Australia Emission Monitoring System Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware and Services), By End-User (Industrial, Energy and Utilities, and Others), By System Type (CEMS and PEMS), and Australia Emission Monitoring System Market Insights, Industry Trend, Forecasts to 2033.

Industry: Semiconductors & ElectronicsAustralia Emission Monitoring System Market Insights Forecasts to 2033

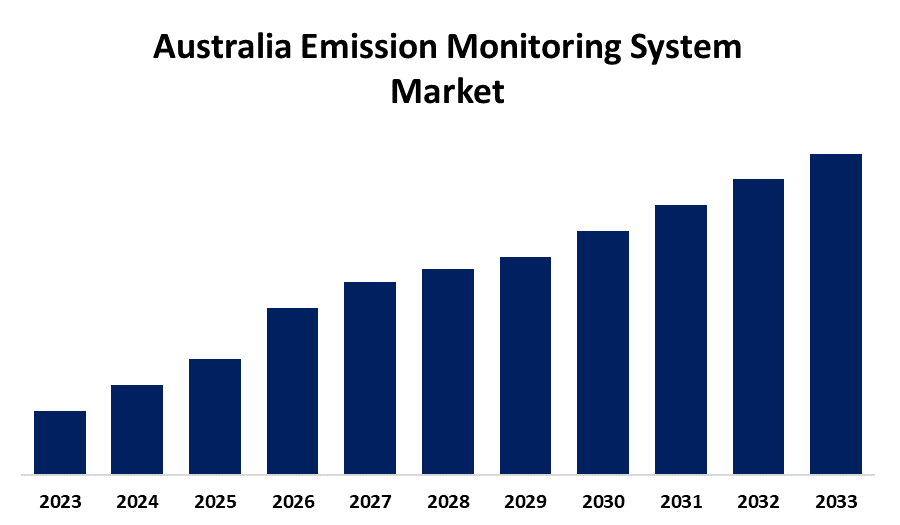

- The Australia Emission Monitoring System Market Size is Growing at a CAGR of 9.3% from 2023 to 2033

- The Australia Emission Monitoring System Market Size is Expected to Reach a Significant Share by 2033

Get more details on this report -

The Australia Emission Monitoring System Market Size is anticipated to reach a significant share by 2033, Growing at a CAGR of 9.3% from 2023 to 2033

Market Overview

Australia emission monitoring system market refers to the sector focused on the technologies and solutions used to monitor and manage emissions from various industrial processes, power plants, and transportation systems in Australia. These systems are designed to measure pollutants such as CO2, NOx, SOx, particulate matter, and volatile organic compounds (VOCs) in real-time. In recent years, there has been a notable shift towards the adoption of advanced EMS technologies like continuous emission monitoring systems (CEMS), remote sensing tools, and artificial intelligence (AI) to enhance the accuracy and efficiency of emissions data collection. The Australian government’s commitment to achieving net-zero emissions by 2050 is further fueling the growth of this market. Additionally, the increasing need for regulatory compliance, environmental reporting, and corporate social responsibility (CSR) has also contributed to the market's expansion. Key industries in the market include energy, manufacturing, transportation, and waste management, all of which play a significant role in shaping the future of emission monitoring in Australia.

Report Coverage

This research report categorizes the market for the Australia emission monitoring system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia emission monitoring system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia emission monitoring system market.

Australia Emission Monitoring System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.3% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Component, By System Type and COVID-19 Impact Analysis |

| Companies covered:: | NatWest Group, Acapela Group, U.S. Bank, Emirates NBD Bank, HSBC, DBS Bank, Central 1 Credit Union, IndusInd Bank, Axis Bank, BankBuddy, and Others key Vendors. |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Technological advancements in EMS, such as the integration of real-time monitoring, remote sensing capabilities, and AI-based analytics, have also contributed to market growth by enhancing the accuracy and efficiency of emissions data collection. Also, the rising cost of carbon emissions and the growing trend of carbon pricing and trading systems have further incentivized businesses to adopt emission monitoring systems to track and mitigate their environmental impact.

Restraining Factors

Integration of EMS into existing industrial infrastructures can be technically complex and resource-intensive, requiring significant expertise and operational downtime, which can deter companies from adopting these systems.

Market Segmentation

The Australia emission monitoring system market share is classified into component, end-user, and system type.

- The hardware segment accounted for the largest revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The Australia emission monitoring system market is segmented by component into hardware and services. Among these, the hardware segment accounted for the largest revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The dominance can be attributed to the essential role that monitoring equipment plays in the accurate and continuous measurement of emissions across industries. Hardware components, such as continuous emission monitoring systems (CEMS), analyzers, sensors, and detectors, are critical in capturing real-time data on pollutants like CO2, NOx, and particulate matter.

- The industrial segment accounted for the leading market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period.

The Australia emission monitoring system market is segmented by end-user into industrial, energy and utilities, and others. Among these, the industrial segment accounted for the leading market share in 2023 and is expected to grow at a remarkable CAGR during the forecast period. The segment growth can be attributed to the high levels of emissions generated by industries such as manufacturing, chemicals, mining, and metals, which are subject to strict environmental regulations. The need for accurate and continuous monitoring of pollutants like CO2, NOx, and particulate matter has driven the adoption of emission monitoring systems in these sectors.

- The PEMS segment accounted for the major market share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The Australia emission monitoring system market is segmented by system type into CEMS and PEMS. Among these, the PEMS segment accounted for the major market share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The segment growth is driven as PEMS offer significant advantages over traditional CEMS, primarily due to their ability to predict emissions based on real-time operational data, rather than requiring continuous physical sampling and measurement. This predictive capability allows for more flexible, cost-effective monitoring, as it reduces the need for frequent on-site equipment checks and can be implemented in a wider range of industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia emission monitoring system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NatWest Group

- Acapela Group

- U.S. Bank

- Emirates NBD Bank

- HSBC

- DBS Bank

- Central 1 Credit Union

- IndusInd Bank

- Axis Bank

- BankBuddy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Honeywell partnered with Weatherford to enhance its emissions management offerings. This collaboration combines Honeywell's suite with Weatherford's Cygnet SCADA platform, enabling upstream oil and gas operators to monitor and reduce emissions effectively. The integrated solution provides near real-time emissions data, advanced analytics, and reporting capabilities, assisting operators in meeting regulatory requirements and achieving environmental goals

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia emission monitoring system market based on the below-mentioned segments:

Australia Emission Monitoring System Market, By Component

- Hardware

- Services

Australia Emission Monitoring System Market, By End-User

- Industrial

- Energy and Utilities

- Others

Australia Emission Monitoring System Market, By System Type

- CEMS

- PEMS

Need help to buy this report?