distilled Spirits Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Australia Distilled Spirits Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 3.94% from 2023 to 2033.

Market Overview

The market that produces, distributes, and consumes alcoholic beverages made by distillation, such as whiskey, vodka, gin, rum, and brandy, is known as the Australia distilled spirits market. Growing demand for premium spirits, more craft distilleries, and shifting consumer behavior have all contributed to the market's steady increase. The rising demand for premium and craft spirits among Australians is one of the main factors propelling the market's expansion. The demand for premium, regionally produced distilled spirits has significantly increased due to consumers' rising disposable incomes and sophistication in beverage preferences. Global trends, such as the rise of cocktail culture, have also affected Australian consumption and propelled the market. Government policies have significantly influenced the growth of the Australia distilled spirits market. Support for local distilleries and craft spirit manufacturers has boosted SMEs, while laws addressing alcohol drinking, labeling, and moderate consumption have created a safer market environment. These efforts strengthen the domestic industry while meeting public health requirements. The combination of consumer demand and favorable government actions continues to drive the market's growth, making it a significant player in the global spirits market.

Report Coverage

This research report categorizes the market for the Australia distilled spirits market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia distilled spirits market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia distilled spirits market.

Australia Distilled Spirits Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.94% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Pernod Ricard Australia, Diageo Australia, Glenfiddich (William Grant & Sons), Four Pillars Distillery, Tasmanian Distillery (Sullivan’s Cove), Prohibition Liquor Co., Red Handed Distillery, and other significant contributors. |

| Pitfalls & Challenges: | Size, Share, Analysis, Trends, Growth, Demand, Outlooks, Insights |

Get more details on this report -

Driving Factors

The growing demand for premium and craft spirits is a major factor driving the distilled spirits market in Australia. Small craft distilleries are springing up all over the country as a result of consumers' growing sophistication and desire for premium, regionally produced spirits. Additionally, the rise of mixology and global cocktail culture has fueled interest in alcoholic beverages like whiskey, gin, and rum, which has helped the market expand. Growing disposable income and increased interest in artisanal, individual spirits are also factors propelling market expansion. Furthermore, both domestic and international tourists looking to learn about local liquor have benefited greatly from Australia's thriving tourism sector.

Restraining Factors

The Australia distilled spirits market faces challenges such as excessive taxation, strict alcohol sales regulations, health concerns, and global spirits brand competition. These factors can increase production costs and restrict market access, especially for small producers, potentially restraining the market's potential.

Market Segmentation

The Australia distilled spirits market share is classified into product type and distribution channel.

- The whiskey segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Australia distilled spirits market is segmented by product type into whiskey, vodka, rum, gin, tequila, brandy, and others. Among these, the whiskey segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The market dominance of Australian whiskey is largely due to the growing popularity of both domestic and overseas brands, with a strong preference for premium and craft whiskey, the rise of local distilleries, and the globalized consumption trend.

- The supermarkets and hypermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Australia distilled spirits market is divided into supermarkets, hypermarkets, specialty stores, drug stores, online, and others. Among these, the supermarkets and hypermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The supermarket and hypermarket formats in Australia provide a convenient one-stop shopping experience for a wide range of alcoholic drinks, including distilled spirits, thereby catering to the increasing demand for a one-stop destination, making them the preferred shop for many Australian consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia distilled spirits market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pernod Ricard Australia

- Diageo Australia

- Glenfiddich (William Grant & Sons)

- Four Pillars Distillery

- Tasmanian Distillery (Sullivan’s Cove)

- Prohibition Liquor Co.

- Red Handed Distillery

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Rare Hare The Tempest, a Tasmanian single malt whisky aged 20 years, was introduced by Playboy Spirits. It offers whisky lovers a distinctive flavor profile after being aged for 17 years in ex-bourbon casks and then finished for three years in ex-port casks.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia distilled spirits market based on the below-mentioned segments:

Australia Distilled Spirits Market, By Product Type

- Whiskey

- Vodka

- Rum

- Gin

- Tequila

- Brandy

- Others

Australia Distilled Spirits Market, By Distribution Channel

- Supermarkets

- Hypermarkets

- Specialty Stores

- Drug Stores

- Online

- Others

Need help to buy this report?