Global Automated Manual Transmission Market Size, Share, and COVID-19 Impact Analysis, By Speed (4 Speed, 6 Speed, 8 Speed), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automated Manual Transmission Market Insights Forecasts to 2033

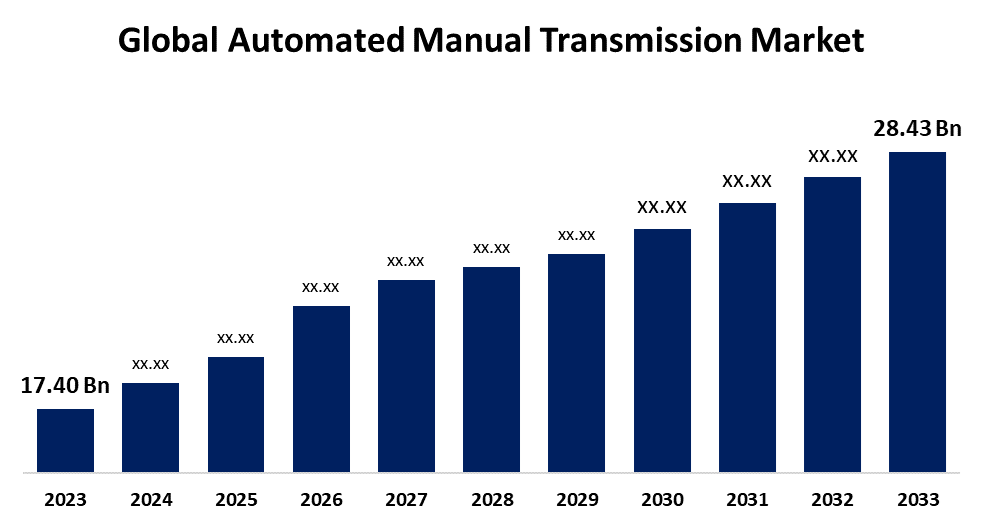

- The Global Automated Manual Transmission Market Size was Valued at USD 17.40 Billion in 2023

- The Market Size is Growing at a CAGR of 5.03% from 2023 to 2033

- The Worldwide Global Automated Manual Transmission Market Size is Expected to Reach USD 28.43 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automated Manual Transmission Market Size is Anticipated to Exceed USD 28.43 Billion by 2033, Growing at a CAGR of 5.03% from 2023 to 2033. The automated manual transmission (AMT) Market is expanding due to growing demand for fuel efficiency, smooth driving experiences, and lower vehicle costs. Innovations in automation technology and increased adoption in mass-market vehicles are driving significant growth across automotive industries globally.

Market Overview

Automated manual transmission is a type of transmission that combines manual and automatic systems. It retains the mechanical structure of the manual transmission but uses automation to take over the clutch and gear shifts, So, unlike traditional manual gearboxes, the driver will not need to intervene during gear change. Furthermore, the growing demand for fuel-efficient vehicles, particularly in entry-level and mid-range cars, drives AMT growth. AMTs are cost-effective, fuel-efficient solutions with the convenience of automatic transmissions. Technological advancements and stricter government regulations enhance adoption. The rising popularity in emerging markets like India and China, along with increasing adoption by automakers, drive the growth of the AMT market. Moreover, technological innovations that boost AMT are improved gear-shifting algorithms, advanced control systems, and electro-hydraulic actuators for smooth operation. The use of lightweight materials enhances fuel economy, while AI and machine learning optimize shifting patterns. On top of this, added ADAS features improve convenience and safety, thereby enhancing the driving experience.

Opportunities and Trends in the Global Automated Manual Transmission Market:

The opportunities in the global AMT market lie in the growing demand for fuel-efficient vehicles, increasing adoption in emerging markets, and technological advancement in AMT. For instance, in April 2021, ZF Friedrichshafen AG has launched new 8-speed automatic trans-mission, ZF PowerLine, for medium duty vehicles. The new ZF PowerLine offers better fuel efficiency than 9- and 10-speed transmission. Trends include integration with EVs; gear-shifting algorithms advance; cost-effective designs for compact cars; and a set of government regulations on "fuel efficiency" that are driving an across-the-board adoption worldwide.

Report Coverage

This research report categorizes the global automated manual transmission market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Automated Manual Transmission market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automated manual transmission market.

Global Automated Manual Transmission Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 17.40 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.03% |

| 2033 Value Projection: | USD 28.43 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 229 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Speed, By Vehicle Type, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | TATA MOTORS, Allison Transmission Inc., FCA US LLC, Detroit Diesel Corporation, ZF Friedrichshafen AG, AB Volvo, Eaton, Shaanxi Fast Gear Co.Ltd., Aisin World Corp. of America, MACK TRUCKS, WABCO, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising fuel efficiency demands, stricter emission standards, and the growing demand for affordable, low-maintenance vehicles are driving the AMT market. Increasing urbanization and traffic congestion push consumers toward more convenient, cost-effective driving options. Moreover, technological advancements in automation and the adoption of AMTs by automakers in emerging markets drive market growth, offering competitive advantages. Moreover, most of the major companies aim to offer technologically led and advanced products to uplift their product portfolio in the market. The companies are also making strategic moves. Recently, in September 2021, Dongfeng Citroen, one of the brands owned by Dongfeng-Peugeot-Citroen Automobile Co., Ltd. (DPCA), released the all-new C5 X luxury crossover, mated with an Aisin 8-speed automated manual transmission (AMT).

