Australia Vanilla Flavor Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural, and Synthetic), By Application (Bakery and Confectionery, Dairy Products, Savory Foods, Soups, Pastas, and Noodles, Beverages, and Others), and Australia Vanilla Flavor Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesAustralia Vanilla Flavor Market Insights Forecasts to 2033

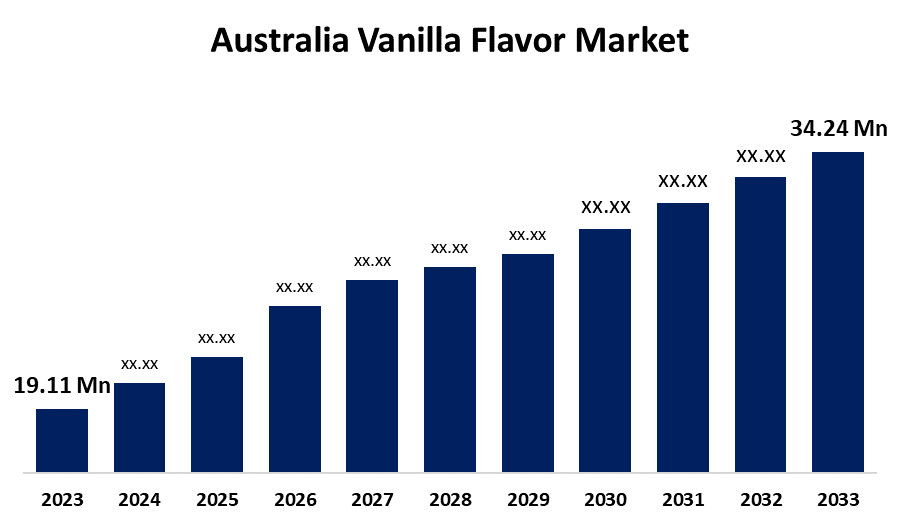

- The Australia Vanilla Flavor Market Size was valued at USD 19.11 Million in 2023.

- The Market is Growing at a CAGR of 6.01% from 2023 to 2033

- The Australia Vanilla Flavor Market Size is Expected to Reach USD 34.24 Million by 2033

Get more details on this report -

The Australia Vanilla Flavor Market Size is Anticipated to exceed USD 34.24 Million by 2033, Growing at a CAGR of 6.01% from 2023 to 2033. Growing consumer interest in high-end, sustainable products, expansion into emerging markets, innovation in vanilla-based products, and rising demand for natural ingredients all present an opportunity for vanilla flavour in the market.

Market Overview

The industry that deals with the manufacture, sale, and use of flavoring products based on vanilla is known as the vanilla flavor market. Food and drink, cosmetics, medications, and scents are just a few of the uses for these products. Vanilla seed pods or chemical procedures are used to make vanilla taste. Vanillin, the main taste of vanilla, is derived from a variety of materials, such as wood, petrochemical products, and vanilla beans. The vanilla flavor market includes both natural and artificial vanilla, with natural vanilla frequently costing more due to the labour-intensive growing process. The growing food processing industry and the continuous importation of components like vanillin are the primary factors drives the Australia vanilla flavor market. Consumer desire for natural ingredients, growing interest in gourmet and premium food products, and the adaptability of vanilla flavor across many industries are the main factors driving the vanilla flavor market.

Report Coverage

This research report categorizes the market for the Australia vanilla flavor market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia vanilla flavor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia vanilla flavor market.

Australia Vanilla Flavor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.11 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.01% |

| 2033 Value Projection: | USD 34.24 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Dr. Oetker Group, Solvay SA, Givaudan SA, Scentral Flavours and Fragrances, Nielsen-Massey Vanillas, Inc., and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for vanilla flavor is expanding due to several important causes. One significant factor is an increasing demand from consumers for natural and organic products, especially in the food and beverage sector. The primary factors driving Australia vanilla flavor market expansion include growing disposable incomes and a shift in consumer preferences toward gourmet and high-end goods. Vanilla's adaptability as a flavoring agent in a range of products, such as food, cosmetics, and medications, contributes to the market's expansion. Innovations in flavoring technologies and improvements in vanilla farming have also improved product quality and availability, increasing demand worldwide.

Restraining Factors

High production costs, erratic supply of vanilla beans due to climate dependency, and the growing popularity of synthetic vanilla, which reduces demand for genuine vanilla products, are some of the factors restricting the vanilla flavor market.

Market Segmentation

The Australia vanilla flavor market share is classified into type and application.

- The natural segment accounted for the largest share of the Australia vanilla flavor market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of type, the Australia vanilla flavor market is divided into natural and synthetic. Among these, the natural segment accounted for the largest share of the Australia vanilla flavor market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Vanilla pods and the fermentation or bioconversion of organic substances such as lignin, ferulic acid, eugenol, curcumin, and glucose are the sources of natural vanillin. The natural vanilla market is growing as a result of Australian customers' growing preference for sustainable, traceable, and ethically sourced products.

- The bakery and confectionery segment accounted for the largest share of the Australia vanilla flavor market in 2023 and is anticipated to grow at a significant CAGR during the forecast period

On the basis of application, the Australia vanilla flavor market is divided into bakery and confectionery, dairy products, savory foods, soups, pastas, and noodles, beverages, and others. Among these, the bakery and confectionery segment accounted for the largest share of the Australia vanilla flavor market in 2023 and is anticipated to significant CAGR during the forecast period. The premium and artisanal bakery and confectionery market in Australia has been a major driver of the demand for vanilla flavor. Further, vanilla is essential in chocolate sweets, toffees, and fudge due to its balance stronger flavors like coffee, caramel, and nutty undertones.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia vanilla flavor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dr. Oetker Group

- Solvay SA

- Givaudan SA

- Scentral Flavours and Fragrances

- Nielsen-Massey Vanillas, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, the Hershey Company launched Kit Kat Vanilla, a new product in its Kit Kat portfolio. Crisp wafers covered in vanilla-flavored crème are the brand's latest taste. Retailers around the country now carry it in both normal and king sizes.

- In September 2024, A plant-based version of the Blue-Ribbon Vanilla frozen treat was launched by the Australian firm Streets. This creative product offers a dairy-free substitute that tastes and feels much like the original. Streets strives to maintain the high standards of its well-known brand while meeting the growing demand for products made from plants.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia vanilla flavor market based on the below-mentioned segments:

Australia Vanilla Flavor Market, By Type

- Natural

- Synthetic

Australia Vanilla Flavor Market, By Application

- Bakery and Confectionery

- Dairy Products

- Savory Foods

- Soups, Pastas, and Noodles

- Beverages

- Other

Need help to buy this report?