Australia Insulin Drugs and Delivery Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Basal or Long-acting Insulins, Bolus or Fast-acting Insulins, Traditional Human Insulins, Combination Insulins, and Biosimilar Insulins), By Device Type (Insulin Pens, Insulin Pumps, Insulin Syringes, and Jet Injectors), and Australia Insulin Drugs and Delivery Devices Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareAustralia Insulin Drugs and Delivery Devices Market Insights Forecasts to 2033

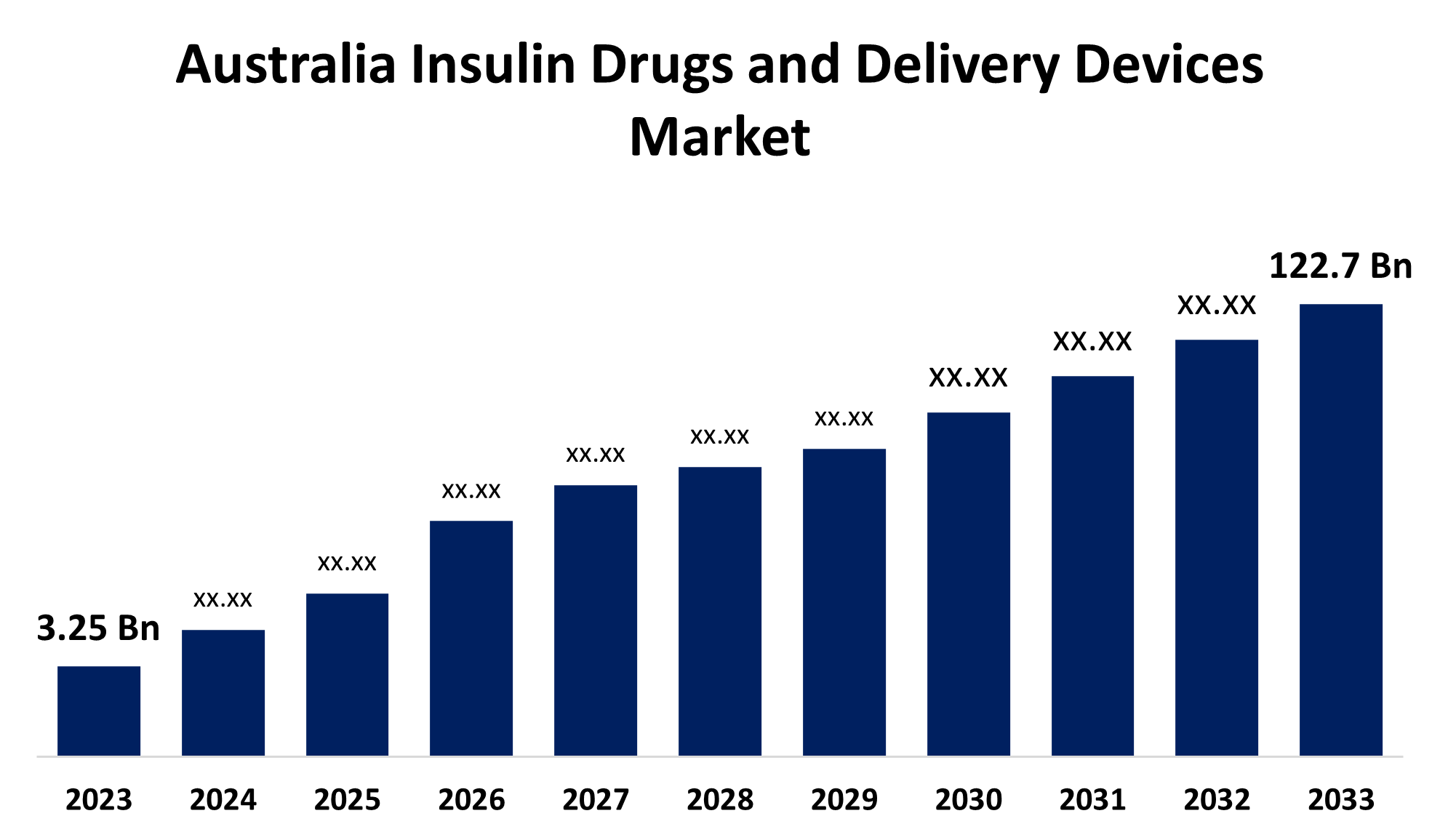

- The Market Size is Growing at a CAGR of XX% from 2023 to 2033

- The Australia Insulin Drugs and Delivery Devices Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The Australia Insulin Drugs and Delivery Devices Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of XX% from 2023 to 2033.

