Global Automated Guided Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Forklift Truck, Tow Vehicle, Hybrid Vehicles, Unit Load Carrier, Pallet Truck, Others), By Navigation Technology (Laser Guidance, Inductive Guidance, Vision Guidance, Magnetic Guidance, Natural Navigation, Others), By Application (Assembly, Raw Material Handling, Logistics & Warehousing, Trailer Loading & Unloading, Packaging, Others), By End Use Industry (Automotive, Pharmaceuticals, Aerospace & Defence, Wholesale & Distribution, Chemicals, Electronics, E-Commerce, Food & Beverages, Metals & Heavy Machinery, Manufacturing, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Automotive & TransportationGlobal Automated Guided Vehicle Market Insights Forecasts to 2030

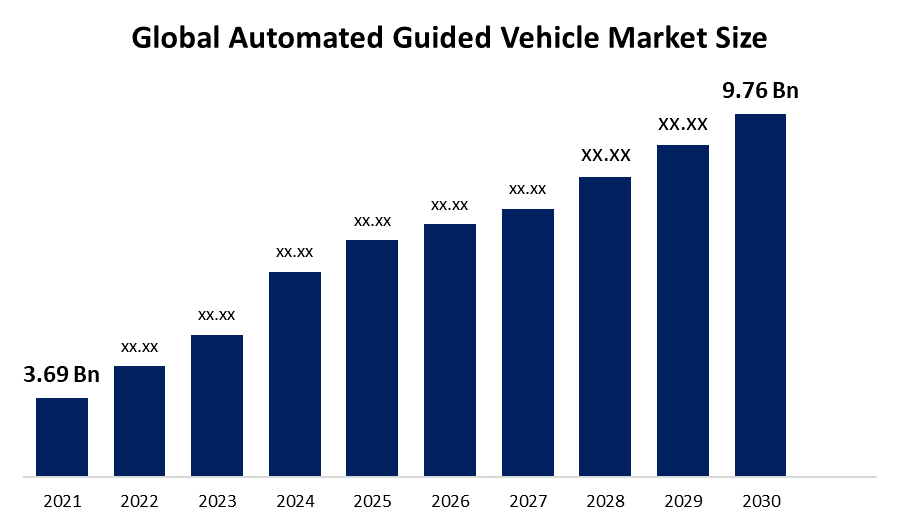

- The Global Automated Guided Vehicle Market Size was valued at USD 3.69 billion in 2021.

- The Worldwide Automated Guided Vehicle Market Size is growing at a CAGR of 9.8% from 2022 to 2030

- The Worldwide Automated Guided Vehicle market is expected to reach USD 9.76 billion by 2030

- Europe is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Automated Guided Vehicle Market Size is expected to reach USD 9.76 billion by 2030, at a CAGR of 9.8% during the forecast period 2022 to 2030. Automated guided vehicles are extensively used for a wide range of factors, including cheap labour prices, minimal damaged products, higher efficiency, and the flexibility to scale to support automated applications. Such significant advantages drive the logistics and transportation industries to use automated guided vehicles to improve overall operational performance. This is likely to fuel market revenue growth throughout the forecast period.

Automated guided vehicles (AGVs) or self-guided vehicles (SGVs), are material handling systems or load carriers that operate independently throughout a storage houses, distribution centers, or processing facilities, without an on-board operator or driver. Automated guided vehicle systems are used for tasks that would typically be handled by forklifts, conveyor systems, or manual carts, moving large volumes of material in a repetitive manner. AGVs are self-driving vehicles whose movement is controlled by software and sensors. Most AGVs follow predefined paths; however autonomous mobile robots (AMRs) have more advanced technology with dynamic navigation capabilities.

