Global Automatic Dependent Surveillance-Broadcast (ADS-B) Market Size, Share, and COVID-19 Impact Analysis, By Component (Transponder, Receiver, Antenna, and Ground Receivers), By Platform (Commercial Aviation, Business Jets, Unmanned Aerial Vehicle, and Helicopters), By Application (ATC Surveillance, Airborne Surveillance, and Others), By End-Use (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Automatic Dependent Surveillance-Broadcast (ADS-B) Market Insights Forecasts to 2033

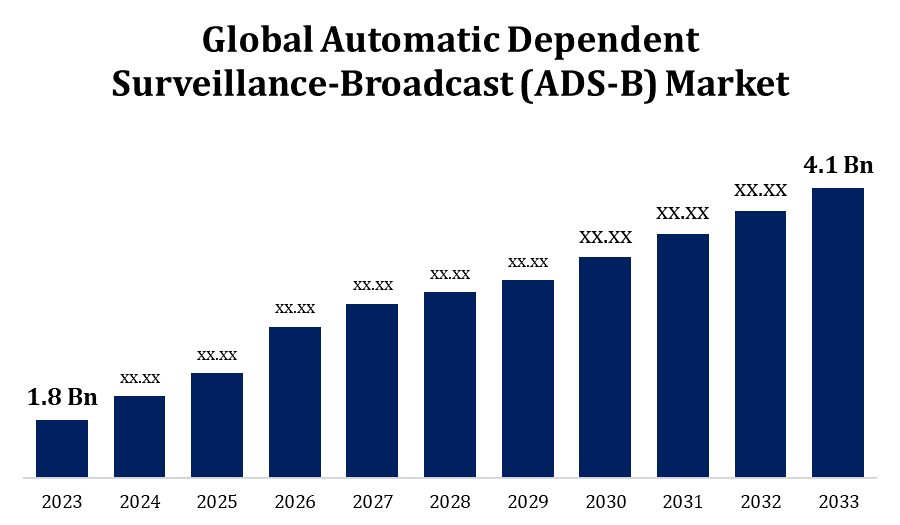

- The Global Automatic Dependent Surveillance-Broadcast (ADS-B) Market Size was valued at USD 1.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.58% from 2023 to 2033

- The Worldwide Automatic Dependent Surveillance-Broadcast (ADS-B) Market Size is expected to reach USD 4.1 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Automatic Dependent Surveillance-Broadcast (ADS-B) Market Size is expected to reach USD 4.1 Billion by 2033, at a CAGR of 8.58% during the forecast period 2023 to 2033.

The Automatic Dependent Surveillance-Broadcast (ADS-B) market is witnessing significant growth driven by increasing demand for efficient air traffic management and enhanced aviation safety. ADS-B technology enables real-time tracking and sharing of aircraft positions, improving situational awareness and reducing the risk of mid-air collisions. Key factors propelling the market include regulatory mandates for ADS-B adoption, advancements in satellite navigation systems, and the growing number of commercial and general aviation aircraft. North America and Europe are leading in ADS-B implementation due to stringent regulatory frameworks, while Asia-Pacific is emerging as a lucrative market due to rising air travel and airport modernization initiatives.

Automatic Dependent Surveillance-Broadcast (ADS-B) Market Value Chain Analysis

The value chain of the Automatic Dependent Surveillance-Broadcast (ADS-B) market encompasses several critical stages, beginning with component suppliers who provide essential parts such as transponders, antennas, and GPS receivers. These components are integrated by system manufacturers into ADS-B devices, which are then subject to rigorous testing and certification processes to meet regulatory standards. The next stage involves distribution channels, including direct sales to airlines and partnerships with aviation maintenance and service providers. End-users, primarily airlines and air traffic control authorities, implement these systems to enhance flight safety and efficiency. Additionally, support and maintenance services ensure the ongoing reliability and performance of ADS-B equipment. This value chain is bolstered by collaboration among stakeholders to innovate and improve ADS-B technology, driving overall market growth.

