Global Automated Truck Loading System Market Size, Share, and COVID-19 Impact Analysis, By Loading Dock (Flush Dock, Enclosed Dock, Sawtooth Dock, Climate Controlled Dock, Others), By System Type (Chain Conveyor System, Slat Conveyor System, Belt Conveyor System, Skate Conveyor System, Automated Guided Vehicles, Others), By Truck Type (Non-Modified Truck Type and Modified Truck Type), By Industry (Aviation, Construction, Packaging, FMCG, Automotive, Textile, Pharmaceutical, Warehouse & Distribution, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Machinery & EquipmentGlobal Automated Truck Loading System Market Size Forecasts to 2032

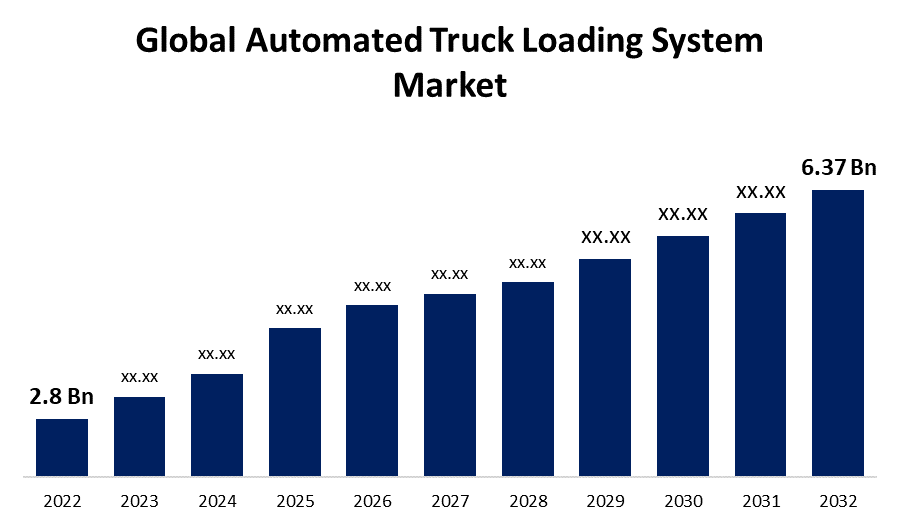

- The Global Automated Truck Loading System Market Size was valued at USD 2.8 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.5% from 2022 to 2032

- The Worldwide Automated Truck Loading System Market Size is expected to reach USD 6.37 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Automated Truck Loading System Market Size is expected to reach USD 6.37 Billion by 2032, at a CAGR of 8.5% during the forecast period 2022 to 2032.

Automated truck loading systems comprise an ensemble of interconnected systems that load and unload materials without the necessity of manual labor. It is a system that combines numerous components, such as truck restraint systems, dock levelers, and specialized conveyors, to provide fast and secure delivery of cargo between the truck and the storage facility or distribution warehouse. Automated truck loading systems provide a variety of positive aspects by removing much of the manual work required in these processes, including efficiency, safety, cost savings, and uniformity. ATLS (automated truck loading systems) have transformed the transportation and logistics industries, introducing new productivity and accuracy to the unloading and loading of freight. The improvement in loading and unloading durations is one of the primary benefits of automated truck loading systems. Manual labor is used in traditional procedures, which can be time-consuming and error-prone. The whole process becomes more efficient, precise, and less demanding of labor with automated truck loading systems. This increased productivity results in cost savings for businesses because it allows them to boost product throughput while decreasing labor-related expenditures.

