Australia Lime Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Aglime (Agricultural Lime), Quick Lime, and Hydrated Lime), By Application (Mining & Metallurgy, Building Material, Agriculture, Water Treatment, and Others), and Australia Lime Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesAustralia Lime Market Insights Forecasts to 2033

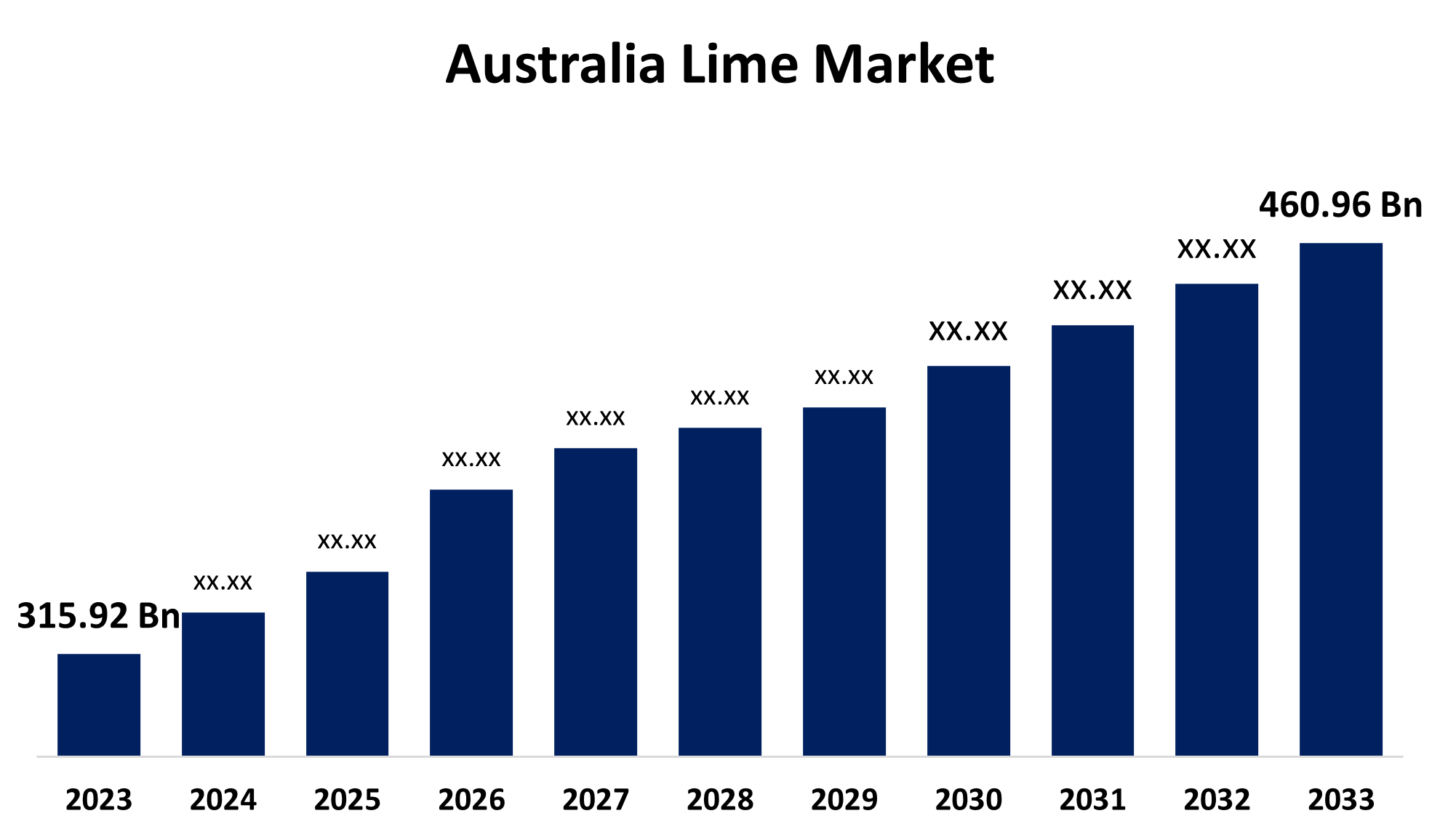

- The Australia Lime Market Size was valued at USD 315.92 Billion in 2023.

