Australia Wind Turbine Operation and Maintenance Market Size, Share, and COVID-19 Impact Analysis, By Type (Scheduled and Unscheduled), By Location (Onshore and Offshore), and Australia Wind Turbine Operation and Maintenance Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerAustralia Wind Turbine Operation and Maintenance Market Insights Forecasts to 2033

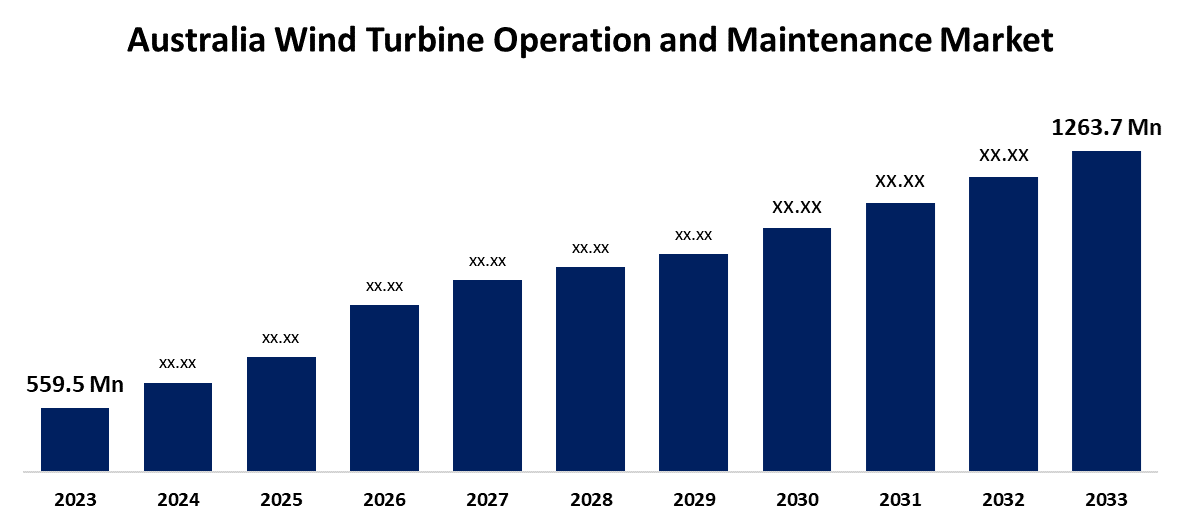

- The Australia Wind Turbine Operation and Maintenance Market Size was valued at USD 559.5 Million in 2023

- The Market is Growing at a CAGR of 8.49% from 2023 to 2033

- The Australia Wind Turbine Operation and Maintenance Market Size is Expected to Reach USD 1263.7 Million by 2033

Get more details on this report -

The Australia Wind Turbine Operation and Maintenance Market Size is Anticipated to Reach USD 1263.7 Million by 2033, growing at a CAGR of 8.49% from 2023 to 2033.

Market Overview

Wind turbine operation and maintenance involves ensuring that wind turbines are performing their best and last as long as possible. It comprises several responsibilities, including check-ups, repairs, and maintenance to ensure constant optimum operation of the turbines. This wind turbine operation and maintenance stage is the difference between increasing energy production, saving on downtime, and lowering overall costs in the wind energy industry. Wind turbine operating and maintenance practices are essential for the wind farm. Some of its parts, such as blades, generators, and gearboxes, require continuous condition monitoring to avoid failure. Failure might result in production levels, with no maintenance. Investment in wind energy is on the increase as it continues to be regarded as an energy alternative. The trend is expected to positively impact the Australian wind turbine operation and maintenance industry in the ensuing years. Operation and maintenance of wind turbines ensure that the wind turbines run and function properly and last for a good number of years through proper inspection, repair, and improvements.

Report Coverage

This research report categorizes the market for the Australia wind turbine operation and maintenance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Australia wind turbine operation and maintenance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Australia wind turbine operation and maintenance market.

Australia Wind Turbine Operation and Maintenance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 559.5 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.49% |

| 2033 Value Projection: | USD 1263.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Type, By Location and COVID-19 Impact Analysis. |

| Companies covered:: | Ropepro High Access Services, Rigcom, Direct Wind Services, Professional Wind, Cosmic Group, Worley, Australian Wind Services, Wind Turbine Services Australia, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Australia possesses very good wind resources, broadly the best located in the southern regions around the Bass Strait. Low-pressure areas and frontal systems are the main generation of wind resources, and much of the northerly production is from monsoon and trade wind systems. Notably, capacity installations have been growing and bringing about an expansion in the operations of wind turbines. Growth has been spurred by environmental concerns, with technological gains ensuring greater efficiency and less downtime. This has resulted in higher energy production and lower downtime. Concerning this, the need for operation and maintenance services in the wind energy sector increased. One of the merits of wind power is its remarkably very low Greenhouse Gas (GHG) footprint, said to be lower than any other existing energy-producing technology, except hydroelectricity. While wind energy is not a direct generator of GHG emissions, it does result in emissions during the life cycle of wind infrastructures, such as GHG-emitting energy sources required to develop the materials and infrastructure.

Restraining Factors

Installation of wind turbines is expensive and highly capital-intensive and also limits the growth of the market. The prime challenges involved include extreme weather conditions, remote locations, and specialized equipment. Relating it to regulations, the timeliness of a project is delayed due to strict compliance requirements. Integration of wind power into the existing grid infrastructure is intermittent, hence requiring advanced management systems and energy storage solutions.

Market Segmentation

The Australia wind turbine operation and maintenance market share is classified into type and location.

- The unscheduled segment is expected to hold the largest market share through the forecast period.

The Australia wind turbine operation and maintenance market is segmented by type into scheduled and unscheduled. Among these, the unscheduled segment is expected to hold the largest market share through the forecast period. Unscheduled maintenance is an indicator of unpredictable failures of a wind turbine, which means missed sales. All the implications and costs related to component failure add up very quickly. Unscheduled maintenance reduced the income of the turbine makers during the warranty period. Maintenance costs affected manufacturers and will eventually affect owners. Unscheduled maintenance above expectations may reduce the Internal Rate of Return of a company.

- The onshore segment is expected to dominate the Australia wind turbine operation and maintenance market during the forecast period.

Based on the location, the Australia wind turbine operation and maintenance market is divided into onshore and offshore. Among these, the onshore segment is expected to dominate the Australia wind turbine operation and maintenance market during the forecast period. Onshore wind power is obtained through turbines on land, whereas offshore turbines are located in the open sea or fresh water. In Australia, onshore wind produces the highest percentage of renewable electricity. Additionally, onshore wind power is Australia's most preferred source of renewable energy because it is cheaper than offshore. Along with simple installation and minimal GHG emissions, wind power is an increasingly affordable alternative to fossil fuel-based power generation. The governments are also releasing programs to set up onshore turbines to expand the industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Australia wind turbine operation and maintenance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ropepro High Access Services

- Rigcom

- Direct Wind Services

- Professional Wind

- Cosmic Group

- Worley

- Australian Wind Services

- Wind Turbine Services Australia

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, RWE was granted a feasibility license from the Australian government for developing the Kent Offshore Wind Farm project in the Bass Strait, off the Gippsland coast.

Market Segment

This study forecasts revenue at Australia, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Australia wind turbine operation and maintenance market based on the below-mentioned segments:

Australia Wind Turbine Operation and Maintenance Market, By Type

- Scheduled

- Unscheduled

Australia Wind Turbine Operation and Maintenance Market, By Location

- Onshore

- Offshore

Need help to buy this report?