Automatic Dependent Surveillance-Broadcast (ADS-B) Market Opportunity Analysis

The ongoing modernization of air traffic management systems and the rise in global air travel amplify the demand for ADS-B technology. Emerging markets in Asia-Pacific and Latin America offer significant growth prospects due to increasing investments in aviation infrastructure and fleet expansion. Innovations in ADS-B technology, such as enhanced data analytics and integration with unmanned aerial systems (UAS), further expand market potential. Additionally, the growing emphasis on reducing aviation carbon footprints presents opportunities for ADS-B to improve fuel efficiency through optimized flight paths. Collaborative ventures and strategic partnerships are also likely to unlock new avenues in the ADS-B ecosystem.

Global Automatic Dependent Surveillance-Broadcast (ADS-B) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.58% |

| 2033 Value Projection: | USD 4.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 242 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Platform, By Application, By End-Use, By Region. |

| Companies covered:: | Garmin Ltd., Honeywell International Inc., L3Harris Technologies Inc., Thales Group, Collins Aerospace, Indra Sistemas, S.A., Nav Canada, Aireon LLC, Saab AB, Aspen Avionics Inc., and Other |

| Growth Drivers: | Modernization of Air Traffic Management Infrastructure to Promote Growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automatic Dependent Surveillance-Broadcast (ADS-B) Market Dynamics

Modernization of Air Traffic Management Infrastructure to Promote Growth

Upgrading ATM systems enhances the efficiency, safety, and capacity of airspace management, necessitating the adoption of advanced surveillance technologies like ADS-B. ADS-B provides real-time, precise aircraft position data, which is crucial for modern ATM systems to manage increasing air traffic volumes and reduce congestion. Regulatory initiatives mandating ADS-B equipage in various regions further accelerate its adoption. Additionally, the shift towards satellite-based navigation and surveillance systems underscores the importance of ADS-B in future-proofing ATM infrastructures. Investments in ATM modernization by governments and aviation authorities globally are creating a robust market environment for ADS-B technology, fostering its widespread implementation and growth.

Restraints & Challenges

High initial installation and retrofitting costs for ADS-B systems are a significant barrier, particularly for smaller airlines and general aviation operators. Additionally, the need for global harmonization of ADS-B standards and regulatory requirements complicates implementation across different regions. Technical challenges, such as ensuring system interoperability and addressing cybersecurity vulnerabilities, also pose risks. Furthermore, the dependency on GPS signals makes ADS-B systems susceptible to signal loss or interference, impacting reliability. Limited infrastructure in developing regions and the slow pace of regulatory adoption in certain countries further restrict market expansion.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automatic Dependent Surveillance-Broadcast (ADS-B) Market from 2023 to 2033. The growth is driven by stringent regulatory mandates and the region's advanced aviation infrastructure. The Federal Aviation Administration (FAA) has played a pivotal role by requiring ADS-B Out equipage for most aircraft operating in controlled airspace since January 2020. This regulatory push has led to widespread adoption among commercial and general aviation operators. North America's focus on enhancing air traffic management efficiency and safety further fuels the demand for ADS-B technology. The presence of key industry players and continuous investments in research and development contribute to market innovation and expansion. Additionally, the integration of ADS-B with NextGen air transportation systems underscores its critical role in modernizing the region's aviation sector.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Regulatory bodies in the region are progressively mandating ADS-B equipage, stimulating market demand. The burgeoning aviation sector, characterized by increasing airline fleets and new airport constructions, further accelerates ADS-B adoption. Additionally, collaborations with international aviation organizations and technology providers are facilitating the integration of advanced ADS-B systems. As the Asia-Pacific region continues to prioritize airspace optimization and safety, the ADS-B market is expected to expand rapidly, addressing the growing need for efficient and reliable surveillance solutions.

Segmentation Analysis

Insights by Component

The receiver segment accounted for the largest market share over the forecast period 2023 to 2033. This segment's expansion is fueled by widespread regulatory mandates requiring ADS-B equipage, prompting airlines and general aviation operators to invest in advanced receiver technology. Technological advancements in ADS-B receivers, such as enhanced sensitivity and improved signal processing capabilities, contribute to their rising adoption. Additionally, the integration of ADS-B receivers with other avionics systems enhances overall flight safety and efficiency, further propelling market growth. The demand for robust surveillance in congested airspace and remote regions underscores the importance of high-performance receivers, making this segment a critical component of the broader ADS-B market's development.