- The Australia Lime Market is Growing at a CAGR of 3.85% from 2023 to 2033

- The Australia Lime Market Size is Expected to Reach USD 460.96 Billion by 2033

Get more details on this report -

The Australia Lime market Size is anticipated to reach USD 460.96 billion by 2033, growing at a CAGR of 3.85 % from 2023 to 2033. Government spending on building public infrastructure, such as train stations, is on the rise, which is a significant industrial trend that regulates market development.

Market Overview

The industry that produces, distributes, and consumes lime products in Australia is known as the "Australia lime market." Lime is a multipurpose chemical molecule that may be found in several forms, including agricultural lime (calcium carbonate), hydrated lime (calcium hydroxide), and quicklime (calcium oxide). Numerous industries, including manufacturing, mining, construction, agriculture, and water treatment, apply it. The availability of raw materials, environmental laws, improvements in production technology, and demand from different Australian economic sectors are all factors included in the Australia lime market. Growing production and shifting customer tastes for natural and health-conscious products are driving the Australia lime market. Limes are a popular choice for Australians who are concerned about their diet and well-being since they are high in vitamin C and antioxidants. Lime's increasing use as a pigment and as a filler in more costly paints is anticipated to drive market expansion.

Report Coverage

This research report categorizes the market for the Australia lime market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia lime market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia lime market.

Australia Lime Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 315.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.85% |

| 2033 Value Projection: | USD 460.96 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Adelaide Brighton Limited, Boral Limited, Graymont Limited, Cockburn Cement Limited, Swan Cement Limited, Agricola Mining Pty Ltd, Calcimo Lime & Fertilizers Pty Ltd, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The need for mortar rises in tandem with the expansion of the building industry, whether it is due to infrastructure or residential projects. Lime's numerous uses in enhancing the structural soundness, longevity, and environmental sustainability of infrastructure projects drive demand for the material in infrastructure development, especially in road building and maintenance. Gold, copper, coal, and iron ore are among the many mineral resources found in Australia. Lime is vital for the mining and metallurgy sectors since it is used in ore processing, metal extraction, and refining.

Restraining Factors

A considerable quantity of carbon dioxide (CO2) is released during the energy-intensive process of producing lime, particularly quick lime. Stricter environmental laws on carbon emissions and growing worries about climate change could affect market dynamics and raise the cost of producing lime.

Market Segmentation

The Australia lime market share is classified by product type and application.

- The quick lime segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product type, the Australia lime market is segmented into aglime (agricultural lime), quick lime, and hydrated lime. Among these, the quick lime segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The mining sector uses quick lime extensively for refining, metal extraction, and ore processing. Australia has a thriving mining industry, especially in the production of coal, copper, and gold, which creates a high demand for quick lime in a variety of processes including fluxing and smelting.

- The mining & metallurgy segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the Australia lime market is divided into mining & metallurgy, building material, agriculture, water treatment, and others. Among these, the mining & metallurgy segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. In mining, lime is essential, particularly for the processing of ore. It aids in the extraction of metals from ores, especially in smelting and fluxing operations where lime is used as a fluxing agent to eliminate impurities from metals like copper, aluminum, and gold. The substantial need for lime is driven by Australia's extensive mining sector, particularly in the gold and copper mining industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia lime market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adelaide Brighton Limited

- Boral Limited

- Graymont Limited

- Cockburn Cement Limited

- Swan Cement Limited

- Agricola Mining Pty Ltd

- Calcimo Lime & Fertilizers Pty Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Calix was awarded a US$10m grant from the Australian government’s Carbon Capture Technologies Program to build a commercial demonstration electric calciner for ‘near zero emissions’ lime and cement production.

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia lime market based on the below-mentioned segments:

Australia Lime Market, By Product Type

- Aglime (Agricultural Lime)

- Quick Lime

- Hydrated Lime

Australia Lime Market, By Application

- Mining & Metallurgy

- Building Material

- Agriculture

- Water Treatment

- Others

Need help to buy this report?