Australia Supplementary Cementing Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (Fly Ash, Slag Cement, Silica Fumes, and Others), By End-Use Industry (Construction, Agriculture, and Others), and Australia Supplementary Cementing Materials Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingAustralia Supplementary Cementing Materials Market Insights Forecasts to 2033

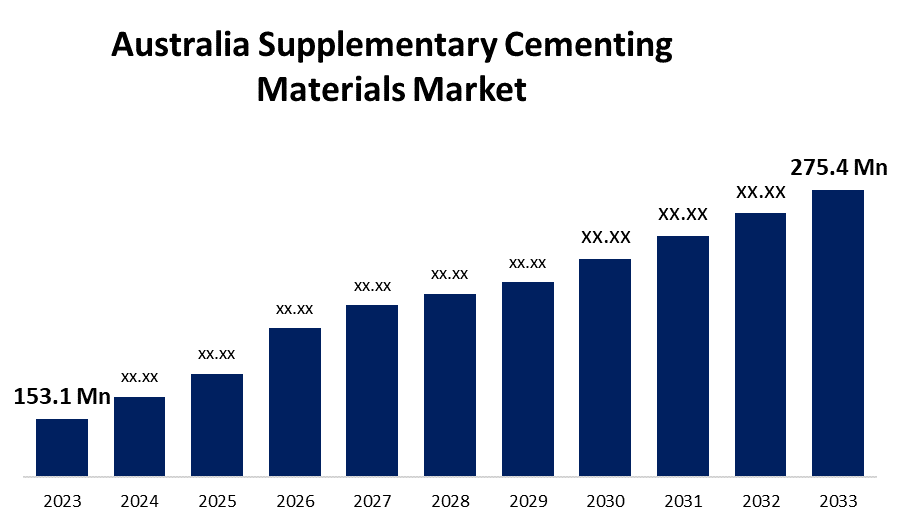

- The Australia Supplementary Cementing Materials Market Size was valued at USD 153.1 Million in 2023.

- The Market Size is Growing at a CAGR of 6.05% from 2023 to 2033

- The Australia Supplementary Cementing Materials Market Size is Expected to Reach USD 275.4 Million by 2033

Get more details on this report -

The Australia Supplementary Cementing Materials Market Size is Anticipated to Reach USD 275.4 Million by 2033, Growing at a CAGR of 6.05% from 2023 to 2033.

Market Overview

Cementitious materials (SCMs) are added to concrete mixtures to improve durability, permeability, and workability. These materials shrink water, lower permeability, exchange reactive alkali, and stabilize the concrete as a whole by water, pozzolanic, or both. As a partial replacement for Portland or cement admixtures in concrete CMs are admixed and generally considered part of the overall cementitious system Although these materials improve durability they may slow down (silica fume is an example). Except for silica fume, SCM retards the absorption process thereby extending the set time. Maximum water content of filler cementing materials decreases the possibility of thermal cracking.

Report Coverage

This research report categorizes the market for the Australia supplementary cementing materials market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia supplementary cementing materials market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia supplementary cementing materials market.

Australia Supplementary Cementing Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 153.1 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.05% |

| 2033 Value Projection: | USD 275.4 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 168 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-Use Industry. |

| Companies covered:: | Hallett Group, Millmerran Flyash, Adelaide Brighton, Fly ash Australia, Wagners, Boral, Cement Australia, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Cement fillers are the most used additives in concrete, and they partly replace cement. As construction industries increase the utilization of concrete, the demand rises within the market to fulfill those needs. Rehabilitation and restoration of older building materials has immense potential as a filler cementitious material. SCMs enhance the performance and prolong the lifecycle of concrete structures by solving problems such as sulfate attacks. This is the driving factor for the market while sustainable solutions that demand in the country’s construction industry rise. With growing knowledge of the benefits of filler cement materials in the construction industry, supported by educational activities of industry and government agencies, new potential markets for architects, engineers, contractors, developers and environmental emerged to utilize SCM in construction projects. Economic benefits are well recognized, leading to greater acceptance and use.

Restraining Factors

The major challenge in the filler SCMs market is an upsurge in fly ash production in concrete manufacturing as conventional SCM fly ash is ejected into the environment, thus, giving this usable material the availability of this value for long-term cement production decreases. The key is the limited availability of cementitious materials additives, coupled with logistical challenges in procuring and distributing the same. It makes a tightrope walk for the whole supply chain, leading to supply and price volatility have occurred. Such strict procurement, distribution, and consumption strategies are required to ensure SCM products are consistent.

Market Segmentation

The Australia supplementary cementing materials market share is classified into type and end-use industry.

- The slag cement segment is expected to hold the largest market share through the forecast period.

The Australia supplementary cementing materials market is segmented by type into fly ash, slag cement, silica fumes, and others. Among these, the slag cement segment is expected to hold the largest market share through the forecast period. Slag cement is produced as a by-product of steel furnaces. When the slag is devolved molten from a steel furnace, the glass so formed is finely crushed and cools rapidly with suitable cementitious properties. Since it has excellent properties, silica fume will find greater demand in the markets because it will strengthen the concrete, reduce bleeding, and limit chemical alkali-silica interactions.

- The construction segment is expected to dominate the Australia supplementary cementing materials market during the forecast period.

Based on the end-use industry, the Australia supplementary cementing materials market is divided into construction, agriculture, and others. Among these, the construction segment is expected to dominate the Australia supplementary cementing materials market during the forecast period. These substances are often employed in concrete as admixtures or as partial cement substitutes. SCMs enhance the workability and effectiveness of concrete but at the expense of the chemical resistance of the material. The construction segment is expected to continue its leadership position during the projection period, given the fact that there is a potential increase in concrete and supplementary cementing materials usage in the building sector. Additionally, greater government effort is expected to drive infrastructure development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia supplementary cementing materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hallett Group

- Millmerran Flyash

- Adelaide Brighton

- Fly ash Australia

- Wagners

- Boral

- Cement Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia Supplementary Cementing Materials market based on the below-mentioned segments:

Australia Supplementary Cementing Materials Market, By Type

- Fly Ash

- Slag Cement

- Silica Fumes

- Others

Australia Supplementary Cementing Materials Market, By End-Use Industry

- Construction

- Agriculture

- Others

Need help to buy this report?