Australia Food Emulsifier Market Size, Share, and COVID-19 Impact Analysis, By Type (Lecithin, Sorbitan Esters, and Polyglycerol Esters), By Application (Dairy and Frozen Products, Bakery, and Meat), and Australia Food Emulsifier Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesAustralia Food Emulsifier Market Insights Forecasts to 2033

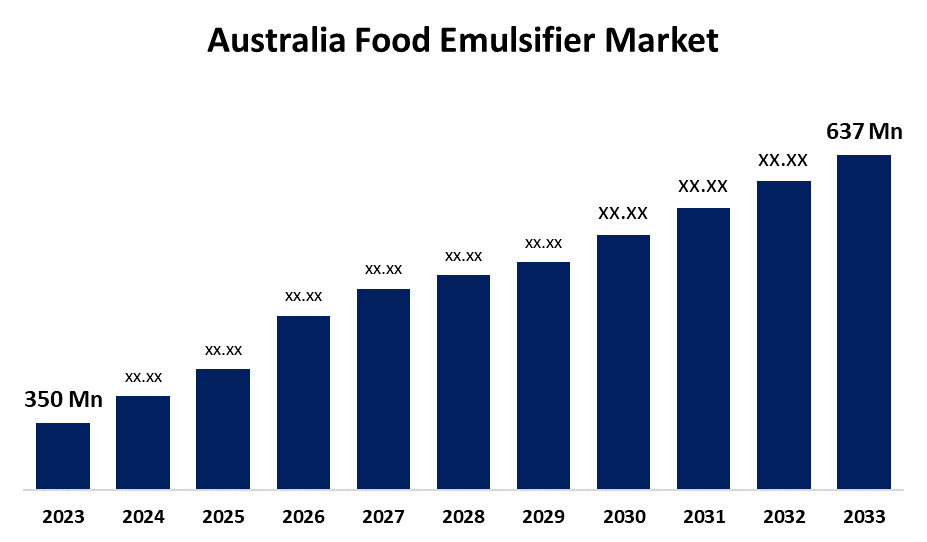

- The Australia Food Emulsifier Market Size was valued at USD 350 Million in 2023.

- The Market Size is Growing at a CAGR of 6.17% from 2023 to 2033

- The Australia Food Emulsifier Market Size is Expected to Reach USD 637 Million by 2033

Get more details on this report -

The Australia Food Emulsifier Market Size is Anticipated to Exceed USD 637 Million by 2033, Growing at a CAGR of 6.17% from 2023 to 2033. Product development innovations, especially those improved stabilizing qualities, present a substantial potential opportunity in the Australia food emulsifier market.

Market Overview

The business devoted to the manufacturing, distribution, and usage of emulsifiers in the Australia food and beverage industry is known as the "Australia food emulsifier market." Emulsifiers are additives that combine and stabilize oil and water combinations to provide products like dairy products, processed meals, baked products, and sauces with a constant texture, flavor, and shelf life. The increasing demand for plant-based goods, clean-label ingredients, and convenience foods is driving the Australia food emulsifier market. The factors propelling Australia food emulsifier market expansion include the growing plant-based food business, the growing number of health-conscious consumers, and the growing food processing sector. The market for Australia food emulsifiers as a whole is anticipated to be driven by Australia's growing disposable income and the increase in processed and convenience food consumption brought on by the growing end-user applications of food emulsifiers. The need for clean-label and functional foods is driving the growing use of food emulsifiers in Australia.

Report Coverage

This research report categorizes the market for the Australia food emulsifier market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia food emulsifier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia food emulsifier market.

Australia Food Emulsifier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 350 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.17% |

| 2033 Value Projection: | USD 637 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Tate & Lyle PLC, BASF SE, Cargill, Corbion NV, Incorporated, Kerry Group plc, Ingredion, Dow Inc., Ingredion Incorporated, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for Australia food emulsifiers has expanded significantly, mostly due to rising convenience food consumption. Pre-made meals or ready-to-eat products that take little time or effort to make are referred to as convenience foods. The increased disposable incomes, the growing middle class, and increased processed food consumption are the main drivers of this growth. Growing uses in the dairy and baking sectors, the growing demand for functional and fortified foods, and regulatory support for safer food additives are some of the main motivators. The Australia food emulsifier market is also being driven by the growth of region’s food processing industry, urbanization, and shifting dietary preferences.

Restraining Factors

Regulatory limitations on synthetic emulsifiers, volatile raw material prices, competition from alternative ingredients, consumer apprehensions regarding food additives, and a lack of knowledge in some areas are some of the challenges facing the Australian food emulsifier market.

Market Segmentation

The Australia food emulsifier market share is classified into type and application.

- The lecithin segment accounted for the largest share of the Australia food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of type, the Australia food emulsifier market is divided into lecithin, sorbitan esters, and polyglycerol esters. Among these, the lecithin segment accounted for the largest share of the Australia food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Lecithin is extensively used in foods like bread, beverages, and chocolates stems due to its inexpensive and natural origin. Since lecithin is made from soybeans that are grown nearby, it has a substantial market.

- The dairy and frozen products segment accounted for the largest share of the Australia food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of application, the Australia food emulsifier market is divided into dairy and frozen products, bakery, and meat. Among these, the dairy and frozen products segment accounted for the largest share of the Australia food emulsifier market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Emulsifiers are becoming more and more popular in dairy and frozen products because they improve texture and stability in items like ice cream, yogurt, and frozen desserts. Australia's robust dairy sector and consumers' inclination for high-end frozen products are advantageous to this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia food emulsifier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tate & Lyle PLC

- BASF SE

- Cargill

- Corbion NV

- Incorporated

- Kerry Group plc

- Ingredion

- Dow Inc.

- Ingredion Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, The Department of Industry, Science, and Resources of the Australian Government announced an AUD 2 Million prize for food technology companies who are interested in emulsifier research. Research into creating more sustainable and effective emulsifiers is supported by this award, which would boost market expansion and improve Australia's standing as a competitive nation in the Asia-Pacific region.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia food emulsifier market based on the below-mentioned segments:

Australia Food Emulsifier Market, By Type

- Lecithin

- Sorbitan Esters

- Polyglycerol Esters

Australia Food Emulsifier Market, By Application

- Dairy and Frozen Products

- Bakery

- Meat

Need help to buy this report?