COVID-19 Automated Guided Vehicle Market Impact

The COVID-19 pandemic set of circumstances, a lack of personnel due to government-imposed lockdowns, and a suspension of industrial activities have all had a substantial influence on the automated guided vehicle market. As a result of the COVID-19 pandemic, the manufacturing industry witnessed a major decline in revenues and investment. Nonetheless, under such uncertainty, the deployment and industrial automation of AGVs proved to be essential in ensuring that manufacturers met their production targets. By allowing businesses to remain operational, the pandemic has created various opportunities for the automated guided vehicle industry. As a result of the new normal, several industries, including healthcare, e-commerce, and food and beverage, have altered their operations.

Key Market Drivers

Rising automation solutions in material handling process and improving workplace safety to drive market

With the increasing e-commerce industry throughout the world, the deployment of automated material systems is also growing in popularity. Currently, developments in material handling technology have enabled manufacturers to develop smart factories, resulting in the implementation of automated material handling processes through the integration of innovations such as cloud computing, intelligent systems, and many others. Thus, further enables manufacturers to benefit from increasingly versatile manufacturing operations, improved quality management, and improved working efficiency.

Personnel safety has become an important issue in many industry sectors, especially storage and distribution, manufacturing, metalworking, industrial equipment, and automotive because workers are needed to perform highly unsafe tasks and operate in dangerous conditions. Industries are working to improve worker safety in attempts to prevent accidents, avoid delays, and boost production. Automated guided vehicles are becoming more popular, and an increasing number of businesses are utilizing them in commercial warehouses.

Key Market Challenges

High Installation Cost & limited payload capacity limit market growth

The high installation cost of automated guided vehicles and insufficient payload capacity and the inability to perform complicated tasks are some of the reasons limiting industry expansion. Industries that use AGVs to automate the manufacturing process or distribution network are required to make significant investments. This involves the price of acquiring, deploying, and upgrading the workplace to make navigation easier and AGV-friendly. Also, even though automated guided vehicles are designed to do simple tasks such as material handling with a limited payload capacity, they cannot handle complex operations like packaging or assemble adequately. This could be expected to constrain market revenue growth.

Key Market Opportunities

Increase in Industry 4.0 adoption

The increased implementation of Industry 4.0 is expected to drive the growth of the automated guided vehicle market over the projected timeframe. Industry 4.0 promotes greater productivity and effectiveness, in addition to greater mobility and versatility throughout a wide range of operations. As a result, manufacturing processes become more automated, with rising demand for various types of automated guided vehicle is increasing.

Automated Guided Vehicle Market Segmentation

Vehicle Type Insights

The tow vehicle segment accounted the largest market share over the forecast period.

On the basis of vehicle type, the global automated guided vehicle market is segmented into forklift truck, tow vehicle, hybrid vehicles, unit load carrier, pallet truck, and others. Among these, the tow vehicle segment is dominating the market and is going to continue its dominance over the forecast period. Tow trucks, which can transport greater loads with several trailers than a single fork truck, are the most productive type of autonomous guided vehicle used for tugging and pulling. The load is either manually or automatically loaded in the vehicle. They can autonomously identify and avoid obstructions in their path due to a navigation system that utilizes sensors and algorithms. This vehicle’s economical design allows them to function at a set speed while still adhering to safety standards and maintaining production goals, that is indirect helping the global automated guided vehicle market to achieve revenue goal and contributing worldwide automated guided vehicle industry to boost demand.

Navigation Technology Insights

The laser guidance segment is dominating the market with the largest revenue share over the forecast period.

On the basis of navigation technology, the global automated guided vehicle market is segmented into laser guidance, inductive guidance, vision guidance, magnetic guidance, natural navigation, and others. Among these, the laser guidance segment is dominating the market with the largest revenue share of 26.5% over the forecast period. For effective navigation inside a facility, laser guidance is a commonly used method for the deployment of automated guided vehicles. With integrating AGVs using lidar systems that produce beams and monitor the environmental parameters, automated guided vehicles can discern reflections of the beam off surfaces such as the floor to establish their positioning and maneuver to their desired location. The increasing deployment of automated vehicles is being fueled by the demand for sophisticated and effective navigation. As a result, the demand for laser guidance as a dependable navigational aid is expected to rise, boosting revenue growth in this market.

