Global Automotive Acoustic Materials Market Size, Share, and COVID-19 Impact Analysis, by Material (Polyurethane, Textile, Fiberglass, and Other Materials), Vehicle Type (Passenger Cars and Commercial Vehicles), Application (Bonnet Liner, Door Trim, and Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Acoustic Materials Market Insights Forecasts to 2033

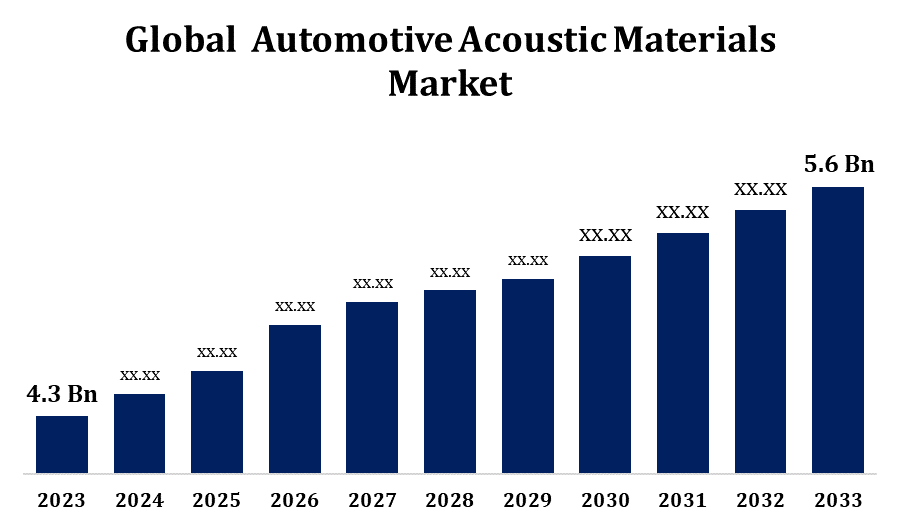

- The Automotive Acoustic Materials Market was valued at USD 4.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 2.68% from 2023 to 2033.

- The Worldwide Automotive Acoustic Materials Market Size is Expected to Reach USD 5.6 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Automotive Acoustic Materials Market is expected to reach USD 5.6 Billion by 2033, at a CAGR of 2.68% during the forecast period 2023 to 2033.

Market Overview

The automotive acoustic materials market is experiencing steady growth, driven by rising demand for quieter and more comfortable vehicles. These materials, including foams, fabrics, and barrier mats, are essential in reducing noise, vibration, and harshness (NVH) within vehicles. Stringent regulations on noise pollution and the increasing focus on enhancing in-cabin experience, especially in electric and hybrid vehicles, are fueling market expansion. Manufacturers are investing in lightweight, sustainable acoustic solutions to meet both environmental and performance standards. The market sees strong contributions from passenger vehicles, with Asia-Pacific emerging as a key growth region due to booming automotive production. Technological advancements and innovations in material science continue to reshape the landscape, making acoustic materials a critical component of modern vehicle design and manufacturing.

Automotive Acoustic Materials Market Value Chain Analysis

The value chain of the automotive acoustic materials market involves several key stages, beginning with raw material suppliers who provide polymers, foams, fibers, and composites used in sound insulation products. These materials are then processed and developed by manufacturers into various acoustic components such as insulation pads, barrier mats, and damping sheets. Component suppliers and system integrators customize these products to fit specific vehicle models, ensuring optimal performance. Original Equipment Manufacturers (OEMs) integrate these materials during vehicle assembly to meet NVH (Noise, Vibration, and Harshness) standards. The distribution network includes both direct sales and third-party distributors, delivering products to global markets. End-users, primarily automotive manufacturers and aftermarket service providers, complete the chain. Continuous R&D and collaboration among stakeholders enhance product efficiency and sustainability.

Automotive Acoustic Materials Market Opportunity Analysis

The automotive acoustic materials market presents significant opportunities driven by the rising adoption of electric and hybrid vehicles. These vehicles, while quieter, necessitate advanced acoustic solutions to mitigate alternative noise sources like electric motors and HVAC systems. Additionally, the increasing demand for lightweight, sustainable materials aligns with industry efforts to enhance fuel efficiency and reduce emissions. Innovations in bio-based and recycled acoustic materials cater to both environmental concerns and performance requirements. Furthermore, the growing emphasis on in-cabin comfort and stringent noise regulations propel the need for advanced acoustic materials. Emerging markets, particularly in Asia-Pacific, offer expansive growth prospects due to rapid automotive industry expansion and urbanization.

Global Automotive Acoustic Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4.3 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 2.68% |

| 023 – 2033 Value Projection: | USD 5.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 265 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | Material Analysis, Vehicle Type Analysis, Application Analysis, Regional Analysis |

| Companies covered:: | 3M Acoustics, BASF SE, Covestro, Freudenberg Group, Henkel Adhesive Technologies, Huntsman, Lyondellbasell, Sika, Sumitomo Riko, and Toray Industries |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Market Dynamics

Automotive Acoustic Materials Market Dynamics

Increasing Demand for High-End and Luxury Automobiles

The escalating demand for premium and luxury vehicles significantly propels the growth of the automotive acoustic materials market. Consumers in this segment prioritize superior cabin comfort and minimal noise, vibration, and harshness (NVH) levels. Manufacturers are responding by integrating advanced acoustic materials to enhance the in-cabin experience. This trend is particularly evident in regions like Europe, where the appetite for luxury vehicles continues to rise. Additionally, the shift towards electric vehicles, known for their quieter operation, underscores the need for specialized acoustic solutions to address alternative noise sources. Consequently, the synergy between the luxury vehicle market's expansion and advancements in acoustic technologies fosters substantial opportunities for growth in the automotive acoustic materials sector.

