Australia Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Refrigerators and Freezers, Dishwashers, Food Processors, Mixers and Grinders, Microwave Ovens, Grills and Roasters, Water Purifiers, and Others), By Distribution Channel (Multi-Brand Stores, Exclusive Stores, Online, and Others), and Australia Kitchen Appliances Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsAustralia Kitchen Appliances Market Insights Forecasts to 2033

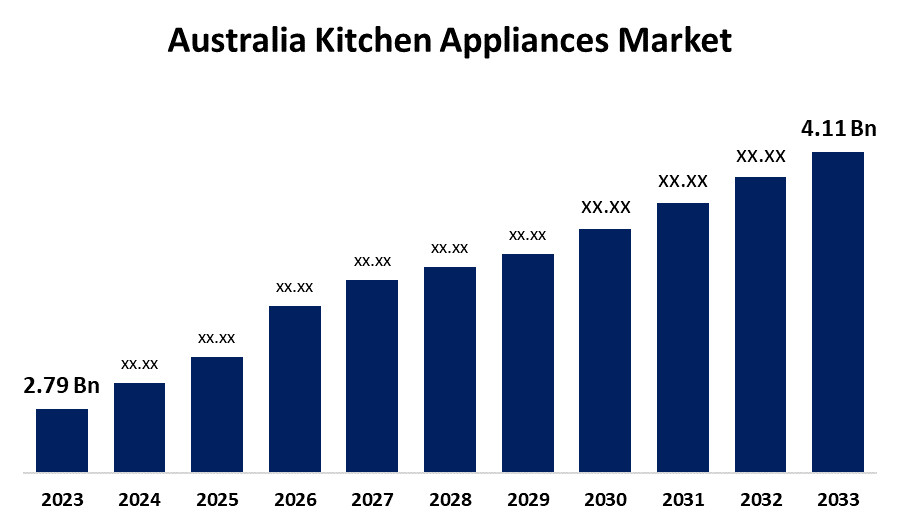

- The Australia Kitchen Appliances Market Size was valued at USD 2.79 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.95% from 2023 to 2033

- The Australia Kitchen Appliances Market Size is Expected to Reach USD 4.11 Billion by 2033

Get more details on this report -

The Australia Kitchen Appliances Market Size is Anticipated to Exceed USD 4.11 Billion by 2033, Growing at a CAGR of 3.95% from 2023 to 2033. The evolving lifestyles of people, the growing inclination for nuclear families, and the expanding hospitality sector are some of the significant factors driving the Australia kitchen appliances market's expansion.

Market Overview

The business devoted to the manufacture, marketing, and distribution of kitchen appliances in Australia is known as the "Australia kitchen appliances market." A vast array of products is available in this sector, including microwaves, dishwashers, ovens, refrigerators, and smaller appliances like mixers and grinders. It serves both home and business clients and things like shifting consumer tastes, lifestyle trends, and technology developments. The market for kitchen equipment in Australia is expanding significantly due to people's hectic lifestyles and changing culinary tastes. The adoption of a variety of appliances is being driven by customers' growing need for time-saving and efficient kitchen solutions. The Australia kitchen appliances market is expanding as a result of people's increased awareness of health and well-being. The market expansion is being driven by the rising effect of house remodeling and renovation initiatives. The market estimate for kitchen appliances indicates that the desire for quick and simple cooking appliances is to raise the demand for smart and efficient cooking appliances overall.

Report Coverage

This research report categorizes the market for the Australia kitchen appliances market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia kitchen appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia kitchen appliances market.

Australia Kitchen Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.79 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.95% |

| 2033 Value Projection: | USD 4.11 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Electrolux, Haier Group, LG Electronics, Breville Group, Samsung Electronics, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Technological developments, including smart technology integration and energy-efficient features, changing culinary tastes, hectic lives, and the impact of home remodeling projects are all driving the kitchen appliances market's notable expansion. Increasingly, smart technology integration, energy-efficient features, and creative designs are all contributing to the kitchen appliances market growth. The need for contemporary and practical kitchen equipment is driven by both population growth and a rising emphasis on home cooking. The expansion of the Australia kitchen appliances market is expected to be driven by technological advancements and increased expenditures in the research and development of different electric kitchen appliances.

Restraining Factors

High product costs, a lack of customer understanding of cutting-edge technology, environmental concerns, and shifting economic situations that impact purchasing power and the sustainability of market development are some of the factors restricting the Australia kitchen appliances market.

Market Segmentation

The Australia kitchen appliances market share is classified into product and distribution channel.

- The refrigerators and freezers segment accounted for the largest share of the Australia kitchen appliances market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of product, the Australia kitchen appliances market is divided into refrigerators and freezers, dishwashers, food processors, mixers and grinders, microwave ovens, grills and roasters, water purifiers, and others. Among these, the refrigerators and freezers segment accounted for the largest share of the Australia kitchen appliances market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is attributed to the refrigerators and freezers' vital function in food preservation and their regular replacement cycles. Consequently, it is logical to conclude that freezers and refrigerators probably made up a significant share of the market.

- The multi-brand stores segment accounted for the largest share of the Australia kitchen appliances market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of distribution channel, the Australia kitchen appliances market is divided into multi-brand stores, exclusive stores, online, and others. Among these, the multi-brand stores segment accounted for the largest share of the Australia kitchen appliances market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Multi-brand stores provide a wide variety of brands and products under one roof, giving customers a large selection and the ease of comparing alternatives in the Australian kitchen appliances market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia kitchen appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Electrolux

- Haier Group

- LG Electronics

- Breville Group

- Samsung Electronics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, the announcement of its innovative InFizz line through creative agency the General Store, kitchen equipment giant Breville enters the carbonated beverage market. Showcasing two new products, the InFizz Fusion and the InFizz Aqua, the range is an innovative way for consumers to unleash their creativity this summer. With its FusionCap pressure control technology, the InFizz Fusion can carbonate flavored drinks without overflowing or requiring the addition of sparkling water to pre-existing mixtures.

- In April 2023, Haier, the number one brand globally in major appliances, has today become the Official Home Appliances Partner and Gold Partner of the ATP Tour. This partnership would provide a premium platform for Haier to promote its latest innovations and sustainability focus to tennis fans - a community numbering more than one billion globally with aligns with Haier’s Zero Distance strategy.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia kitchen appliances market based on the below-mentioned segments:

Australia Kitchen Appliances Market, By Product

- Refrigerators and Freezers

- Dishwashers

- Food Processors

- Mixers and Grinders

- Microwave Ovens

- Grills and Roasters

- Water Purifiers

- Others

Australia Kitchen Appliances Market, By Distribution Channel

- Multi-Brand Stores

- Exclusive Stores

- Online

- Others

Need help to buy this report?