Australia Endoscopy Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Endoscopes, Endoscopy Visualization Systems, Endoscopy Visualization Components, and Operative Devices), By End Use (Hospitals and Outpatient Facilities), and Australia Endoscopy Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareAustralia Endoscopy Devices Market Insights Forecasts to 2033

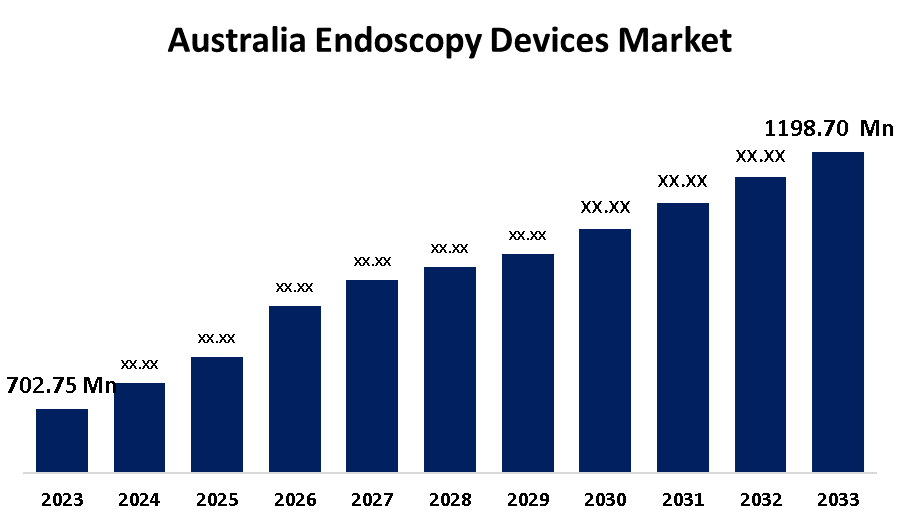

- The Australia Endoscopy Devices Market Size was valued at USD 702.75 Million in 2023.

- The Market is Growing at a CAGR of 5.49% from 2023 to 2033

- The Australia Endoscopy Devices Market Size is Expected to Reach USD 1198.70 Million by 2033

Get more details on this report -

The Australia Endoscopy Devices Market is Anticipated to exceed USD 1198.70 Million by 2033, growing at a CAGR of 5.49% from 2023 to 2033. The market for endoscopy devices in Australia is driven by the growing desire among medical professionals to use cutting-edge equipment furnished with a high-definition camera and light sources to assist doctors in examining inside organs of interest.

Market Overview

Medical devices used in endoscopic operations are developed, manufactured, and distributed by the industry known as the endoscopy devices market. Healthcare practitioners use endoscopy, a minimally invasive procedure, to look at a patient's interior organs or tissues. The existence of a small number of domestic producers has resulted in a consolidated market for endoscopic devices in Australia. The prevalent disorders that necessitate endoscopic operations and the growing desire for minimally invasive surgeries are the primary factors driving the growth of the Australia endoscopy devices market. The growing prevalence of cardiovascular disorders in Australia is anticipated to boost the use of endoscopic techniques for diagnosis, driving the market expansion. The need for cardiac endoscopy is expected to increase as a result of government investment in simple and efficient cardiovascular services, which is driving the expansion of the Australia endoscopy devices market.

Report Coverage

This research report categorizes the market for the Australia endoscopy devices market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia endoscopy devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia endoscopy devices market.

Australia Endoscopy Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 702.75 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.49% |

| 2033 Value Projection: | USD 1198.70 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End Use |

| Companies covered:: | Stryker Corporation, Medtronic Plc., Hoya Group (PENTAX Medical), Olympus Corporation, FUJIFILM Holdings Corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market expansion is driven by the FDA's favorable approvals and reimbursement rules for endoscopic equipment. The Australia endoscopy market is likely to develop due to the preference for minimally invasive surgical techniques over open or invasive surgeries and the anticipated rise in demand for these devices. The primary elements expected to drive market expansion are the less intrusive characteristics and reasonably priced post-procedure and pre-procedure costs of endoscopic equipment. Market expansion is also anticipated to be driven by a tendency toward the usage of disposable endoscopic components to reduce procedure costs and the risk of cross-contamination.

Restraining Factors

A lack of qualified medical professionals and endoscopists, possible adverse effects from endoscopic treatments, and the high expense of endoscopy equipment are some of the issues that might restrict the growth of Australia endoscopy devices market.

Market Segmentation

The Australia endoscopy devices market share is classified into product and end use.

- The endoscopes segment accounted for the largest share of the Australia endoscopy devices market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of product, the global Australia endoscopy devices market is divided into endoscopes, endoscopy visualization systems, endoscopy visualization components, and operative devices. Among these, the endoscopes segment accounted for the largest share of the Australia endoscopy devices market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Endoscopes' market expansion is being driven by growing awareness and an increasing rate of adoption across a range of diagnostic and therapeutic procedures. Moreover, endoscopes help diagnose complicated medical problems like lung, GI, urinary, and cancer syndromes.

- The outpatient facilities segment accounted for a substantial share of the Australia endoscopy devices market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of end use, the Australia endoscopy devices market is divided into hospitals and outpatient facilities. Among these, the outpatient facilities segment accounted for a substantial share of the Australia endoscopy devices market in 2023 and is anticipated to grow at a rapid pace during the projected period. Outpatient facilities like diagnostic clinics and ambulatory surgery centers are anticipated to see profitable growth as a result of the growing demand for minimally invasive procedures. It is anticipated that these procedures would reduce overall costs and the number of hospitals stays.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia endoscopy devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stryker Corporation

- Medtronic Plc.

- Hoya Group (PENTAX Medical)

- Olympus Corporation

- FUJIFILM Holdings Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, the opening of "Sapphire," Olympus Australia's first flexible endoscope sterilization facility, was announced by the multinational MedTech company dedicated to improving people's health, safety, and quality of life. Sapphire, which is based in Melbourne, Australia, is a component of the recently released Olympus On-Demand solution, which is intended to lower the risks, expenses, and complications related to running an endoscopic service and is accessible to Australian healthcare facilities.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia endoscopy devices market based on the below-mentioned segments:

Australia Endoscopy Devices Market, By Product

- Endoscopes

- Endoscopy Visualization Systems

- Endoscopy Visualization Components

- Operative Devices

Australia Endoscopy Devices Market, By End Use

- Hospitals

- Outpatient Facilities

Need help to buy this report?