Restraints & Challenges

Fluctuating raw material prices, including acrylonitrile, ethylene, rubber, polyurethane, polypropylene, and fiberglass, pose significant cost pressures on manufacturers. Integrating advanced acoustic solutions into vehicles can be complex and require additional investments in design and manufacturing processes. Additionally, the increasing adoption of Active Noise Control (ANC) systems, which electronically reduce cabin noise, may reduce the demand for traditional acoustic materials. Environmental regulations restricting hazardous substances necessitate the development of sustainable, recyclable acoustic materials, adding to production complexities. Moreover, the high cost of advanced acoustic materials can be a barrier for price-sensitive vehicle segments, impacting widespread adoption. Addressing these challenges requires continuous innovation and strategic planning within the industry.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Automotive Acoustic Materials Market from 2023 to 2033. The growth is driven by increasing consumer demand for enhanced in-cabin comfort and stringent noise pollution regulations. The region's strong automotive industry, particularly in the United States and Canada, supports the adoption of advanced acoustic solutions. The rising popularity of electric vehicles, which require specialized noise-damping materials to address unique sound profiles, further propels market expansion. Additionally, the trend toward premium and luxury vehicles emphasizes superior acoustic performance, encouraging manufacturers to integrate high-quality soundproofing materials. Collaborations between material suppliers and automotive OEMs are fostering innovations in lightweight and sustainable acoustic materials, aligning with environmental standards and fuel efficiency goals.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The surge in electric vehicle adoption, particularly in China, necessitates advanced acoustic solutions to address unique noise profiles. Rapid urbanization and rising consumer incomes have escalated the demand for enhanced in-cabin comfort, prompting manufacturers to integrate superior acoustic materials. Furthermore, the availability of raw materials and cost-effective manufacturing processes in the region contribute to market growth. Government initiatives aimed at reducing vehicle noise pollution further bolster the adoption of these materials. Overall, Asia-Pacific's expanding automotive sector and increasing focus on vehicle comfort position it as a pivotal player in the global automotive acoustic materials market.

Segmentation Analysis

Insights by Material

The polyurethane segment accounted for the largest market share over the forecast period 2023 to 2033. Its versatility allows it to be used in various vehicle components such as seat cushions, headliners, door panels, and floor carpets, effectively reducing noise, vibration, and harshness (NVH). As automakers focus more on enhancing cabin comfort, especially in electric and hybrid vehicles, the demand for polyurethane-based materials continues to rise. The material’s lightweight nature also supports fuel efficiency and aligns with the industry’s shift toward eco-friendly solutions. Additionally, advancements in low-emission and recyclable polyurethane foams are further boosting its adoption. With a strong presence in both luxury and mass-market vehicles, polyurethane remains a key driver of innovation in automotive acoustic applications.

Insights by Vehicle

The passenger car segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is primarily due to consumers' increasing demand for quieter and more comfortable vehicle interiors. This trend is especially pronounced in premium and luxury vehicles, where superior acoustic performance is a key differentiator. The rising adoption of electric vehicles further amplifies this demand, as their inherently quieter operation necessitates advanced acoustic solutions to manage alternative noise sources like tire and wind noise. Manufacturers are responding by integrating innovative soundproofing materials to enhance the in-cabin experience. Additionally, stringent noise pollution regulations compel automakers to prioritize effective acoustic insulation in passenger cars. Collectively, these factors underscore the passenger car segment's significant contribution to the expansion and evolution of the automotive acoustic materials market.

Insights by Application

The door trim segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the escalating consumer demand for enhanced vehicle interior comfort and noise reduction. Once considered a luxury, advanced door upholstery has become standard in mid-segment vehicles, with manufacturers incorporating materials like ABS, polypropylene, and polyurethane to improve aesthetics and acoustic performance. This evolution reflects the industry's commitment to addressing noise, vibration, and harshness (NVH) levels, thereby elevating the overall driving experience. The surge in electric vehicle adoption further amplifies the need for effective door trim acoustic solutions, as the absence of engine noise in these vehicles necessitates superior insulation against other sound sources. Consequently, the door trim segment remains pivotal in advancing automotive acoustic innovation.

Recent Market Developments

- In October 2021, Sumitomo Riko, in collaboration with the National Institute of Advanced Industrial Science and Technology (AIST) in Japan, announced the completion of a joint research initiative that involved restoring a portion of the vehicle testing proving ground at AIST's Tsukuba North Site.

Competitive Landscape

Major players in the market

- 3M Acoustics

- BASF SE

- CovestroFreudenberg Group

- Henkel Adhesive Technologies

- Huntsman

- Lyondellbasell

- Sika

- Sumitomo Riko

- Toray Industries

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Acoustic Materials Market, Material Analysis

- Polyurethane

- Textile

- Fiberglass

- Other Materials

Automotive Acoustic Materials Market, Vehicle Type Analysis

- Passenger Cars

- Commercial Vehicles

Automotive Acoustic Materials Market, Application Analysis

- Bonnet Liner

- Door Trim

- Other Applications

Automotive Acoustic Materials Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Acoustic Materials Market?The global Automotive Acoustic Materials Market is expected to grow from USD 4.3 billion in 2023 to USD 5.6 billion by 2033, at a CAGR of 2.68% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Acoustic Materials Market?Some of the key market players of the market are 3M Acoustics, BASF SE, Covestro, Freudenberg Group, Henkel Adhesive Technologies, Huntsman, Lyondellbasell, Sika, Sumitomo Riko, and Toray Industries.

-

3. Which segment holds the largest market share?The passenger cars segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?