Automated Truck Loading System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.5% |

| 2032 Value Projection: | USD 6.37 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Loading Dock, By System Type, By Truck Type, By Industry, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Actiw Oy, GEBHARDT Fördertechnik GmbH, HAVER & BOECKER OHG, ATLS Ltd., Industrial Conveying Pty Ltd., KEITH Manufacturing Co., Capo Tecnologia, ACTIW LTD., BEUMER GROUP, Cargo Floor B.V, Dexter Company S.A. de C.V., Q-Loader, Dematic, FMH Conveyors, Asbreuk Service B.V., Joloda Hydraroll Ltd., Secon Components S.L., VDL Systems bv, CLSi Logispeed, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for automated truck loading systems includes a diverse set of technologies aimed at automating the operation of loading and unloading vehicles. These systems combine robotics, sensors, and software with the goal of ensuring that commodities are loaded onto trucks as quickly and efficiently as feasible. The automated truck loading systems (ATLS) market has experienced tremendous expansion and growth in the past decade, owing to changing logistics and transportation industry demands. This rise in demand can be attributed to a variety of factors, including technological developments, the drive for operational efficiency, and the demand for safer working conditions. The most important reach of ATLS is the huge leap in operational efficiency it enables. Faster loading times result in faster truck turnaround, boosting logistics throughput along with potential revenue growth for logistics enterprises. Companies are looking for strategies to maintain operating standards while lowering overheads as labor prices continue to grow globally. An automated truck loading system demonstrates a solution by reducing the requirement for physical labor during the loading process. With the rise of globalization raising international trade, the demand for effective and promptly delivered commodities transportation is increasing. As a result, an automated truck loading system may lead to more efficient cross-border logistics operations.

Market Segmentation

By Loading Dock Insights

The flush dock segment is dominating the market with the largest revenue share over the forecast period.

On the basis of the loading dock, the global automated truck loading system market is segmented into the flush dock, enclosed dock, sawtooth dock, climate controlled dock, and others. Among these, the flush dock segment is dominating the market with the largest revenue share of 38.6% over the forecast period. Flush Docks integrate firmly into the structure, making them ideal for small enterprises and saving space. Furthermore, a flush dock is placed parallel to the building with a tight cushion to prevent any harm from the wall, which is advantageous for safety.

By System Type Insights

The belt conveyor system segment is witnessing highest CAGR growth over the forecast period.

On the basis of system type, the global automated truck loading system market is segmented into chain conveyor systems, slat conveyor systems, belt conveyor systems, skate conveyor systems, automated guided vehicles, and others. Among these, the belt conveyor system segment is witnessing the highest CAGR growth over the forecast period. This is due to an increase in e-commerce shipping and storage operations, which brings with it workforce issues, redundant warehouse design, peak season fluctuations, and intense competition. Belt conveyors, such as flexible belt conveyors, improve precision and effectiveness in warehouse automation and activities, as well as hasten up truck loading and unloading. This drives market growth during the anticipated timeframe.

By Truck Type Insights

The non-modified truck type segment is expected to hold the largest share of the global automated truck loading system market during the forecast period.

Based on the truck type, the global automated truck loading system market is classified into non-modified truck type and modified truck type. Among these, the non-modified truck type segment is expected to hold the largest share of the automated truck loading system market during the forecast period. The majority of companies may currently operate a fleet of non-modified trucks. Utilizing automatic truck loading systems built for non-modified trucks allows them to smoothly incorporate them into their existing fleet without requiring major changes to their current operations or fleet management. Because of this compatibility with the existing fleet, automated truck-loading systems for non-modified vehicles are being adopted. This drives the segment's market expansion over the anticipated duration.

By Industry Insights

The FMCG segment accounted for the largest revenue share of more than 38.2% over the forecast period.

On the basis of industry, the global automated truck loading system market is segmented into aviation, construction, packaging, FMCG, automotive, textile, pharmaceutical, warehouse & distribution, and others. Among these, the FMCG segment is dominating the market with the largest revenue share of 38.2% over the forecast period, because of the growing popularity of the e-commerce platforms throughout the fast-moving consumer goods industry. This sector manages a large range of products that are in continual demand and require frequent delivery, such as beverages and food, personal care items, household items, and others. This industry has enormous production volumes and necessitates rapid and dependable transport options to meet consumer demand. This increases the segment's consumption in this market.

