Australia Oilseed Market Size, Share, and COVID-19 Impact Analysis, By Type (Canola, Soybean, Sunflower, and Cottonseed), By Application (Food, Feed, and Industrial), and Australia Oilseed Market Insights, Industry Trend, Forecasts to 2033.

Industry: AgricultureAustralia Oilseed Market Insights Forecasts to 2033

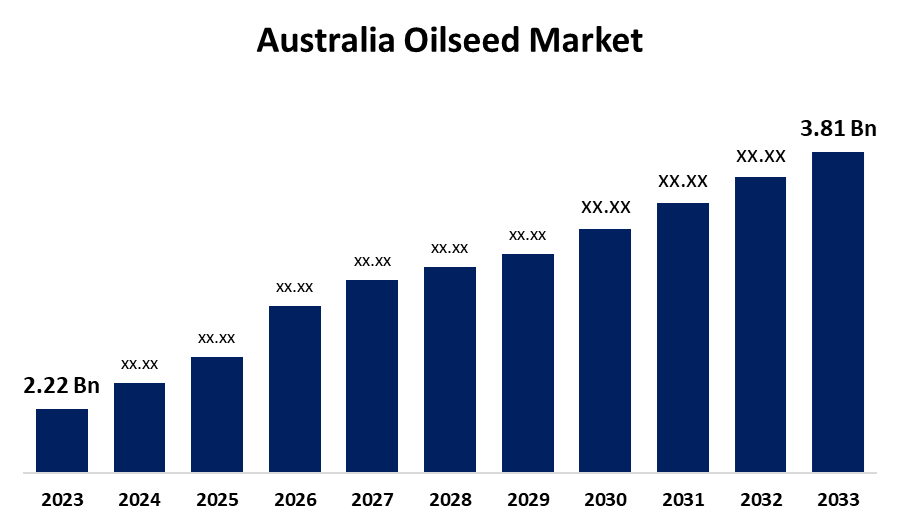

- The Australia Oilseed Market Size was valued at USD 2.22 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.55% from 2023 to 2033

- The Australia Oilseed Market Size is Expected to Reach USD 3.81 Billion by 2033

Get more details on this report -

The Australia Oilseed Market Size is Anticipated to exceed USD 3.81 Billion by 2033, growing at a CAGR of 5.55% from 2023 to 2033. The Australia oilseeds federation (AOF) indicates that domestic oilseed consumption has skyrocketed, with canola and soybean oils driving the Australia oilseeds market.

Market Overview

The industry that produces, processes, and trades oilseeds in Australia is known as the "Australia oilseed market." Oilseeds are crops that are grown mainly for their oil content, which is extracted for a variety of purposes such as food processing, cooking, and the creation of industrial products and biofuels. Agricultural growers, processing firms, and exporters that meet both local and foreign demand are all part of the Australia oilseed market. The growing use of oils and oilseeds, including canola, mono sun, cottonseeds, and mid/high oleic canola, in the food and beverage industry due to their superior nutritional qualities is driving the rise of the oilseed market in Australia. The agricultural industry in Australia is heavily reliant on the oilseeds market, which is produced for a variety of uses such as food items, animal feed, and biofuels. Market expansion is being driven by consumers' growing desire for plant-based oils such canola, soybean, and sunflower oil.

Report Coverage

This research report categorizes the market for the Australia oilseed market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia oilseed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia oilseed market.

Australia Oilseed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.22 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.55% |

| 2033 Value Projection: | USD 3.81 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Bunge Limited, Ridley Corporation, GrainCorp, Viterra, MSM Milling, Cargill Australia, Wilmar International, Louis Dreyfus Company, Riverina Oils & Bio Energy, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing need for animal feed, biofuels, and culinary oils, as well as government programs encouraging sustainable farming methods, are the main factors driving growth of Australia oilseeds market. Environmental concerns, agricultural technology innovations like genetic engineering and precision farming, and growing government support are the main factors driving the Australia oilseeds market. The growing demand for plant-based oils and technological developments in oilseed cultivation are driving the Australia oilseed market.

Restraining Factors

Climate variability susceptibility is one of the main challenges. Due to its reliance on ideal weather for oilseed production, Australia is vulnerable to temperature extremes, floods, and droughts, all of which lower yields and cause supply instability.

Market Segmentation

The Australia oilseed market share is classified into type and application.

- The canola segment accounted for the largest share of the Australia oilseed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of type, the Australia oilseed market is divided into canola, soybean, sunflower, and cottonseed. Among these, the canola segment accounted for the largest share of the Australia oilseed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The primary factor driving the canola segment's demand in the Australian oilseed market is its significance as a major source of vegetable oil. The health benefits of canola oil, such as its high omega-3 fatty acid concentration and low saturated fat content, are making it more popular with consumers.

- The food segment accounted for the largest share of the Australia oilseed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of application mode, the Australia oilseed market is divided into food, feed, and industrial. Among these, the food segment accounted for the largest share of the Australia oilseed market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Several important factors are driving the expansion of food applications in the canola sector. The first major factor driving the expansion is the growing demand for healthier cooking oils. Customers looking for healthier options are increasingly choosing canola oil owing to its high levels of essential fatty acids and low saturated fat content.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia oilseed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bunge Limited

- Ridley Corporation

- GrainCorp

- Viterra

- MSM Milling

- Cargill Australia

- Wilmar International

- Louis Dreyfus Company

- Riverina Oils & Bio Energy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, A Comprehensive Economic Partnership Agreement (CEPA) was announced by the governments of Australia and the United Arab Emirates (UAE). Through this bilateral agreement, Australia's 5% tax on canola seed shipments to the United Arab Emirates was lifted, along with levies on other oilseeds.

- In September 2024, Grains Australia is accepting applications to form a new Oilseed Council. The focus of this council can be on making the Australian oilseed sector more profitable and competitive. Creating classification frameworks, seeing business opportunities, and offering industry knowledge are some of its duties.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia oilseed market based on the below-mentioned segments:

Australia Oilseed Market, By Type

- Canola

- Soybean

- Sunflower

- Cottonseed

Australia Oilseed Market, By Application

- Food

- Feed

- Industrial

Need help to buy this report?