Global Auto Insurance Market Size, Share, and COVID-19 Impact Analysis, By Application (Personal and Commercial), By Distribution Channel (Insurance Agents/Brokers, Direct Response, Banks, and Others), By Coverage (Third-Party Liability Coverage, Collision/Comprehensive, and Other Optional Coverage), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Auto Insurance Market Insights Forecasts to 2033

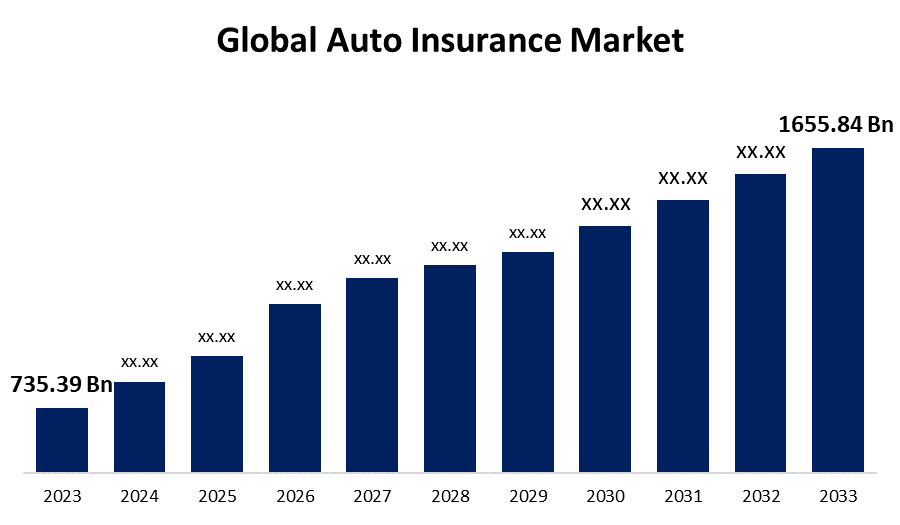

- The Global Auto Insurance Market Size was Valued at USD 735.39 Billion in 2023

- The Market Size is Growing at a CAGR of 8.46% from 2023 to 2033

- The Worldwide Auto Insurance Market Size is Expected to Reach USD 1655.84 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Auto Insurance Market Size is Anticipated to Exceed USD 1655.84 Billion by 2033, Growing at a CAGR of 8.46% from 2023 to 2033.

Market Overview

Auto insurance is a contract that safeguards policyholders against monetary loss in the case of an accident or theft between the policyholder and the insurance provider. The insurance company agrees to reimburse the policyholder's losses as specified in the policy in exchange for the policyholder paying a premium. As a financial safety net, auto insurance protects people from physical injury brought on by traffic accidents and vehicle theft. It also includes costs resulting from collisions in which the owner of an insured vehicle bears responsibility for harm done to other drivers, other cars, or property such as buildings, fences, or utility infrastructure. While state laws governing auto insurance are different many states require the purchase of liability coverage for both property damage and bodily injury before a vehicle can be operated or maintained on a public road. Increased accident rates, stringent government regulations about auto insurance purchases, and rising global automobile sales due to rising consumer per capita income are the main factors propelling the global auto insurance market forward. Additionally, throughout the forecast period, emerging nations' growing need for third-party liability coverage and the integration of new technologies into current product and service lines are anticipated to present appealing possibilities for the growth of the auto insurance market.

Report Coverage

This research report categorizes the market for the global auto insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global auto insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global auto insurance market.

Global Auto Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 735.39 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.46% |

| 2033 Value Projection: | USD 1655.84 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Distribution Channel, By Coverage, By Region |

| Companies covered:: | AXA SA Group, Liberty Mutual Insurance, Bajaj Allianz, American International Group Inc., Insurethebox, Verisk Analytics Inc., Allianz, State Farm Mutual, Tokio Marine Group, Automobile Insurance, Ping An Insurance (group), Admiral Group plc, berkshire hathaway inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The need for commercial vehicles is increasing as a result of growing economic activity in both developed and developing countries. The e-commerce industry's explosive growth has greatly pushed global demand for commercial vehicles, which has increased demand for transportation solutions globally. Over the projection period, there is anticipated to be an increase in demand for car insurance due to the growing global usage of personal and commercial automobiles. Purchasing a car insurance policy is mandated by law in many countries. Consequently, the regulations governing car purchases significantly impact the expansion of the auto insurance industry. Furthermore, the increase in incidents in recent years, including traffic injuries, drunk driving, and speeding while distracted, has made auto insurance important. For protection against financial losses, such as harm to other drivers, passengers, or pedestrians, the majority of automobile owners depend on their auto insurance.

