Australia Food Colorants Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Color and Synthetic Color), By Application (Dairy & Frozen Products, Bakery and Confectionery, Meat, Poultry and Seafood, Beverages, Sauces and Condiments, and Others), and Australia Food Colorants Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesAustralia Food Colorants Market Insights Forecasts to 2033

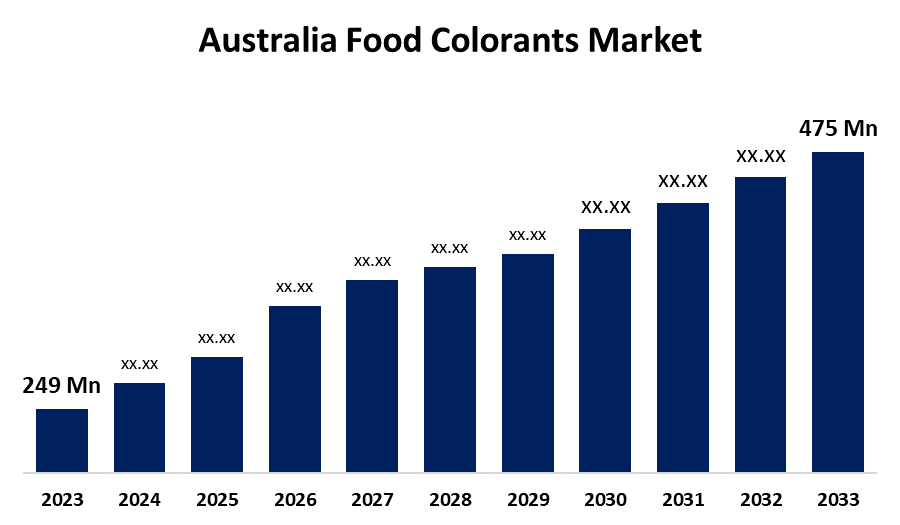

- The Australia Food Colorants Market Size was valued at USD 249 Million in 2023.

- The Market is Growing at a CAGR of 6.67% from 2023 to 2033

- The Australia Food Colorants Market Size is Expected to Reach USD 475 Million by 2033

Get more details on this report -

The Australia Food Colorants Market Size is Anticipated to Exceed USD 475 Million by 2033, Growing at a CAGR of 6.67% from 2023 to 2033. The market for food colorants agents is rising as a result of the growing trend of snacking and eating during the move, where consumers can be affected by the availability of bright, aesthetically pleasing processed meals.

Market Overview

The business devoted to the manufacture, distribution, and use of food coloring in Australia is known as the "Australia food colorants market." Food colorants are chemicals, either synthetic or natural, that are used to change or improve the color of food and drink. The increased need for natural and clean-label ingredients, as well as the need for aesthetically pleasing food products, is driving the food colorants market. Materials used to improve or change the color of food and drink are marketed by the Australia food colorants market. Growing consumer preferences for clean-label products, a spike in processed food consumption, and a growing need for natural food coloring are all driving the Australia food colorants market. Food colorants are mostly driven by consumers' growing appetite for colorful foods. A crucial element in improving product penetration is the use of edible color to improve the food's texture and aesthetic appeal. The Australia food colorants market for food coloring is expected to be greatly driven by Australia's rising consumption of processed and ready-to-eat meals.

Report Coverage

This research report categorizes the market for the Australia food colorants market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia food colorants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia food colorants market.

Australia Food Colorants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 249 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.67% |

| 2033 Value Projection: | USD 475 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Application, By Type and COVID-19 Impact Analysis |

| Companies covered:: | Tate & Lyle PLC, Hansen Holding A/S, Kerry Group, Symrise AG, FMC Corporation, Cargill, Inc., BASF SE, Sensient Technologies Corporation, McCormick & Company, Inc., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rise in processed food consumption, growing consumer preferences for clean-label products, and growing demand for natural food coloring are all driving the expansion of the Australia food colorants market. To improve the appearance and appeal of processed meals, food manufacturers are increasingly using food coloring agents as customer tastes change toward convenient and aesthetically pleasing products. Consumer convenience and tastes for aesthetically pleasing, health-conscious products are driving Australia food colorants market due to the growing demand for processed foods.

Restraining Factors

High manufacturing costs, strict regulations, a lack of natural colorants, customer apprehension about synthetic chemicals, and the difficulty of preserving stability in processed foods are some of the constraints facing the Australia food coloring market.

Market Segmentation

The Australia food colorants market share is classified into type and application.

- The natural color segment accounted for the largest share of the Australia food colorants market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of type, the Australia food colorants market is divided natural color and synthetic color. Among these, the natural color segment accounted for the largest share of the Australia food colorants market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Growing customer desire for clean-label products and a move toward healthier, natural ingredients are the main drivers of the natural color market. Additionally, the popularity of natural color food colorants has increased due to the rising desire for products devoid of artificial ingredients.

- The bakery and confectionery segment accounted for the largest share of the Australia food colorants market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of application, the Australia food colorants market is divided into dairy & frozen products, bakery and confectionery, meat, poultry and seafood, beverages, sauces and condiments, and others. Among these, the bakery and confectionery segment accounted for the largest share of the Australia food colorant market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Bright colors are frequently used to improve visual appeal and consumer preference in items like cakes, pastries, candies, and other sweets, which is the reason the bakery and confectionery market uses food coloring so heavily.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia food colorants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tate & Lyle PLC

- Hansen Holding A/S

- Kerry Group

- Symrise AG

- FMC Corporation

- Cargill, Inc.

- BASF SE

- Sensient Technologies Corporation

- McCormick & Company, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia food colorants market based on the below-mentioned segments:

Australia Food Colorants Market, By Type

- Natural Color

- Synthetic Color

Australia Food Colorants Market, By Application

- Dairy & Frozen Products

- Bakery and Confectionery

- Meat, Poultry and Seafood

- Beverages

- Sauces and Condiments

- Others

Need help to buy this report?