Australia Pharmaceuticals Market Size, Share, and COVID-19 Impact Analysis, By Therapeutic Class (Alimentary Tract and Metabolism, Blood and Blood Forming Organs, Cardiovascular System, Genito Urinary System and Sex Hormones, Dermatologicals, Systemic Hormonal Preparations, Antineoplastic and Immunomodulating Agents, Anti-Infectives for Systemic Use, Musculoskeletal System, Nervous System, Antiparasitic Products, Insecticides and Repellents, Respiratory System, Sensory Organs, and Others), By Drug Type (Branded and Generic), By Prescription Type (Prescription Drugs (Rx) and OTC Drugs), and Australia Pharmaceuticals Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareAustralia Pharmaceuticals Market Insights Forecasts to 2033

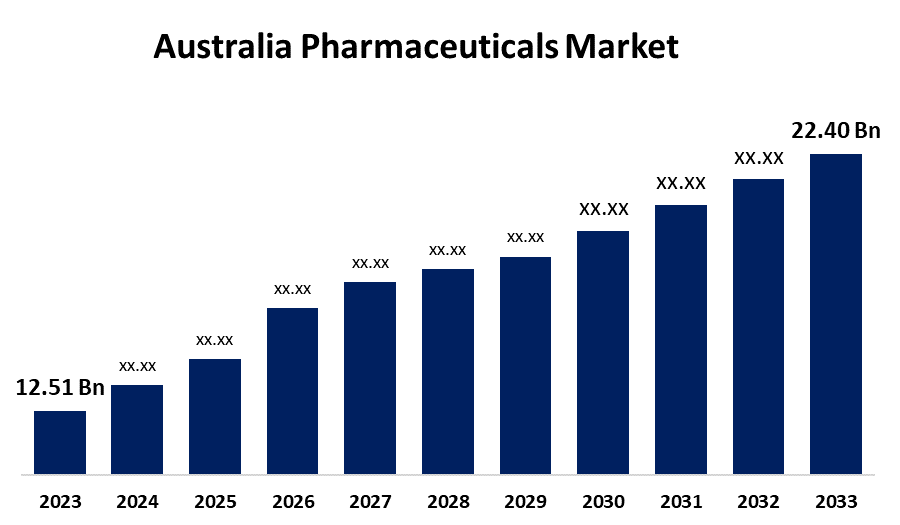

- The Australia Pharmaceuticals Market Size Was Estimated at USD 12.51 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.00% from 2023 to 2033

- The Australia Pharmaceuticals Market Size is Expected to Reach USD 22.40 Billion by 2033

Get more details on this report -

The Australia Pharmaceuticals Market Size is Expected to reach USD 22.40 Billion by 2033, Growing at a CAGR of 6.00% from 2023 to 2033

Market Overview

The creation, production, distribution, and retailing of pharmaceutical products in Australia are all encompassed by the Australian pharmaceuticals market. Prescription pharmaceuticals, over-the-counter drugs, and biological medical goods are all included in this. The market is driven by aging populations, rising rates of chronic diseases, and rising healthcare costs. Improvements in RNAi-based therapies, tailored medicine, and biologics are improving the results of treatment. Market expansion is further supported by accelerated regulatory routes and rising demand for patient-centric solutions. Market expansion is also aided by technological advancements in drug delivery methods and growing access to healthcare in developing nations. Product development and competitiveness in the market are still fueled by strategic partnerships and R&D investments. Furthermore, government initiatives aid in market expansion. For instance, the Australian government promotes the use of biosimilar medications in an effort to lower healthcare costs and increase access to treatment. The National Medicines Policy seeks to guarantee prompt access to reasonably priced and superior medications, and this program is in line with that goal.

Report Coverage

This research report categorizes the market for the Australia pharmaceuticals market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia pharmaceuticals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia pharmaceuticals market.