Restraining Factors

Lack of understanding and comprehension of auto insurance coverage is a major factor impeding the expansion of the auto insurance industry. The main issue that has to be resolved by closing knowledge gaps in the automotive insurance industry is consumer experiences with frequent traffic accidents and low uptake of auto insurance.

Market Segmentation

The global auto insurance market share is segmented into application, distribution channel, and coverage.

- The personal segment dominates the market with the largest market share through the forecast period.

Based on the application, the global auto insurance market is segmented into personal and commercial. Among these, the personal segment dominates the market with the largest market share through the forecast period. A car that is designated as a personal vehicle can accommodate up to eight passengers, including the driver. Owing to their increased durability, enhanced comfort, and cost-effectiveness, these vehicles have experienced substantial market expansion. The growing consumer demand for personal vehicles and the fact that more passenger cars are being produced globally than commercial vehicles are driving the segment's expansion.

- The insurance agents/brokers segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the distribution channel, the global auto insurance market is segmented into insurance agents/brokers, direct response, banks, and others. Among these, the insurance agents/brokers segment is anticipated to grow at the fastest CAGR growth through the forecast period. Insurance agents and brokers are utilizing various websites and online selling platforms in response to the increasing need for personalized and customized services, which is a key trend in the auto insurance industry. In addition to purchasing insurance from different companies, insurance brokers use their in-depth understanding of risks and the insurance market to identify and arrange the best insurance plans for their clients.

- The third-party liability coverage segment accounted for the largest revenue share through the forecast period.

Based on the coverage, the global auto insurance market is segmented into third-party liability coverage, collision/comprehensive, and other optional coverage. Among these, the third-party liability coverage segment accounted for the largest revenue share through the forecast period. To defend against claims from other parties, one purchases third-party liability insurance coverage. When it comes to vehicle insurance, third-party coverage guards against claims of losses and damages incurred by uninsured drivers who are not covered under the policy. Third-party liability insurance becomes mandatory under the Motor Vehicles Act. New and old vehicle owners must be present at the moment of vehicle registration, which is a major factor driving the market's growth internationally.

Regional Segment Analysis of the Global Auto Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global auto insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global auto insurance market over the predicted timeframe. The North American vehicle insurance industry is expanding due to the existence of major insurance companies, growing consumer understanding of the advantages of auto insurance, high disposable income, rising car demand, and rising middle-class affordability. It is projected that growing consumer knowledge of the advantages of electric vehicles will increase demand for EVs in the coming years, which will in turn lead to a considerable increase in the need for auto insurance in North America. In the developed markets of the United States and Canada, the insurance industry is remarkably well-established. The North American auto insurance market is expanding significantly as a result of the growing use of digital platforms for policy purchases and renewals.

Asia Pacific is expected to grow at the fastest CAGR growth of the global auto insurance market during the forecast period. The growing need for automobiles is a result of expanding economic activity, growing public infrastructure spending, and quick urbanization. The region's growing middle class and large population are driving up demand for automobiles. The Asia Pacific car insurance market is expanding rapidly owing in large part to required government regulations in countries like India requiring the adoption of auto insurance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global auto insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA SA Group

- Liberty Mutual Insurance

- Bajaj Allianz

- American International Group Inc.

- Insurethebox

- Verisk Analytics Inc.

- Allianz

- State Farm Mutual

- Tokio Marine Group

- Automobile Insurance

- Ping An Insurance (group)

- Admiral Group plc

- berkshire hathaway inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2022, Bajaj Allianz introduced Pay As You Consume (PAYC), a usage-based insurance cover add-on. Under the Insurance Regulatory and Development Authority of India (IRDAI), the company is the first to introduce and launch this sort of insurance, allowing automobile companies to add on advanced insurance.

- In May 2022, Liberty Mutual Insurance finalized the acquisition of Insurance Portal Services' technological assets. This helped Liberty Insurance Company leverage insurance's inherent capabilities in the automobile sector.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global auto insurance market based on the below-mentioned segments:

Global Auto Insurance Market, By Application

- Personal

- Commercial

Global Auto Insurance Market, By Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

Global Auto Insurance Market, By Coverage

- Third-Party Liability Coverage

- Collision/Comprehensive

- Other Optional Coverage

Global Auto Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?AXA SA Group, Liberty Mutual Insurance, Bajaj Allianz, American International Group Inc., Insurethebox, Verisk Analytics Inc., Allianz, State Farm Mutual, Tokio Marine Group, Automobile Insurance, Ping An Insurance (Group), Admiral Group plc, Berkshire Hathaway Inc., and Others.

-

2. What is the size of the Global Auto Insurance Market?The Global Auto Insurance Market Size is Expected to Grow from USD 735.39 Billion in 2023 to USD 1655.84 Billion by 2033, at a CAGR of 8.46% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global auto insurance market over the predicted timeframe.

Need help to buy this report?