Australia Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Type (Automotive Lubricant and Industrial Lubricant), By Grade (Mineral, Semi-Synthetic, and Synthetic), By Application (Engine Oil, Gear Oil, Grease, and Other) and Australia Lubricants Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsAustralia Lubricants Market Insights Forecasts to 2033

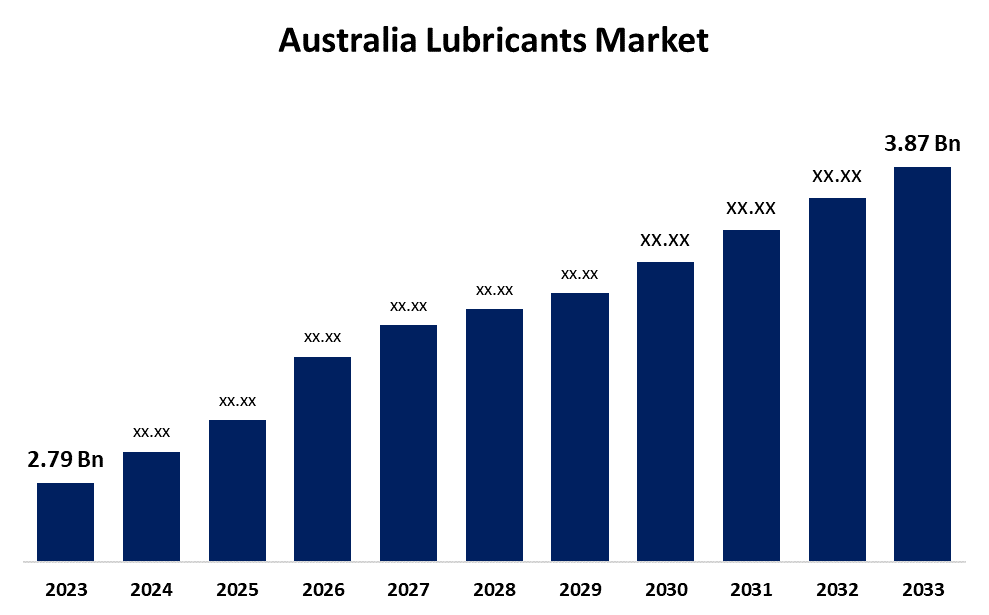

- The Australia Lubricants Market Size was valued at USD 2.79 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.33% from 2023 to 2033

- The Australia Lubricants Market Size is Expected to Reach USD 3.87 Billion by 2033

Get more details on this report -

The Australia Lubricants Market Size is Anticipated to Reach USD 3.87 Billion by 2033, Growing at a CAGR of 3.33% from 2023 to 2033

Market Overview

The substances used to reduce friction and amplify the performance of mechanical systems by accelerating smooth movement between surfaces are known as lubricants. Lubricants can be oils, greases, or dry lubricants which are widely used in various industries from manufacturing and automotive to aeronautical and maritime usage. By reducing wear and heat accumulation and by creating a shield between moving parts, lubricants lengthen the life of machinery and equipment. Proper lubricant selection and maintenance are essential which leads to improved overall efficiency, lower energy consumption, and reduction of equipment failure. The biggest consumer of lubricants is the automotive industry in Australia due to the growing number of cars on the road and consumers’ increasing awareness of the vitality of routine vehicle maintenance. Expansion of automotive and manufacturing industries, rising demand for high-performance lubricants, and strict use of eco-friendly products by reusing the lubricants led to the growth of Australia lubricant market. For instance, the Australian Government launched the Product Stewardship for Oil (PSO) Scheme in which more than half of Australia’s annual oil sales are recycled which is 320 megalitres of oil every year which helps to reduce the environmental risks posed by lubricants.

Report Coverage

This research report categorizes the market for the Australia lubricants based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia lubricants market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia lubricants market.

Australia Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.79 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.33% |

| 2033 Value Projection: | USD 3.87 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Grade, By Application |

| Companies covered:: | Ampol, BP Australia, Caltex, Fuchs Lubricants (Australasia) Ltd., Phoenix Lubricant Ltd, TOTAL Oil Australia Ltd, Viva Energy Holding, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Growing urbanization and expansion of mining industries are the main drivers of the Australia lubricant market. To enhance the equipment longevity, smooth machinery performance, and lower friction leads to the need for lubricants. The demand for intense mining activities is increased due to the availability of abundant mineral resources which boost the lubricant demand. With novel formulations to satisfy changing industrial demands, the Australia lubricant market is expected to grow, propelling the industry toward a more promising future. Great emphasis on environmental sustainability by lowering the emission profiles and bio-lubricants is also driving an increase in demand for lubricants.

Restraining Factors

Rising environmental concerns, strict regulations, and consumer preferences for environmentally responsible products lead to the facing of sustainability challenges by Australia lubricating market. To develop sustainable alternatives, manufacturers face broad research and investment, country’s diverse climate and geography complicate supply chain logistics and production costs, impeding market growth and profitability.

Market Segmentation

The Australia lubricants market share is classified into type, grade, and application.

- The automotive lubricant segment is expected to hold the largest market share through the forecast period.

The Australia lubricants market is segmented by type into automotive lubricants and industrial lubricants. Among these, the automotive lubricant segment is expected to hold the largest market share through the forecast period. The dominance can be attributed to the sizeable automotive sector in the nation and the strong demand for lubricants such as engine oils and transmission fluids that are necessary for vehicle performance and maintenance. In the Australia lubricants market, the automotive lubricant segment is expanded and includes a broad variety of lubricants made especially for use in automobiles, trucks, and motorcycles.

- The synthetic lubricants segment is expected to dominate the Australia lubricants market during the forecast period.

Based on the grade, the Australia lubricants market is divided into mineral, semi-synthetic, and synthetic. Among these, the synthetic lubricants segment is expected to dominate the Australia lubricants market during the forecast period. This is attributed to the rising demand for high-performance lubricants in Australia's industrial machinery, automotive, and aerospace industries. Comparing synthetic lubricants to their mineral and semi-synthetic counterparts, the former is renowned for their greater performance, stability, and longevity.

- The engine oil segment is expected to hold the largest market share through the forecast period.

The Australia lubricants market is segmented by application into engine oil, gear oil, grease, and others. Among these, the engine oil segment is expected to hold the largest market share through the forecast period. This can be attributed to the automotive and industrial sectors as there is a need for maintaining engine oil to function machinery and vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia lubricants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ampol

- BP Australia

- Caltex

- Fuchs Lubricants (Australasia) Ltd.

- Phoenix Lubricant Ltd

- TOTAL Oil Australia Ltd

- Viva Energy Holding

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia lubricants market based on the below-mentioned segments:

Australia Lubricants Market, By Type

- Automotive Lubricant

- Industrial Lubricant

Australia Lubricants Market, By Grade

- Mineral

- Semi-Synthetic

- Synthetic

Australia Lubricants Market, By Application

- Engine Oil

- Gear Oil

- Grease

- Other

Need help to buy this report?