Application Insights

The logistics & warehousing segment accounted the largest market share over the forecast period.

On the basis of application, the global automated guided vehicle market is segmented into the assembly, raw material handling, logistics & warehousing, trailer loading & unloading, packaging, and others. Among these, the logistics & warehousing segment is dominating the market and is going to continue its dominance over the forecast period. The logistics and warehousing industry is mostly classified into transportation, storage facilities, wholesale & distribution, and cross-docking. Autonomous guided vehicles are developed to transport items from their initial point to the final destination with minimal human assistance. AGVs are capable of maneuvering tight places, helping manage materials at high elevations, and operating many loading units with a single iteration. As a result, the demand for logistics and warehousing is expected to grow, supporting revenue growth in this industry.

End Use Industry Insights

The wholesale and distribution segment accounted the largest revenue share of more than 76.2% over the forecast period.

On the basis of end use industry, the global automated guided vehicle market is segmented into automotive, pharmaceuticals, aerospace & defence, wholesale and distribution, chemicals, electronics, e-commerce, food & beverages, metals & heavy machinery, manufacturing, and others. Among these, the wholesale and distribution segment accounted for the largest revenue share of over 76.2% over the forecast period. In order to boost productivity and efficiency, the wholesale and distribution sector uses automated guided vehicles. In addition to automation, automated guided vehicles can be utilized for material handling, inventory control, and order fulfillment, loading, and unloading. Automated guided vehicles can be designed to retrieve and distribute specified items from warehouses to packaging and delivery facilities, enhancing order fulfillment speed and accuracy. Additionally, automated guided vehicles can be connected with several other warehousing automation technologies like conveyor system and remotely operated to develop a completely automated supply chain network.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 45.9% market share over the forecast period. The growth for automated guided vehicles is highest in Asia Pacific because of the region's competitive marketplace, cost-effective access to economical automation services, and rising production in the automotive industry. Also, e-commerce industries have rapidly increased their utilization of automated guided vehicles at warehouses due to the growing demand for e-commerce in developing nations like India, China, and Japan's neighboring countries. As a result, market demand in the e-commerce industry has intensified, and manufacturing industry players are striving to discern themselves by decreasing the duration required to deliver goods to end customers.

Toyota Industries Corporation, for example, stated in May 2021 that it had established a strategic cooperation arrangement with Third Wave Automation, Inc. to develop autonomous material handling vehicles which including automated guided vehicles (AGV) and automated guided forklifts (AGF). By merging TWA's image recognition and artificial intelligence capabilities with Toyota Industries' vehicular technologies and vehicle management platform, the two businesses want to build next-generation vehicles that enable autonomous driving, advanced automation, and manpower savings.

Europe, on the contrary hand, had maintained the second major revenue share due to a rise in the number of government initiatives and financial assistance funded by the European Union (EU), as well as growing demands for service robots across numerous end-use industries in this region's countries. Additionally, automation in many sectors has aided market expansion in this region. For example, in May 2022, the BMW Group will debut a new automated steel pressing facility at its Swindon plant. The new press will create steel panels for the MINI facility in Oxford, with a new fleet of Automated Guided Vehicles handling steel blanks and finished panels (AGVs). The new press has six independent stations and can generate up to 18 components per minute, which is more than double the capacity of the previous press line. The usage of AGVs has streamlined logistics, especially with the deployment of a massive AGV capable of transporting up to six tons of freight. In total, 23 new AGVs have been installed in the new facilities, with more on the way in the coming years.

North America is predicted to develop at an unprecedented pace as region with the most automated guided vehicle market share throughout the projected timeframe. The rise of the volume of export and import operations is driving the expansion. Logistics companies are rapidly adopting automation technology to streamline warehouse operations and maximize efficiency.

