Australia Professional Hair Care Market Size, Share, and COVID-19 Impact Analysis, By Product Category (Coloring, Perming & Straightening, Shampoo & Conditioning, Styling Gel, Hair Spray, Serum, Others), By Type (Organic, In-Organic), and Australia Professional Hair Care Market Insights Forecasts to 2032

Industry: HealthcareAustralia Professional Hair Care Market Size Insights Forecasts to 2032

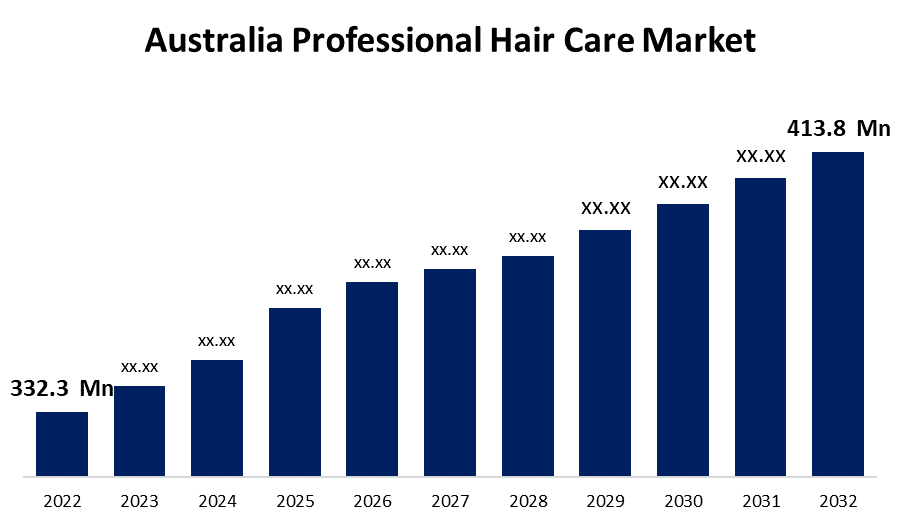

- The Australia Professional Hair Care Market Size was valued at USD 332.3 Million in 2022.

- The Market Size is Growing at a CAGR of 2.2% from 2022 to 2032.

- The Australia Professional Hair Care Market Size is Expected to Reach USD 413.8 Million by 2032.

Get more details on this report -

The Australia Professional Hair Care Market Size is Expected to Reach USD 413.8 Million by 2032, at a CAGR of 2.2% during the forecast period 2022 to 2032.

Market Overview

The market in Australia has been described as primarily driven by shifting customer dynamics and rising product awareness. Furthermore, hair care products are proving to be the most luxurious and cost-effective solution for people all over the country who are concerned about thinning, volume loss, dryness, and other hair-related issues. Customers are also preferring products free of synthetically generated chemicals, which is encouraging manufacturers to release hair care products containing natural and organic ingredients. A growing number of people in Australia are becoming aware of the advantages of using various types of hair care products. Natural and sustainable hair care products are increasingly popular among Australian consumers. As a result, many Australian hair care brands have emerged that prioritize natural and sustainable ingredients in their formulations. In Australia, there is a growing demand for vegan and cruelty-free hair care products as consumers become more aware of animal rights and environmental issues. Many hair care companies are responding to this demand by developing vegan and cruelty-free products.

Report Coverage

This research report categorizes the market for the Australia professional hair care market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia professional hair care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia professional hair care market.

Australia Professional Hair Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

Get more details on this report -

Driving Factors

The increasing demand for organic hair care products, as well as the increased availability of a variety of products, are driving the growth of the Australia professional hair care market. Organic hair care products are available in a variety of specifications designed specifically for different types of hair, such as dry, normal, and oily scalps. Global atmospheric and seasonal changes have a significant impact on hair growth, which is one of the major factors driving the consumption of organic hair care products. The Australia professional hair care market is expanding due to rising demand for hair coloring products, changing consumer dynamics, and increased product awareness. Hair coloring is now done not only at the salon but also at home, and the use of professional hair coloring products has increased as a result of the growing preference for salon-quality hair colors.

Restraining Factors

The high cost of raw materials, combined with the scarcity of professional hair care products available through existing distribution channels, is limiting market growth. Owing to toxic chemical use, a large number of people with sensitive hair experience allergic reactions to products such as shampoo, cleanser, serum, and others, hampering the Australia professional hair care market.

Market Segment

- In 2022, the shampoo & conditioning segment is expected to hold the largest share of the Australia professional hair care market during the forecast period.

Based on the product category, the Australia professional hair care market is classified into coloring, perming & straightening, shampoo & conditioning, styling gel, hair spray, serum, and others. Among these, the shampoo & conditioning segment is expected to hold the largest share of the Australia professional hair care market during the forecast period owing to they are widely available through various sales channels, and they are also the most commonly used products in hair care. The rising rate of hair loss and damage has increased the demand for products containing natural ingredients. Products that target specific hair types and provide additional benefits are becoming more popular, and manufacturers are focusing on products containing such active ingredients. The changing consumer dynamics, increased product awareness, and an increase in cases of hair loss and hair damage among the population are driving up demand for shampoo and conditioning in Australia.

- In 2022, the in-organic segment accounted for the largest revenue share over the forecast period.

Based on the type, the Australia professional hair care market is segmented into organic, and in-organic. Among these, the in-organic segment has the largest revenue share over the forecast period, owing to the increased consumer concerns about scalp health and problems related to hair thinning hair loss, and sensitive scalp. Organic hair care products can be specially formulated to direct and manage hair problems caused by constant bleaching on hair coloring, making them a lifesaver for severely damaged hair. Organic hair care products are frequently designed to help prevent hair damage caused by the use of hair straighteners or hair dryers on a regular basis.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia professional hair care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L'Oréal SA

- Johnson & Johnson Services Inc.

- Procter & Gamble Co.

- Unilever Plc

- Henkel AG & Co. KGaA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Epres Brand introduced two new hair care products: an at-home product and a professional in-salon SKU. The treatments are science-based and employ Biodiffusion technology.

- In September 2022, David Mallett's styling line debuted two new products: Fresh Eau de Concombre, a hair mist product, and Volume Powder, which aids in the retention of hair volume. The brand also debuted the "Pure" product line, which includes a 96% natural and fragrance-free shampoo and conditioner.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Australia professional hair care market based on the below-mentioned segments:

Australia Professional Hair Care Market, By Product Category

- Coloring

- Perming & Straightening

- Shampoo & Conditioning

- Styling Gel

- Hair Spray

- Serum

- Others

Australia Professional Hair Care Market, By Type

- Organic

- In-Organic

Need help to buy this report?