Australia Fintech Market Size, Share, and COVID-19 Impact Analysis, By Technology (Application Programming Interface (API), Artificial Intelligence (AI), Blockchain, Data Analytics, Robotic Process Automation (RPA), and Others), By Application (Payments and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), and Australia Fintech Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyAustralia Fintech Market Insights Forecasts to 2033

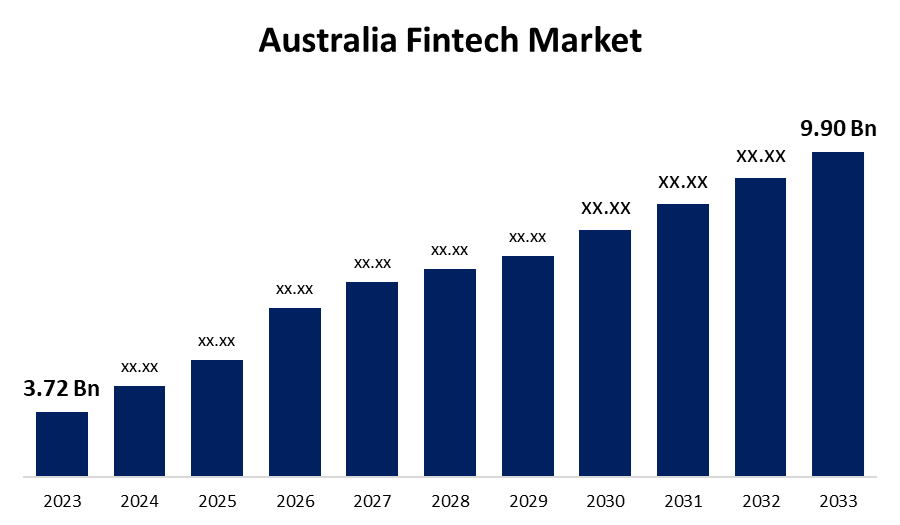

- The Australia Fintech Market Size was valued at USD 3.72 Billion in 2023.

- The Market is Growing at a CAGR of 10.28% from 2023 to 2033

- The Australia Fintech Market Size is Expected to Reach USD 9.90 Billion by 2033

Get more details on this report -

The Australia Fintech Market is Anticipated to Exceed USD 9.90 Billion by 2033, Growing at a CAGR of 10.28% from 2023 to 2033. Growing digital payments, blockchain technology, AI-powered solutions, international collaborations, improved customer experiences, and reaching underserved populations with customized financial services are some of the opportunities in the Australia fintech market.

Market Overview

The creative use of technology to improve financial services and solutions in Australia is known as the "Australia fintech market." It includes a wide range of activities, including robo-advisors, bitcoin, internet banking, digital payments, and lending platforms. Technology developments, a tech-savvy populace, and benevolent government policies have all contributed to this market's notable expansion. The Australia fintech market includes the use of cutting-edge technologies like cloud computing, blockchain, and artificial intelligence to improve client experiences, create new business models, and increase operational efficiency. The significant increase in the use of digital payments, the growing acceptance of BNPL services by younger customers looking for flexible payment choices, and the expanding use of RegTech solutions to automate compliance and fraud detection procedures are the main factors driving the Australia fintech market. The financial industry's growing digitalization and the use of cutting-edge technologies like artificial intelligence (AI), blockchain, and data analytics are driving the fintech market to strong expansion in Australia.

Report Coverage

This research report categorizes the market for the Australia fintech market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia fintech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia fintech market.

Australia Fintech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.72 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.28% |

| 2033 Value Projection: | USD 9.90 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Stripe Inc., Afterpay, Divipay Pty Ltd, Airwallex Pty Ltd, Wise Australia Pty Ltd, mx51 Pty Ltd, PTRN Pty Ltd, Athena Mortgage Pty Ltd, Zeller Australia Pty Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for scalable, effective solutions is making RegTech a major force in the Australian fintech sector. The financial technology industry's increasing use of cloud computing is anticipated to propel Australia fintech market. The Australia fintech market is a vibrant and exciting industry with substantial growth potential, driven by technical breakthroughs, shifts in consumer behavior, and regulatory developments. Technology developments, rising smartphone adoption, a tech-savvy populace, benevolent government policies, a robust startup environment, and rising customer demand for cutting-edge financial products are the main factors driving the Australia fintech market.

Restraining Factors

The Australia fintech market is restricted by a number of reasons, such as difficult macroeconomic conditions, talent shortages, regulatory complexity, cybersecurity threats, market consolidation, and restricted access to finance. These constraints make it difficult for new fintech companies to expand and survive.

Market Segmentation

The Australia fintech market share is classified into technology and application.

- The artificial intelligence (AI) segment accounted for the largest share of the Australia fintech market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of technology, the Australia fintech market is divided into application programming interface (API), artificial intelligence (AI), blockchain, data analytics, robotic process automation (RPA), and others. Among these, the artificial intelligence (AI) segment accounted for the largest share of the Australia fintech market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. artificial intelligence (AI) is being used more and more in fintech applications such as credit risk assessment, fraud detection, robo-advisory services, and digital financial planning. AI's critical role in improving the industry's operational efficiencies and consumer experiences is shown by its broad adoption.

- The payments and fund transfer segment accounted for the largest share of the Australia fintech market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of application, the Australia fintech market is divided into payments and fund transfer, loans, insurance and personal finance, wealth management, and others. Among these, the payments and fund transfer segment accounted for the largest share of the Australia fintech market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The extensive use of mobile wallets, real-time processing, and innovations such as Buy Now, Pay Later (BNPL) services are the main drivers of the payments and cash transfer market. The ease and security of transactions have been greatly improved by these developments, satisfying the growing need for smooth digital payments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia fintech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stripe Inc.

- Afterpay

- Divipay Pty Ltd

- Airwallex Pty Ltd

- Wise Australia Pty Ltd

- mx51 Pty Ltd

- PTRN Pty Ltd

- Athena Mortgage Pty Ltd

- Zeller Australia Pty Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, the financial platform Airwallex successfully acquired a 100% share in Guangzhou Shang Wu Tong Network Technology Co., Ltd., an information and online payment services firm, and subsequently obtained a payment business license in China.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia fintech market based on the below-mentioned segments:

Australia Fintech Market, By Technology

- Application Programming Interface (API)

- Artificial Intelligence (AI)

- Blockchain

- Data Analytics

- Robotic Process Automation (RPA)

- Others

Australia Fintech Market, By Application

- Payments and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Need help to buy this report?