Key Market Developments

- In May 2022, BMW has chosen Intelligent Energy's (IE) fuel cell modules to power the Leipzig production. Intelligent Energy and FES GmbH Fahrzeug-Entwicklung Sachsen (FES) have been working with BMW Group for the past two years to develop a bespoke solution for the DS Automation built Automated Guided Vehicles (AGV) in operation at the BMW Leipzig production. Since its maiden operation in January of this year, the first of the AGVs has proven to be a success, and other AGVs will soon be converted to hydrogen fuel cells.

- In April 2021, Continental Romania announced that its electrical component factories in Timisoara and Sibiu, tire factories in Timisoara, and ContiTech units in Carei, Nadab, and Timisoara deploy autonomously guided vehicles (AGV) and other industry-specific 4.0 technologies to increase production efficiency. The project team relied on their automotive experience during the design, production, and assembly of the AGV. The goal is for AGV to be accessible as a key technology for use in production at all Continental factories around the world.

List of Key Market Players

- BMW AG

- Mazda Motor

- Nissan

- Proton

- KUKA

- Renault S.A.

- COMPAS

- Volkswagen

- Swindon Pressing Ltd.

- KION GROUP AG

- Rohm Co. Ltd.

- Cepton Technologies Ltd.

- Nippon Chemi-Con Corp.

- Daifuku

- Hyster-Yale Materials Handling, Inc.

- AB SFk

- Swisslog Holding AG

- Faurecia SE

- Toyota Industries Corp.

- Ichikoh Industries, Ltd.

- Nidec Corp.

- JBT

- Mitsubishi Electric Corp.

- Aisin Corp.

- Continental AG

- Musashi Seimitsu Industry Co., Ltd.

- Seegrid Corporation

- Bastian Solutions, Inc.,

- KMH Fleet Solutions

- E&K Automation GmbH

Automated Guided Vehicle Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global automated guided vehicle market based on the below-mentioned segments:

Automated Guided Vehicle Market, Vehicle Type Analysis

- Forklift Truck

- Tow Vehicle

- Hybrid Vehicles

- Unit Load Carrier

- Pallet Truck

- Others

Automated Guided Vehicle Market, Navigation Technology Analysis

- Laser Guidance

- Inductive Guidance

- Vision Guidance

- Magnetic Guidance

- Natural Navigation

- Others

Automated Guided Vehicle Market, Application Analysis

- Assembly

- Raw Material Handling

- Logistics & Warehousing

- Trailer Loading & Unloading

- Packaging

- Others

Automated Guided Vehicle Market, End Use Industry Analysis

- Automotive

- Pharmaceuticals

- Aerospace & Defence

- Wholesale & Distribution

- Chemicals

- Electronics

- E-Commerce

- Food & Beverages

- Metals & Heavy Machinery

- Manufacturing

- Others

Automated Guided Vehicle Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region is dominating the automated guided vehicle market?Asia Pacific is dominating the Automated Guided Vehicle market with more than 45.9% market share.

-

2. Which are the key companies in the market?Daifuku, Hyster-Yale Materials Handling, Inc., AB SFk, Swisslog Holding AG, Faurecia SE, Toyota Industries Corp., Mitsubishi Electric Corp., Aisin Corp., and Continental AG

-

3. What is the market size of the automated guided vehicle?The global automated guided vehicle market is expected to grow from USD 3.69 Billion in 2021 to USD 9.76 Billion by 2030, at a CAGR of 9.8% during the forecast period 2021-2030.

-

4. What are the major driving factors for the lithium-ion battery?Increasing usage of AGVs in the e-commerce industry, rising demand for automation to reduce labor costs and improve productivity, rise in adoption of Industry 4.0, and increase in demand for automation in warehousing and logistics.

-

5. Which segment dominated the automated guided vehicle market share?The wholesale and distribution segment of end use industry dominated the automated guided vehicle market in 2021 and accounted for a revenue share of over 76.2%.

Need help to buy this report?