Market Overview

The Australia Insulin Drugs and Delivery Devices Market is responsible for producing, distributing, and consuming insulin medications and devices for diabetes management in Australia, crucial for individuals with Type 1 or Type 2 diabetes. Pharmaceuticals and devices used to treat diabetes, including insulin and its delivery systems, are sold in the Australia insulin drugs and delivery devices market. The market includes delivery devices like syringes, insulin pens, pumps, and continuous glucose monitors (CGMs) in addition to insulin medications in injectable, inhalation, and fast-acting forms. The goal of these products is to help diabetics maintain healthy blood sugar levels and general well-being. The aging of the population, rising obesity rates, and the growing number of diabetics, particularly type 2 diabetes, brought on by lifestyle changes are the main factors driving the Australian market. As patients seek more effective, convenient, and painless ways to manage their condition, the market is growing with increasingly advanced insulin medications and delivery systems. Another major factor driving the market has been the development of insulin pumps, smart pens, and CGM systems, which have improved blood glucose control and the quality of life for diabetic patients. The Australian government's Pharmaceutical Benefits Scheme subsidies and support for diabetes management technologies have made insulin medications and devices more affordable for patients. Healthcare policy and public campaigns aim to raise awareness and increase demand for insulin therapies and devices.

Report Coverage

This research report categorizes the market for the Australia insulin drugs and delivery devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia insulin drugs and delivery devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia insulin drugs and delivery devices market.

Australia Insulin Drugs and Delivery Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Device Type |

| Companies covered:: | Novo Nordisk, Sanofi, Bayer HealthCare, Roche Diabetes Care, Medtronic, Lilly Australia (Eli Lilly), Johnson & Johnson, F. Hoffmann-La Roche Ltd., Ypsomed, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Australia insulin drugs and delivery devices market is expanding due to factors such as the increasing incidence of diabetes, an aging population, physical inactivity, and unhealthy diets. The demand for insulin drugs and advanced delivery devices is also increasing due to improvements in insulin pumps, smart pens, and continuous glucose monitoring systems. Government initiatives like PBS subsidies make these products more accessible to a wider population, driving market growth.

Restraining Factors

The market for advanced insulin delivery devices faces challenges such as high costs, government subsidies, lack of knowledge about current technology, and regulatory barriers. These factors can limit the use of these devices by certain patient populations, particularly those without good insurance or living in rural areas. Long approval procedures can also hinder the launch of new products.

Market Segmentation

The Australia insulin drugs and delivery devices market share is classified into type and device type.

- The basal or long-acting insulins segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Australia insulin drugs and delivery devices market is segmented by type into basal or long-acting insulins, bolus or fast-acting insulins, traditional human insulins, combination insulins, and biosimilar insulins. Among these, the basal or long-acting insulins segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Insulins are essential for maintaining blood sugar levels throughout the day, especially for type 1 and type 2 diabetes. Their growth is primarily driven by the rise in type 2 diabetes, where basal insulin is the first-line treatment.

- The insulin pens segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the device type, the Australia insulin drugs and delivery devices market is divided into insulin pens, insulin pumps, insulin syringes, and jet injectors. Among these, the insulin pens segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Insulin pens are the preferred choice in diabetes care due to their comfort, convenience, and accuracy in dose delivery. They are suitable for both type 1 and type 2 diabetic patients, and their discreet administration makes them ideal for those needing multiple daily insulin injections.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia insulin drugs and delivery devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Sanofi

- Bayer HealthCare

- Roche Diabetes Care

- Medtronic

- Lilly Australia (Eli Lilly)

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd.

- Ypsomed

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia insulin drugs and delivery devices market based on the below-mentioned segments:

Australia Insulin Drugs and Delivery Devices Market, By Type

- Basal or Long-acting Insulins

- Bolus or Fast-acting Insulins

- Traditional Human Insulins

- Combination Insulins

- Biosimilar Insulins

Australia Insulin Drugs and Delivery Devices Market, By Device Type

- Insulin Pens

- Insulin Pumps

- Insulin Syringes

- Jet Injectors

Need help to buy this report?