Australia LNG Bunkering Market Size, Share, and COVID-19 Impact Analysis, By Type (Truck-to-Ship, Port-to-Ship, and Ship-to-Ship), By End User (Container Vessels, Tankers, and Bulk and General Cargo Vessels), and Australia LNG Bunkering Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerAustralia LNG Bunkering Market Insights Forecasts to 2033

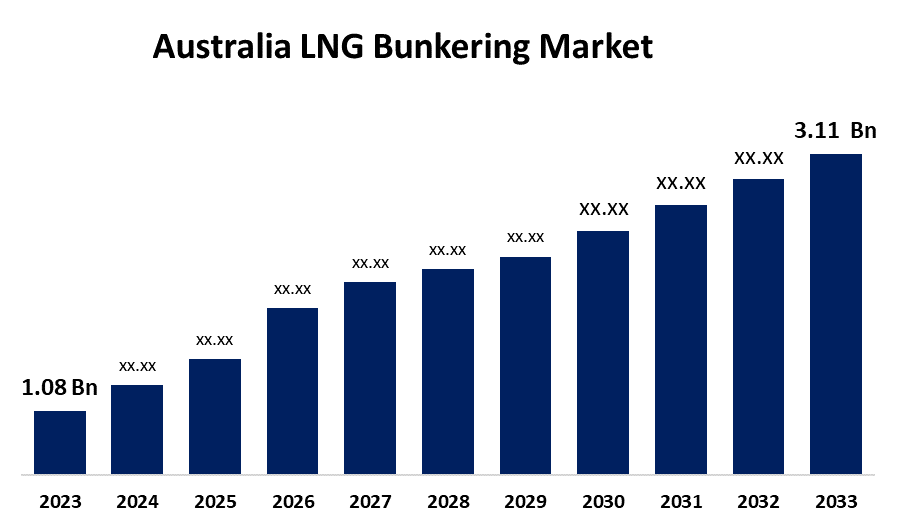

- The Australia LNG Bunkering Market Size was valued at USD 1.08 Billion in 2023.

- The Market is Size Growing at a CAGR of 11.16% from 2023 to 2033

- The Australia LNG Bunkering Market Size is Expected to Reach USD 3.11 Billion by 2033

Get more details on this report -

The Australia LNG Bunkering Market is Anticipated to Exceed USD 3.11 Billion by 2033, Growing at a CAGR of 11.16% from 2023 to 2033. Environmental laws, a wealth of natural gas reserves, growing LNG infrastructure, a growth in shipping, and the need for cleaner marine fuels to cut emissions are the main factors driving the Australia LNG bunkering market.

Market Overview

The sector that supplies and distributes liquefied natural gas (LNG) as a marine fuel in Australia is known as the Australia LNG bunkering market. To lessen greenhouse gas emissions and adhere to more stringent environmental requirements, this market is essential in promoting greener energy solutions for the maritime sector. It includes building infrastructure to facilitate the use of LNG in marine transportation, such as filling stations and storage facilities. The growing use of cleaner marine fuels and stricter environmental regulations are driving the growth of the Australia LNG bunkering market. The IMO's sulfur rules and the increased focus on lowering greenhouse gas emissions in the marine industry are the main factors driving the Australia LNG bunkering market's explosive growth. The need for LNG-fueled fleets is anticipated to rise in Australia due to the growing number of ferries and OSV fleets, and is expected to support the LNG bunkering market.

Report Coverage

This research report categorizes the market for the Australia LNG bunkering market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia LNG bunkering market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia LNG bunkering market.

div class="table-responsive-outer">

Driving Factors

The LNG bunkering market in Australia has grown significantly as a result of several important factors. The strategic position of Australia as a major LNG supplier is one of the main contributing reasons. Australia exports its LNG using big LNG tankers, and due to LNG being readily available, refilling LNG ships can save costs and emissions. This is anticipated to drive the need for LNG bunkering facilities in the nation throughout the forecast period. Sulphur rules from the International Marine Organization (IMO) and the increased focus on lowering greenhouse gas emissions in the marine industry are the main drivers of the LNG bunkering market's explosive growth in Australia.

Restraining Factors

High infrastructure costs, complicated regulations, a lack of LNG bunkering facilities, competition from other fuels, and the requirement for significant investments to develop the supply chain and distribution network are some of the challenges facing the Australia LNG bunkering market.

Market Segmentation

The Australia LNG bunkering market share is classified into type and end user.

- The ship-to-ship segment accounted for the largest share of the Australia LNG bunkering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of type, the Australia LNG bunkering market is divided into truck-to-ship, port-to-ship, and ship-to-ship. Among these, the ship-to-ship segment accounted for the largest share of the Australia LNG bunkering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Compared to port-to-ship and truck-to-ship bunkering, the ship-to-ship sector is usually more specialized due to its intricate logistics and requirement for specialist equipment.

- The container vessels segment accounted for the largest share of the Australia LNG bunkering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of end user, the Australia LNG bunkering market is divided into container vessels, tankers, and bulk and general cargo vessels. Among these, the container vessels segment accounted for the largest share of the Australia LNG bunkering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The spread of e-commerce and the growing need for international trade are the main drivers of this segmental growth. Moving a variety of products requires container boats, and the growth in consumer demand, particularly from emerging markets, has had a significant effect on the segment's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia LNG bunkering market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gas Energy Australia

- Oceania Marine Energy

- Woodside Petroleum Ltd

- Siem Offshore Inc.

- Norwest Energy NL

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, Shell Australia announced the opening of its new LNG bunkering plant at the Port of Brisbane, which is intended to lower shipping-related carbon emissions. In line with Australia's efforts to satisfy environmental and sustainability goals in the shipping sector, this facility signifies a substantial investment in the development of LNG as a cleaner alternative fuel for marine transportation.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia LNG bunkering market based on the below-mentioned segments:

Australia LNG Bunkering Market, By Type

- Truck-to-Ship

- Port-to-Ship

- Ship-to-Ship

Australia LNG Bunkering Market, By End User

- Container Vessels

- Tankers

- Bulk & General Cargo Vessels

Need help to buy this report?