Insights by Platform

The commercial aviation segment dominates the market and has the largest market share over the forecast period 2023 to 2033. Airlines are investing in ADS-B technology to enhance operational efficiency, safety, and compliance with air traffic management modernization initiatives. The benefits of ADS-B, including real-time aircraft tracking, optimized flight paths, and reduced separation minima, contribute to cost savings and improved fuel efficiency, further encouraging uptake. Additionally, the expansion of airline fleets and increasing air travel demand, particularly in emerging markets, bolster the commercial aviation segment. The integration of ADS-B with next-generation aviation systems underscores its critical role in future-proofing commercial aviation operations.

Insights by Application

The airborne surveillance segment accounted for the largest market share over the forecast period 2023 to 2033. This segment benefits from regulatory mandates for ADS-B Out equipage, enhancing situational awareness and safety for both commercial and general aviation. Technological advancements, such as improved signal processing and integration with other avionics, boost the capabilities and reliability of airborne surveillance systems. The rise in global air traffic and the need for efficient airspace management further propel this segment's expansion. Moreover, military and defense applications, which demand precise and secure airborne surveillance, contribute to market growth. As aviation authorities worldwide prioritize modernizing air traffic management systems, the airborne surveillance segment is poised for continued robust growth.

Insights by End Use

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. OEMs are crucial players in the ADS-B market as they incorporate ADS-B transponders and receivers into new aircraft designs, ensuring compliance with evolving regulatory standards worldwide. The segment's growth is driven by the global trend towards modernizing air traffic management systems, which includes mandates for ADS-B equipage to enhance airspace efficiency and safety. OEMs are also focusing on developing advanced ADS-B technologies that offer improved performance, reliability, and integration with other avionics systems.

Recent Market Developments

- In September 2020, China Eastern Airlines has signed a contract with Thales Group to upgrade its B737 fleet with NXT-800 DO-260B compliant transponders to meet the Civil Aviation Administration of China's (CAAC) ADS-B Out mandate.

Competitive Landscape

Major players in the market

- Garmin Ltd.

- Honeywell International Inc.

- L3Harris Technologies Inc.

- Thales Group

- Collins Aerospace

- Indra Sistemas

- S.A.

- Nav Canada

- Aireon LLC

- Saab AB

- Aspen Avionics Inc.

- Other

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automatic Dependent Surveillance-Broadcast (ADS-B) Market, Component Analysis

- Transponder

- Receiver

- Antenna

- Ground Receivers

Automatic Dependent Surveillance-Broadcast (ADS-B) Market, Platform Analysis

- Commercial Aviation

- Business Jets

- Unmanned Aerial Vehicle

- Helicopters

Automatic Dependent Surveillance-Broadcast (ADS-B) Market, Application Analysis

- ATC Surveillance

- Airborne Surveillance

- Others

Automatic Dependent Surveillance-Broadcast (ADS-B) Market, End-Use Analysis

- OEM

- Aftermarket

Automatic Dependent Surveillance-Broadcast (ADS-B) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automatic Dependent Surveillance-Broadcast (ADS-B)?The global Automatic Dependent Surveillance-Broadcast (ADS-B) Market is expected to grow from USD 1.8 billion in 2023 to USD 4.1 billion by 2033, at a CAGR of 8.58% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automatic Dependent Surveillance-Broadcast (ADS-B) Market?Some of the key market players of the market are Garmin Ltd., Honeywell International Inc., L3Harris Technologies Inc., Thales Group, Collins Aerospace, Indra Sistemas, S.A., Nav Canada, Aireon LLC, Saab AB, and Aspen Avionics Inc.

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automatic Dependent Surveillance-Broadcast (ADS-B) market?North America dominates the Automatic Dependent Surveillance-Broadcast (ADS-B) market and has the highest market share.

Need help to buy this report?