Australia Forklift Truck Market Size, Share, and COVID-19 Impact Analysis, By Class (Class I (Electric Motor Rider Trucks), Class II (Electric Motor Narrow Aisle Trucks), Class III (Hand Rider Trucks), Class IV (IC Engine Trucks, Solid/Cushion Tires), Class V (IC Engine Trucks, Pneumatic Tires), and Others), By Fuel Type (Diesel, Gasoline, and Electric), By End User (Retail & Wholesale, Logistics, Automotive, and Food Industry) and Australia Forklift Truck Market Insights, Industry Trend, Forecasts to 2033.

Industry: Automotive & TransportationAustralia Forklift Truck Market Insights Forecasts to 2033

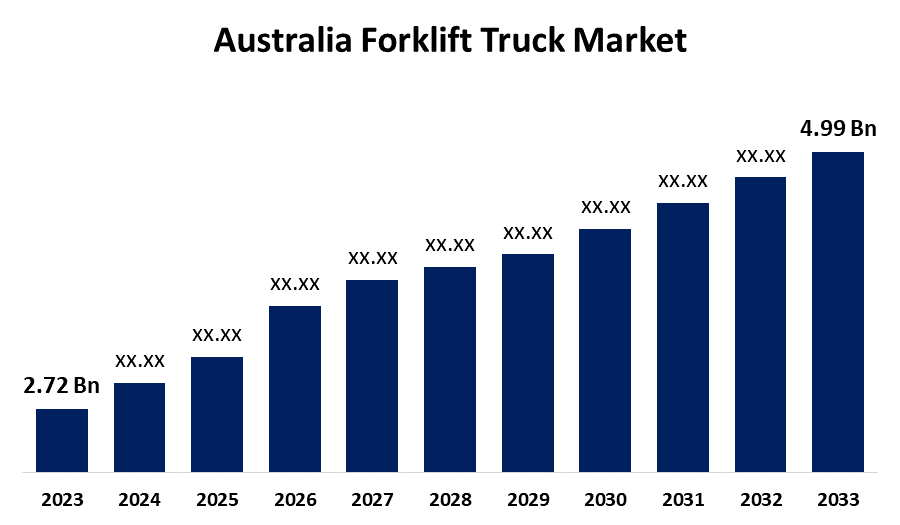

- The Australia Forklift Truck Market Size was valued at USD 2.72 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.26% from 2023 to 2033.

- The Australia Forklift Truck Market Size is Expected to Reach USD 4.99 Billion by 2033

Get more details on this report -

The Australia Forklift Truck Market Size is Anticipated to Reach USD 4.99 Billion by 2033, growing at a CAGR of 6.26% from 2023 to 2033.

Market Overview

A mechanical truck, equipped with a motor that can move materials on pallets inside warehouses, storage facilities, and distribution centers is known as a forklift truck. Due to their strong rigid frame, dual front wheels, and rear wheel steering system, forklift trucks can move in confined locations. With the help of their hydraulic fork that can be raised and lowered, boxes, packs, and other bulky items can be lifted and moved or shifted to another place. Safe and accurate load handling and placement are guaranteed by trained operators of forklift trucks which helps in increasing productivity and efficiency across the sector. Australia forklift truck market is expanding due to several factors such as rising demand for effective material handling equipment, technological advancements, increased focus on workplace safety laws, and the need for cost and productivity optimization across a range of industries, including manufacturing, warehousing, and logistics. For instance, the Ministry of Education and Human Resources Development (MEHRD) took delivery of a new forklift to help its Education Resources Unit (ERU) safely stack curriculum materials and other learning resources before delivering them to schools around the region.

Report Coverage

This research report categorizes the market for the Australia forklift truck market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia forklift truck market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia forklift truck market.

Australia Forklift Truck Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.72 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.26% |

| 2033 Value Projection: | USD 4.99 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Class, By Fuel Type, and By End User |

| Companies covered:: | Toyota Industries Corporation, Crown, MANITOU, Clark, Linde, Hyster-Yale, Mitsubishi, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Faster procurement, convenient delivery, rising disposable income, and declining material costs are some of the factors that increase the demand for material handling solutions. More orders are being placed across warehouses, which results in the expansion of e-commerce, online shopping, sales, and distribution. For instance, total e-commerce sales for the year 2023 would be around $63.6 Billion showing about 1.2% year-on-year growth. Demand for small forklift trucks is increasing due to the increased volume of sales as the warehouse pathways are becoming increasingly narrow. As the forklifts are designed with quicker pick-up and unloading times, it is becoming essential to daily warehouse routine.

Restraining Factors

The largest contribution to carbon emissions is made by the logistics and transportation industries due to the use of traditional engines in trucks and other construction equipment. Australian government regulatory agencies have implemented many rules and regulations aimed at reducing carbon emissions. Factors such as the increasing cost of raw materials and fuel hampers the Australia forklift truck market.

Market Segmentation

The Australia forklift truck market share is classified into class, fuel type and end-users.

- The class IV (IC engine trucks, solid/cushion tires) segment is expected to hold the largest market share through the forecast period.

The Australia forklift truck market is segmented by class into class I (electric motor rider trucks), class II (electric motor narrow aisle trucks), class III (hand rider trucks), class IV (IC engine trucks, solid/cushion tires), class V (IC engine trucks, pneumatic tires), and others). Among these, the class IV (IC engine trucks, solid/cushion tires) segment is expected to hold the largest market share through the forecast period. These forklift trucks offer efficient performance for indoor applications and are widely used in a variety of industrial applications.

- The electric segment is expected to dominate the Australia forklift truck market during the forecast period.

Based on the fuel type, the Australia forklift truck market is divided into diesel, gasoline, and electric. Among these, the electric segment is expected to dominate the Australia forklift truck market during the forecast period. The electric forklift truck market in Australia has also witnessed significant growth with the increase in concern for sustainability and environmental awareness, as well as government initiatives to promote electric vehicles.

- The logistics segment is expected to hold the largest market share through the forecast period.

The Australia forklift truck market is segmented by end-users into retail & wholesale, logistics, automotive, and food industry. Among these, the logistics segment is expected to hold the largest market share through the forecast period. The logistics of large loads and efficient handling of materials are essential for the delivery and transportation of goods and services. Forklifts are essential equipment for the movement and storage of goods in warehouses, ports, and distribution centres.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia forklift truck market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyota Industries Corporation

- Crown

- MANITOU

- Clark

- Linde

- Hyster-Yale

- Mitsubishi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, under tariff heading HS 842710, the Australian government implemented import duty concessions for battery-powered driver-operated forklift trucks through Tariff Concession. Retroactively, started in October 2023, the import tariff was lowered from 5% to 0%.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia forklift truck market based on the below-mentioned segments:

Australia Forklift Truck Market, By Class

- Class I (Electric Motor Rider Trucks)

- Class II (Electric Motor Narrow Aisle Trucks)

- Class III (Hand Rider Trucks)

- Class IV (IC Engine Trucks, Solid/Cushion Tires)

- Class V (IC Engine Trucks, Pneumatic Tires)

- Others

Australia Forklift Truck Market, By Fuel Type

- Diesel

- Gasoline

- Electric

Australia Forklift Truck Market, By End-User

- Retail & Wholesale

- Logistics

- Automotive

- Food Industry

Need help to buy this report?