Australia Period Care Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Tampons, Period Underwear, Menstrual Cups, Sanitary Pads, and Panty Liners & Shields), By Distribution Channel (Grocery Stores, Dollar Stores, Specialty Stores, Pure-Play Online, Discount Department Stores, Brick Mortar, and Convenience Stores), and Australia Period Care Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsAustralia Period Care Market Insights Forecasts to 2033

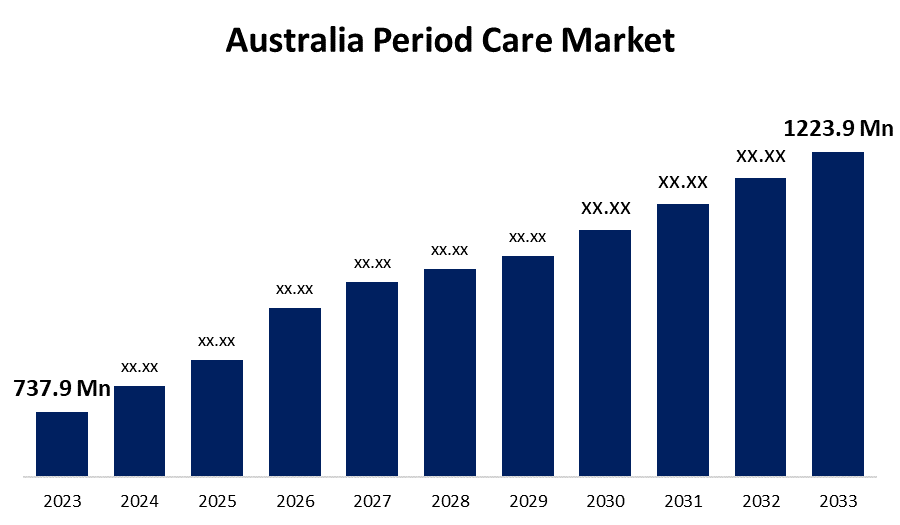

- The Australia Period Care Market Size was valued at USD 737.9 Million in 2023.

- The Market Size is Growing at a CAGR of 5.19% from 2023 to 2033

- The Australia Period Care Market Size is Expected to Reach USD 1223.9 Million by 2033

Get more details on this report -

The Australia Period Care Market is Anticipated to Reach USD 1223.9 Million by 2033, growing at a CAGR of 5.19% from 2023 to 2033.

Market Overview

A set of practices also termed menstrual hygiene management, or period care, enables menstruators to maintain themselves healthy and comfortable throughout the period. Period care products are for the hygiene maintenance of menstrual secretions, vaginal discharges, and other secretions in vulvovaginal areas. It encompasses sanitary pads, tampons, panty liners/shields, period underwear, and menstrual cups. The most frequently used products for the period are sanitary pads, available in varying sizes, shapes, and levels of absorption. These products are liked by women because they offer discreet leakage protection. Australia's period care business increased at a record rate over the past few years and is meant to be expected to keep up with this rapid pace ahead as women become concerned with personal health and cleanliness.

Report Coverage

This research report categorizes the market for the Australia period care market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia period care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia period care market.

Australia Period Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 737.9 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.19% |

| 2033 Value Projection: | USD 1223.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 265 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Bonds, Unicharm Corporation, Love Luna Au, Juju (Freedom Products), Knicked, Wunderthings, Kimberly-Clark Corporation, Edgewell Personal Care Company, Procter & Gamble, Modibodi Eu, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The period care market is expected to gain growth over the forecast period due to rising education levels among consumers and awareness about alternative hygiene products such as tampons and panty liners have led to an increase in demand for these products. At present, there is an increase in knowledge of personal hygiene among women, mainly due to a few government initiatives and social networking sites' awareness campaigns. These programs and campaigns will facilitate enhancing understanding and acceptance of period care products. With high growth in the working population for females, affordable period care products have increased demand in the period care industry of this world and, hence, fueled total market growth. Demand for organic, biodegradable period care products will drive growth in this market. Organic material sanitary products, such as organic cotton, are less risky to use because they reduce exposure to many harmful chemicals, dyes, and irritants present in mainstream period care products including sanitary napkins or tampons. Hence, this is an opportunity that is commercially viable for the producers to venture into the development of such new products and gain a formidable position in the market.

Restraining Factors

The period care market is limited by health issues associated with materials used to make commercial sanitary pads, dioxin, rayon, metal dyes, and wood pulp. These various constituents will cause irritation and itchy, irritable, abnormal cell growth, endometriosis, cancer, and infertility. In addition, common period care products can cause toxic shock syndrome.

Market Segmentation

The Australia period care market share is classified into product type and distribution channel.

- The sanitary pads segment is expected to hold the largest market share through the forecast period.

The Australia period care market is segmented by product type into tampons, period underwear, menstrual cups, sanitary pads, and panty liners & shields. Among these, the sanitary pads segment is expected to hold the largest market share through the forecast period. Sanitary pads are the most commonly used feminine hygiene product, and they are expected to grow at a rising rate from increased demand, higher awareness, and increased government activities for menstrual care. Further, the giant competitors have developed products according to the needs of women. There are sanitary pads to be used during the night, sanitary pads that do not allow stench elements to come out, and sanitary pads of various sizes, and varieties.

- The grocery store and retail pharmacies segment is expected to dominate the Australia period care market during the forecast period.

Based on the distribution channel, the Australia period care market is divided into grocery store, dollar stores, specialty store, pure-play online, discount department stores, brick mortar, and convenience stores. Among these, the grocery store and retail pharmacies segment are expected to dominate the Australia Period Care market during the forecast period. Easy access and availability to buy periodic care products from pharmacy stores will be the growth driving factor for this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia period care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bonds

- Unicharm Corporation

- Love Luna Au

- Juju (Freedom Products)

- Knicked

- Wunderthings

- Kimberly-Clark Corporation

- Edgewell Personal Care Company

- Procter & Gamble

- Modibodi Eu

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia period care market based on the below-mentioned segments:

Australia Period Care Market, By Product Type

- Tampons

- Period Underwear

- Menstrual Cups

- Sanitary Pads

- Panty Liners & Shields

Australia Period Care Market, By Distribution Channel

- Grocery Store

- Dollar Stores

- Specialty Store

- Pure-Play Online

- Discount Department Stores

- Brick Mortar

- Convenience Stores

Need help to buy this report?