Restraints & Challenges

The automated manual transmission market will face issues such as consumer perception of a rougher driving experience compared to traditional automatics. High initial costs compared to manual transmissions and low adoption in premium cars are other obstacles. Also, technology issues like slower gear shifting and durability can discourage the widespread acceptance and growth of this technology.

Market Segmentation

The global automated manual transmission market share is classified into material type, application.

- The 6-speed segment is expected to hold the largest share of the global automated manual transmission market during the forecast period.

Based on speed, the global automated manual transmission market is categorized as 4-speed, 6-speed, and 8-speed. Among these, the 6-speed segment is expected to hold the largest share of the global automated manual transmission market during the forecast period. Segmental growth is due to the best balance performance, fuel economy, and affordability. While it offers more gear ratios than a 4-speed, it still offers an improvement in driving dynamics than an 8-speed counterpart, yet more affordable and simpler than other systems. Its compact to mid-range vehicle application versatility and common adoption by carmakers make this the most preferred.

- The passenger car segment is expected to grow at the fastest CAGR during the forecast period.

Based on the vehicle type the global automated manual transmission market is categorized as passenger car, light commercial vehicle, and heavy commercial vehicle. Among these, the passenger car segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by consumer demand for fuel-efficient, affordable vehicles - especially in compact and subcompact categories. AMTs are very cost-effective compared to other automatics, so their usage is increasing. Urbanization and adoption by automakers also increase the use of passenger cars with AMTs.

Regional Segment Analysis of the Global Automated Manual Transmission Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global automated manual transmission market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global automated manual transmission market over the forecast period. The region is due to the high demand for affordable and fuel-efficient vehicles in countries such as India and China. Rapid urbanization, government regulations promoting fuel efficiency, and the presence of major automotive manufacturers driving AMT adoption in passenger and commercial vehicles contribute to this dominant market position. For instance, Honda (China & India), Honda Amaze with AMT Technology is launched in India with an emphasis on the cost-effectiveness of automatic transmissions for the compact sedan segment. The AMTs of Honda promise better fuel economy compared to traditional torque-converter automatics while offering a simpler system.

Europe is expected to grow at the fastest CAGR growth of the global automated manual transmission market during the forecast period. Strict emission rules in Europe, such as Euro 6, motivate buyers toward fuel-efficient technology and automated manual transmission. Customer requirement for affordable, urban-oriented, fuel-efficient products adds to the growth of the adoption of automated manual transmission. This growth is also added by automakers like Volkswagen and Renault, which have committed their vehicles to AMT production. On average, ZF produces 3.5 million units of this 8-speed automatic transmission for Aston Martin, FCA, JLR, and the Volkswagen group yearly. In 2019, it won a contract worth one billion dollars from BMW. ZF will supply its latest version of this 8-speed automatic transmission to a BMW series of models that could go into production in 2022.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Automated Manual Transmission market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TATA MOTORS

- Allison Transmission Inc.

- FCA US LLC

- Detroit Diesel Corporation

- ZF Friedrichshafen AG

- AB Volvo

- Eaton

- Shaanxi Fast Gear Co.Ltd.

- Aisin World Corp. of America

- MACK TRUCKS

- WABCO

- Others

Key Market Developments

- In November 2024, Tata Motors, India's major multinational vehicle manufacturer, unveiled its first automatic manual transmission (AMT) truck, the Tata Prima 4440.S AMT, in Saudi Arabia.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automated manual transmission market based on the below-mentioned segments:

Global Automated Manual Transmission Market, By Speed

- 4-Speed

- 6-Speed

- 8-Speed

Global Automated Manual Transmission Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Global Automated Manual Transmission Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global automated manual transmission market over the forecast period?The global automated manual transmission market size is expected to grow from USD 17.40 billion in 2023 to USD 28.43 billion by 2033, at a CAGR of 5.03% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share of the global automated manual transmission market?Asia Pacific is projected to hold the largest share of the global automated manual transmission market over the forecast period.

-

3. Who are the top key players in the global automated manual transmission market?Allison Transmission Inc., FCA US LLC, Detroit Diesel Corporation, ZF Friedrichshafen AG, AB Volvo, Eaton, Shaanxi Fast Gear Co.Ltd., Aisin World Corp. of America, MACK TRUCKS, WABCO, and others.

Need help to buy this report?