Australia Water Treatment Technology Market Size, Share, and COVID-19 Impact Analysis, By Chemicals (Antifoams And Defoamers, Corrosion And Scale Inhibitors, Activated Carbon, Biocides, Others, and Coagulants And Flocculants), By Membrane System (Reverse Osmosis, Ultrafiltration, Microfiltration, Electrodialysis, Gas Separation, and Others), and Australia Water Treatment Technology Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsAustralia Water Treatment Technology Market Insights Forecasts to 2033

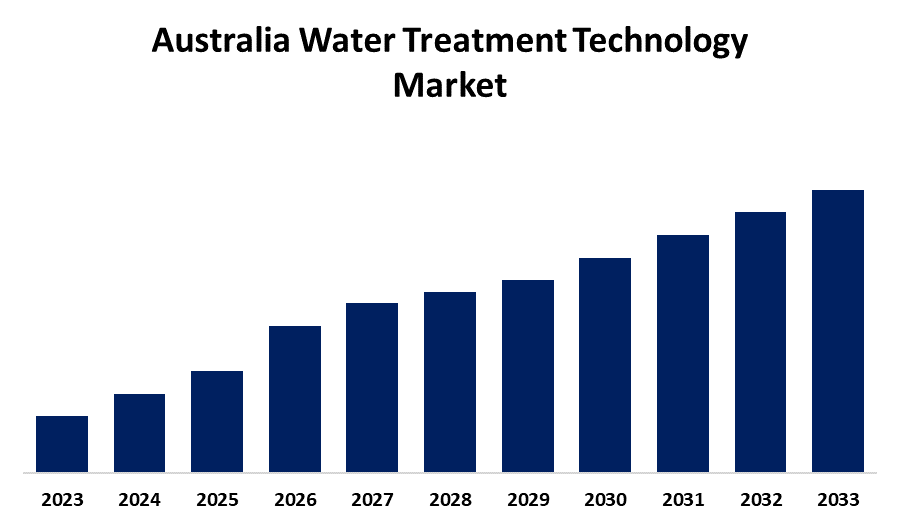

- The Australia Water Treatment Technology Market Size is Growing at a CAGR of 5.1% from 2023 to 2033

- The Australia Water Treatment Technology Market Size is Expected to Reach a Significant Share by 2033

Get more details on this report -

The Australia Water Treatment Technology Market Size is anticipated to reach a significant share by 2033, growing at a CAGR of 5.1% from 2023 to 2033

Market Overview

Australia water treatment technology market Size encompasses a broad range of technologies, including water filtration, desalination, wastewater treatment, and advanced water recycling systems. These technologies are designed to address critical challenges such as water scarcity, pollution, and the growing demand for sustainable water management. As the country faces increasing pressure on its water resources due to climate change, urbanization, and population growth, the need for advanced water treatment solutions has never been more urgent. Additionally, advanced systems like reverse osmosis, ultraviolet (UV) disinfection, and membrane filtration are becoming increasingly popular in both residential and industrial applications, offering higher efficiency, lower operational costs, and a reduced environmental footprint. Moreover, the government’s National Water Infrastructure Development Fund supports projects that improve water infrastructure and enhance water security across the country. Also, local governments are increasingly implementing stricter regulations on wastewater disposal and encouraging businesses to adopt sustainable water practices.

Report Coverage

This research report categorizes the market for the Australia water treatment technology market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia water treatment technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia water treatment technology market.

Australia Water Treatment Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.1% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Chemicals, By Membrane System |

| Companies covered:: | PepsiCo, Aquatech International LLC, The Coca-Cola Company, BASF SE, BioMicrobics, Inc., The 3M Company, DuPont, Ashland Global Holdings Inc., DOW, AECOM, Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rapid urbanization and industrialization are placing more strain on existing water infrastructure, leading to a greater need for advanced treatment technologies to manage wastewater and ensure sustainable water supplies. Additionally, innovations such as membrane filtration, reverse osmosis, and ultraviolet (UV) disinfection have made water treatment processes more efficient, cost-effective, and environmentally friendly, making them more accessible for various industries, including agriculture, manufacturing, and municipal water services.

Restraining Factors

Technologies such as reverse osmosis, desalination plants, and sophisticated filtration systems require substantial upfront capital investment, which can be a barrier for smaller municipalities, industries, or businesses with limited budgets.

Market Segmentation

The Australia water treatment technology market share is classified into chemicals and membrane system.

- The coagulants and flocculants segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Australia water treatment technology market is segmented by chemicals into antifoams and defoamers, corrosion and scale inhibitors, activated carbon, biocides, others, and coagulants and flocculants. Among these, the coagulants and flocculants segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven because coagulants and flocculants are critical in water treatment, particularly in removing suspended particles, solids, and impurities from water. These chemicals facilitate the agglomeration of particles into larger masses, which can then be easily removed from water during filtration processes.

- The reverse osmosis segment accounted for the largest revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The Australia water treatment technology market is segmented by membrane system into reverse osmosis, ultrafiltration, microfiltration, electrodialysis, gas separation, and others. Among these, the reverse osmosis segment accounted for the largest revenue share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The segment growth is driven because reverse osmosis is a widely used membrane technology for water desalination and purification, where water is forced through a semi-permeable membrane that removes dissolved salts, impurities, and other contaminants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia water treatment technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo

- Aquatech International LLC

- The Coca-Cola Company

- BASF SE

- BioMicrobics, Inc.

- The 3M Company

- DuPont

- Ashland Global Holdings Inc.

- DOW

- AECOM

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, LiqTech International and Waterco have indeed strengthened their partnership through an exclusive distribution agreement. This collaboration focuses on expanding the reach of LiqTech's Aqua Solution® swimming pool water filtration systems across Australia, New Zealand, Papua New Guinea, and the Pacific Islands.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia water treatment technology market based on the below-mentioned segments:

Australia Water Treatment Technology Market, By Chemicals

- Antifoams And Defoamers

- Corrosion And Scale Inhibitors

- Activated Carbon

- Biocides

- Others

- Coagulants And Flocculants

Australia Water Treatment Technology Market, By Membrane System

- Reverse Osmosis

- Ultrafiltration

- Microfiltration

- Electrodialysis

- Gas Separation

- Others

Need help to buy this report?