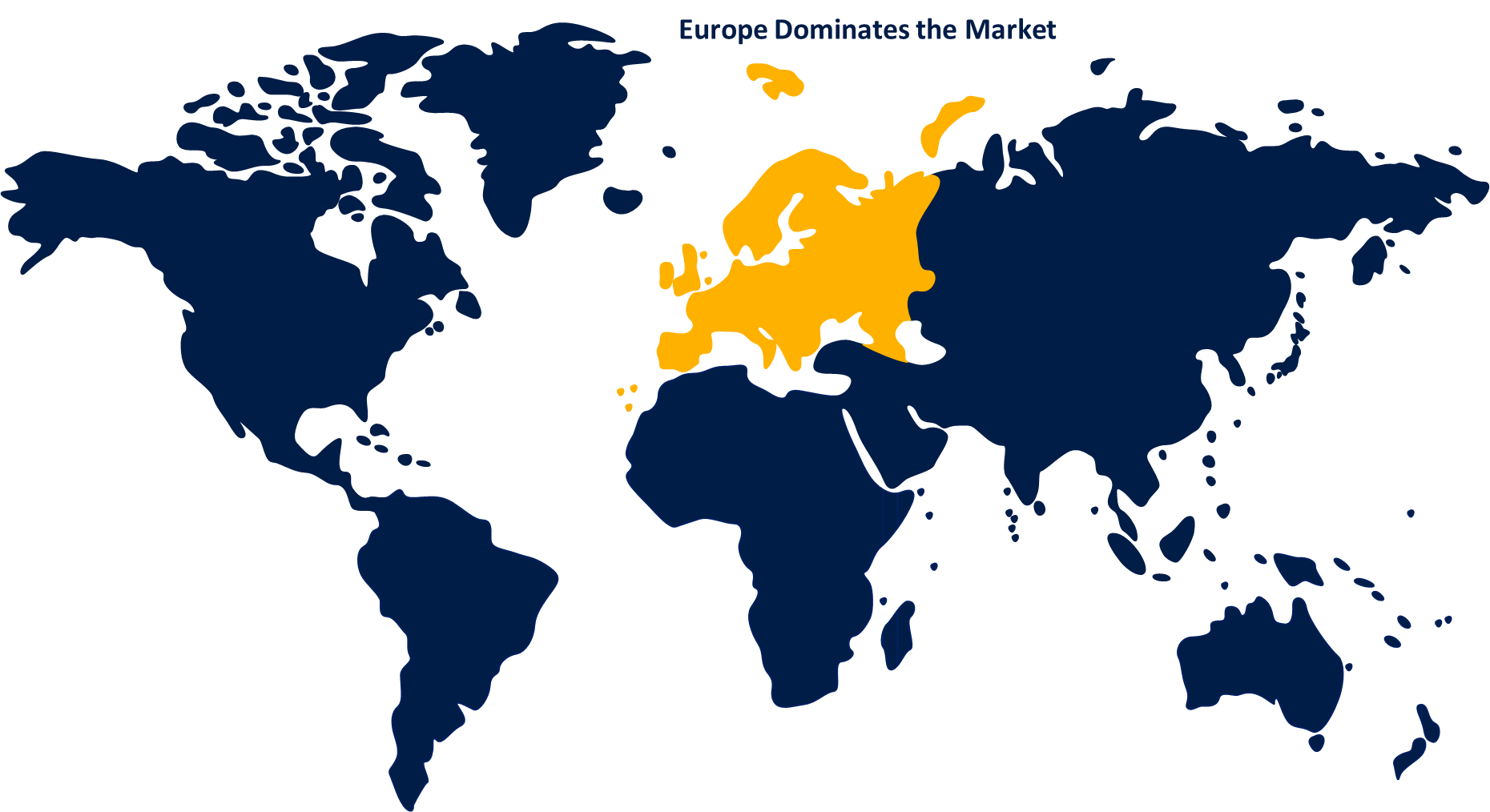

Regional Insights

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe dominated the market with more than 43.8% market share over the forecast period, owing to the logistics and transportation industry's early adoption of automation and technology. In addition, the region's robust logistics industry, paired with its emphasis on technical innovation and long-term viability has placed it at the leading edge of the adoption of automated truck loading systems. A number of European countries have stood at the forefront of implementing cutting-edge technologies that streamline supply chain processes, decrease labor expenses, and boost productivity. As a result of its early adoption, Europe reaps an advantageous position in this sector, contributing to its domination.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The region is rapidly industrializing, with increased manufacturing and logistics activity. As enterprises in the region expand their manufacturing as well as distribution operations to meet the rising demand for goods, there is a greater demand for reliable and automated transportation solutions, maximizing the region's automated truck loading system market over the projection period.

List of Key Market Players

- Actiw Oy

- GEBHARDT Fördertechnik GmbH

- HAVER & BOECKER OHG

- ATLS Ltd.

- Industrial Conveying Pty Ltd.

- KEITH Manufacturing Co.

- Capo Tecnologia

- ACTIW LTD.

- BEUMER GROUP

- Cargo Floor B.V

- Dexter Company S.A. de C.V.

- Q-Loader

- Dematic

- FMH Conveyors

- Asbreuk Service B.V.

- Joloda Hydraroll Ltd.

- Secon Components S.L.

- VDL Systems bv

- CLSi Logispeed

Key Market Developments

- On January 2023, Dematic has partnered with Vinpac International to supply autonomous guided trucks to increase production and efficiency at Vinpac's South Australian factory. The AGVs can carry a weight of up to 1,500 kg to a height of four meters.

- On April 2022, Gideon, a robotics and AI solutions provider, has launched Trey, an autonomous forklift for truck trailer loading and unloading activities. Trey loads and unloads pallets totally on his own, saving more than 80% of the time of a worker. It works alongside people in dynamic circumstances, securely, consistently, and dependably.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Automated Truck Loading System Market based on the below-mentioned segments:

