Australia Power and Distribution Transformers Market Size, Share, and COVID-19 Impact Analysis, By Type (Power Transformer and Distribution Transformer), By Application (Power Utilities and Industrial), and Australia Power and Distribution Transformers Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerAustralia Power and Distribution Transformers Market Insights Forecasts to 2033

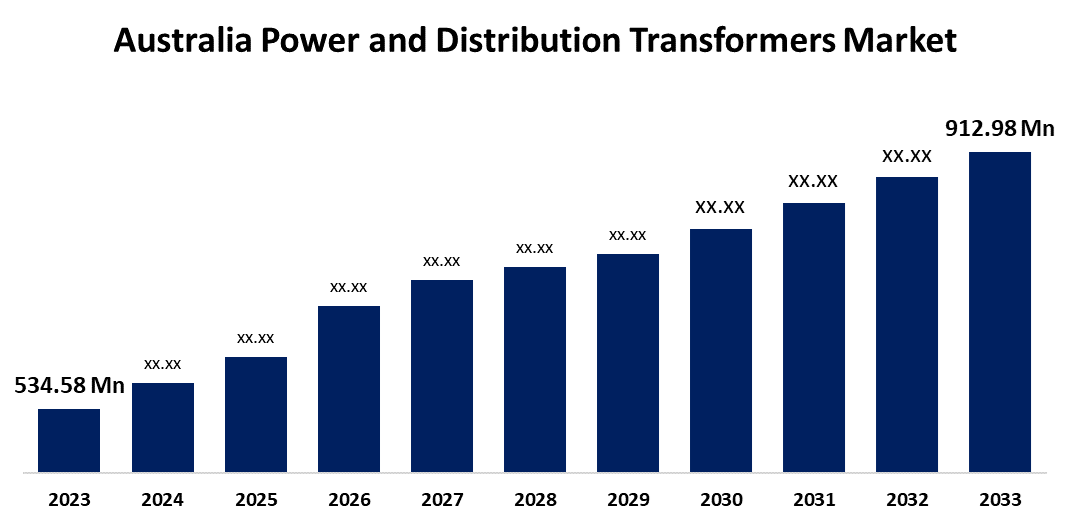

- The Australia Power and Distribution Transformers Market Size was valued at USD 534.58 Million in 2023

- The Market is Growing at a CAGR of 5.50% from 2023 to 2033

- The Australia Power and Distribution Transformers Market Size is Expected to Reach USD 912.98 Million By 2033

Get more details on this report -

The Australia Power and Distribution Transformers Market Size is Anticipated to Reach USD 912.98 Million by 2033, growing at a CAGR of 5.50% from 2023 to 2033.

Market Overview

Power and distribution transformers are electrical devices that transfer electrical energy from one circuit to another, usually at varying voltage levels. To step up or step-down voltages for effective transmission and distribution over long distances in power generating stations and substations is the main purpose of power transformers. They are built to resist high voltages and they can manage high power levels. Distribution transformers are used to supply lower-voltage electrical energy to end users, usually in commercial, industrial, and residential settings. As they control voltage and minimize electrical losses in distribution, they are essential in preserving a secure and dependable electrical supply. The main factors to drive the market are increasing demand for electricity and satisfying the needs of industries and residential places. The government’s focus on modernizing and improving existing electrical infrastructure is adding to the demand for high-voltage power transformers. For instance, the Rewiring the Nation program, initiated by the Australian Government, entails a $20 billion investment to modernize the electrical grid and provide new and upgraded transmission infrastructure. This program seeks to accomplish emissions reduction goals and promote the integration of renewable energy. Densely populated cities such as Melbourne, Perth, Sydney, and Brisbane with extensive electricity usage due to industrialization and commercialization.

Report Coverage

This research report categorizes the market for the Australia power and distribution transformers market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia power and distribution transformers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia power and distribution transformers market.

Australia Power and Distribution Transformers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 534.58 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.50% |

| 2033 Value Projection: | USD 912.98 Millio |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Wilson Transformer Company, Eaton Industries Pty Ltd, AEM Transformers, TMC Transformers, Power Partners, Ampcontrol, Delta Transformer, Tamini Transformers, Schneider Electric Australia, Siemens Australia, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing urbanization and industrialization led to the need for a dependable and efficient power supply which is furnished by the power and distribution transformer and that’s the reason to drive the market. To reduce the use of conventional energy fossil-fuel-based power generation, Australia is building a lot more renewable energy infrastructure, such as solar panels and wind farms. As a result of this more transformers will be needed to transfer and distribute the electricity produced by these renewable sources. These renewable sources have expanded the market for power and distribution transformers in Australia.

Restraining Factors

One of the major restraining factors is the increasing investment needed to maintain and develop transformers in Australia. The need for electricity has increased due to the growth in industrial development and population. Transformer replacement and improvements are urgently needed due to severe increment in the power consumption and thus all these factors hinder the market.

Market Segmentation

The Australia power and distribution transformers market share is classified into type and application.

- The power transformer segment is expected to hold the largest market share through the forecast period.

The Australia power and distribution transformer market is segmented by type of power transformer and distribution transformer segments. Among these, the power transformer segment is expected to hold the largest market share through the forecast period. This is attributed to the rapid development of the power infrastructure. Power transformers are frequently used in high-voltage applications like power plants and substations and play a significant part in the transmission of electrical power. Modifying voltage levels to facilitate more effective power transfer is much more needed.

- The power utilities segment is expected to dominate the Australia power and distribution transformers market during the forecast period.

Based on the application, the Australian power and distribution transformers market is divided into power utilities and industrial. Among these, the power utilities segment is expected to dominate the Australian power and distribution transformers market during the forecast period. This is attributed to meeting the nation’s power demand. Power utilities are businesses and organizations that generate, transfer, and distribute electricity to residential, commercial, and industrial users. Power-producing companies and electricity distributors make up this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia power and distribution transformers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wilson Transformer Company

- Eaton Industries Pty Ltd

- AEM Transformers

- TMC Transformers

- Power Partners

- Ampcontrol

- Delta Transformer

- Tamini Transformers

- Schneider Electric Australia

- Siemens Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Australia seeks input on energy efficiency upgrades for distribution transformers. Options to raise the minimum energy performance requirements for distribution transformers are evaluated in the Consultation Regulation Impact Statement (CRIS).

Market Segment

This study forecasts revenue at Australian, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia power and distribution transformers market based on the below-mentioned segments:

Australia Power and Distribution Transformers Market, By Type

- Power Transformer

- Distribution Transformer

Australia Power and Distribution Transformers Market, By Application

- Power Utilities

- Industrial

Need help to buy this report?