Australia Soy Protein Market Size, Share, and COVID-19 Impact Analysis, By Form (Concentrates, Isolates, and Textured/Hydrolyzed), By End User (Animal Feed, Personal Care and Cosmetics, Food and Beverages, and Supplements), Australia Soy Protein Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesAustralia Soy Protein Market Insights Forecasts to 2033

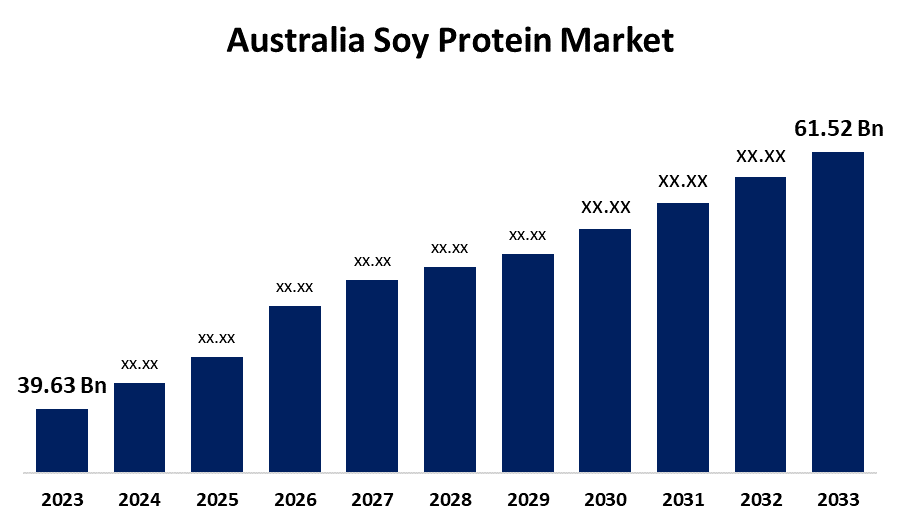

- The Australia Soy Protein Market Size was valued at USD 39.63 Million in 2023.

- The Market Size is Growing at a CAGR of 4.50% from 2023 to 2033

- The Australia Soy Protein Market Size is Expected to Reach USD 61.52 Million by 2033

Get more details on this report -

The Australia Soy Protein Market Size is Anticipated to Exceed USD 61.52 Million by 2033, Growing at a CAGR of 4.50% from 2023 to 2033. The growing number of vegans, the need for plant-based diets, the growing prevalence of lifestyle diseases, growing health consciousness, and the market's many uses in food, drink, and medicine are the main factors driving the soy protein market.

Market Overview

The business centered on the manufacture, distribution, and usage of soy protein products in Australia is known as the "Australia soy protein market." These soybean-based products are extensively utilized in food and drink, animal feed, and personal care due to their high nutritional content, useful qualities, and reasonable price. Health-conscious consumer trends, the growing need for plant-based protein sources, and advancements in soy-based products are driving the Australia soy protein market. The growing prevalence of lifestyle illnesses, the growing focus on eating a healthy diet, and expanding consumer awareness of the health advantages of soy protein are some of the major factors propelling the Australia soy protein market. The main factors driving the soy protein market expansion are rising athlete utilization and growing need for less expensive protein sources. Applications in the food and beverage sector are the main factors driving the soy protein market in Australia.

Report Coverage

This research report categorizes the market for the Australia soy protein market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia soy protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia soy protein market.

Australia Soy Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 39.63 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.50% |

| 2033 Value Projection: | USD 61.52 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Form, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Cargill, Incorporated, Kerry Group PLC, Wilmar International Ltd, International Flavors & Fragrances, Inc., The Archer-Daniels-Midland Company, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for soy protein in Australia is mostly being driven by the growing popularity of plant-based diets and the increasing need for soy protein since it lowers cholesterol, lowers the risk of heart disease, and supports strong bones. Growing focus on healthy eating practices and the incidence of lifestyle illnesses are driving Australia soy protein market expansion. The growing number of vegetarians and vegans, as well as the popularity of plant-based diets, are driving the soy protein market's expansion.

Restraining Factors

High manufacturing costs, little consumer knowledge, difficulties locating raw materials, and competition from other protein sources are some of the restraining factors that prevent soy protein products from growing and becoming widely used in Australia.

Market Segmentation

The Australia soy protein market share is classified into form and end user.

- The isolates segment accounted for the largest share of the Australia soy protein market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of form, the Australia soy protein market is divided into concentrates, isolates, and textured/hydrolyzed. Among these, the isolates segment accounted for the largest share of the Australia Soy Protein market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Soy protein isolates are well-liked in the expanding market for plant-based proteins, which has experienced a sharp increase in demand as a result of vegetarian, vegan, and health-conscious dietary trends.

- The animal feed segment accounted for the largest share of the Australia soy protein market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of end user, the Australia soy protein market is divided into animal feed, personal care and cosmetics, food and beverages, and supplements. Among these, the animal feed segment accounted for the largest share of the Australia soy protein market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The animal feed industry finds extensive use of soy protein concentrates due to their excellent digestibility and high nutritional content, making them the perfect source of protein for animal feed. Its usage is further supported by the fact that it is less expensive than isolates.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia soy protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Kerry Group PLC

- Wilmar International Ltd

- International Flavors & Fragrances, Inc.

- The Archer-Daniels-Midland Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2022, Australian B2B alternative protein firm Harvest B stated that it launched a facility in Australia to produce plant-based meat ingredients as part of its growth. Harvest B claims that the facility is state-of-the-art and furnished with the most sophisticated manufacturing equipment for producing proteins such as soy, pea, wheat, and oat. The building would also include a brand-new R&D lab where scientists will work to maximize the components for plant-based meat substitutes.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia soy protein market based on the below-mentioned segments:

Australia Soy Protein Market, By Form

- Concentrates

- Isolates

- Textured/Hydrolyzed

Australia Soy Protein Market, By End User

- Animal Feed

- Personal Care and Cosmetics

- Food and Beverages

- Supplements

Need help to buy this report?