Automated Truck Loading System Market, Loading Dock Analysis

- Flush Dock

- Enclosed Dock

- Sawtooth Dock

- Climate Controlled Dock

- Others

Automated Truck Loading System Market, System Type Analysis

- Chain Conveyor System

- Slat Conveyor System

- Belt Conveyor System

- Skate Conveyor System

- Automated Guided Vehicles

- Others

Automated Truck Loading System Market, Truck Type Analysis

- Non-Modified Truck Type

- Modified Truck Type

Automated Truck Loading System Market, Industry Analysis

- Aviation

- Construction

- Packaging

- FMCG

- Automotive

- Textile

- Pharmaceutical

- Warehouse & Distribution

- Others

Automated Truck Loading System Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automated Truck Loading System market?The Global Automated Truck Loading System Market is expected to grow from USD 2.8 billion in 2022 to USD 6.37 billion by 2032, at a CAGR of 8.5% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Actiw Oy, GEBHARDT Fördertechnik GmbH, HAVER & BOECKER OHG, ATLS Ltd., Industrial Conveying Pty Ltd., KEITH Manufacturing Co., Capo Tecnologia, ACTIW LTD., BEUMER GROUP, Cargo Floor B.V, Dexter Company S.A. de C.V., Q-Loader, Dematic, FMH Conveyors, Asbreuk Service B.V., Joloda Hydraroll Ltd., Secon Components S.L., VDL Systems bv, CLSi Logispeed

-

3. Which segment dominated the Automated Truck Loading System market share?The FMCG segment in industry type dominated the Automated Truck Loading System market in 2022 and accounted for a revenue share of over 38.2%.

-

4. Which region is dominating the Automated Truck Loading System market?Europe is dominating the Automated Truck Loading System market with more than 43.8% market share.

-

5. Which segment holds the largest market share of the Automated Truck Loading System market?The flush dock segment based on loading dock type holds the maximum market share of the Automated Truck Loading System market.

Need help to buy this report?