Australia Pharmaceuticals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.51 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.00% |

| 2033 Value Projection: | USD 12.51 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Therapeutic Class, By Drug Type, By Prescription Type and COVID-19 Impact Analysis |

| Companies covered:: | AbbVie Inc., AstraZeneca PLC, Amgen Inc., Sanofi SA, Johnson and Johnson, Merck KGaA, Pfizer Inc., CSL Limited, F. Hoffmann-La Roche AG, GlaxoSmithKline PLC, Eli Lilly and Company, Novartis AG, Others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The Australia pharmaceuticals market is growing due to the increasing incidence of these conditions is driving the need for medications, including painkillers, anti-inflammatory drugs, and mental health treatments. This trend highlights the need for continuous pharmaceutical innovation to address the evolving healthcare needs of chronic diseases. The expanding use of telehealth services and e-pharmacies is one of the primary drivers propelling the expansion of the Australian pharmaceutical market. Additionally, a strong product pipeline and therapeutic advances have contributed to the pharmaceutical market's notable expansion.

Restraining Factors

Australia's pharmaceuticals market expansion is anticipated to be impeded by stringent regulatory requirements for product approvals.

Market Segmentation

The Australian pharmaceuticals market share is classified into therapeutic class, drug type, and prescription type.

- The alimentary tract and metabolism segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the therapeutic class, the Australia pharmaceuticals market is divided into alimentary tract and metabolism, blood and blood forming organs, cardiovascular system, genito urinary system and sex hormones, dermatologicals, systemic hormonal preparations, antineoplastic and immunomodulating agents, anti-infectives for systemic use, musculoskeletal system, nervous system, antiparasitic products, insecticides and repellents, respiratory system, sensory organs, and others. Among these, the alimentary tract and metabolism segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The main causes of this growth are the rising incidence of diabetes, obesity, and gastrointestinal diseases, all of which call for efficient pharmacological treatments.

- The branded segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the drug type, the Australian pharmaceuticals market is categorized into branded and generic. Among these, the branded segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The pharmaceutical market's branded segment is its foundation, driving expansion through exclusivity and innovation. In addition, premium pricing for privileged medications, which are sold under proprietary names and address healthcare issues like cancer, rare disorders, and chronic diseases, reflects extensive research, development, and regulatory clearances.

- The prescription drugs (RX) segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the prescription type, the Australia pharmaceuticals market is classified into prescription drugs (RX) and OTC drugs. Among these, the prescription drugs (RX) segment accounted for the largest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing because of increased access to healthcare, technological developments in medication research, and a growing demand for treatments for chronic diseases. This growth was facilitated by favorable payment policies, greater dependence on prescription drugs by physicians, and growing patient awareness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia pharmaceuticals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AbbVie Inc.

- AstraZeneca PLC

- Amgen Inc.

- Sanofi SA

- Johnson and Johnson

- Merck KGaA

- Pfizer Inc.

- CSL Limited

- F. Hoffmann-La Roche AG

- GlaxoSmithKline PLC

- Eli Lilly and Company

- Novartis AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Race Oncology declared that it had finished a therapeutic development program at Monash University's Fragment Platform that was focused on FTOs. The company claims that the technique used fragment-based NMR screening to identify 39 molecular candidates that only bind to the FTO protein, which is the m6A RNA demethylase. The development of novel, patentable chemicals that could result in novel treatments that target the m6A RNA epigenetic pathway is based on these proven FTO-binding chemical scaffolds.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia pharmaceuticals market based on the below-mentioned segments:

Australia Pharmaceuticals Market, By Therapeutic Class

- Alimentary Tract and Metabolism

- Blood and Blood Forming Organs

- Cardiovascular System

- Genito Urinary System and Sex Hormones

- Dermatologicals

- Systemic Hormonal Preparations

- Antineoplastic and Immunomodulating Agents

- Anti-Infectives for Systemic Use

- Musculoskeletal System

- Nervous System

- Antiparasitic Products

- Insecticides and Repellents

- Respiratory System

- Sensory Organs

- Others

Australia Pharmaceuticals Market, By Drug Type

- Branded

- Generic

Australia Pharmaceuticals Market, By Prescription Type

- Prescription Drugs (Rx)

- OTC Drugs

Need help to buy this report?