Global Automotive Airbags Market Size By Position (Frontal, Side, Side Curtain, Knee), By Fabric (Coated, Non-coated), By Vehicle (Passenger Vehicles, Commercial Vehicles), By Distribution Channel (OEM, Aftermarket), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 - 2030

Industry: Automotive & TransportationThe Global Automotive Airbags Market Size was valued at USD 59.5 billion in 2021 and is expected to reach at a CAGR of 5.1% from 2021 to 2030. The market will grow as more people use airbags and as new designs and technologies for airbags are developed. The market for automotive airbags is being driven by a number of advancements in vehicle passive safety systems as well as increased desire for safer, more effective, and convenient driving experiences. The market has grown as a result of ongoing efforts made by top companies to provide cutting-edge airbag and seatbelt technologies.

Get more details on this report -

The global automotive airbags market is predicted to be driven by government initiatives such as the funding of numerous projects to improve passenger safety. For instance, automakers collaborate to coordinate bids for EU-funded research through the European Council for Automotive R&D, or EUCAR. In order to provide better safety technologies for autos, the European Commission financed the airbag valve technology, including customised safety airbags (I-Valve) project in 2017. In accordance with vehicle speed, passenger height and position, and the point of impact, the valve modulates the intensity of airbag deployment.

Driving Factors

Global population growth and increased transportation activity are both predicted to increase demand for autos. Real disposable income and the gross domestic product (GDP) have been greatly boosted by the steadily rising employment, corporate investment, and industrial productivity. The sale of passenger cars and commercial vehicles for the movement of people and commodities has increased due to the rise in per capita income and expanding industrialisation.

Leading businesses' ongoing efforts to roll out cutting-edge airbag and seatbelt innovations have contributed to market expansion. Original Equipment Manufacturers (OEMs) and suppliers have been working to develop cutting-edge products over the past few years. Many of them have had moderate success differentiating their products from those of their rivals. Additionally, they can be put into action as soon as 40 milliseconds after a crash. Another factor boosting market expansion is the installation of strict rules by governments around the world to promote road safety.

Increased consumer awareness of the value of installing passive safety equipment, like as airbags and seatbelts, is also expected to support market growth. To ensure increased road safety, governments, particularly in developing nations like China and India, often change existing laws and enact new ones.

Restraining Factors

The expansion of the market may be hampered by factors including the creation of counterfeit goods, which constitute a serious danger to the sales, revenues, and brand reputation of important companies.

Consumer safety awareness, disposable income, and the number of traffic accidents have all steadily increased. This fuels the demand for automobile airbags worldwide. High maintenance and operating costs, high replacement costs, and fluctuations in component pricing are all restraining the growth of the global automotive airbags market. This is particularly true of the market for automotive airbags. The worldwide automotive airbags market, however, is experiencing profitable growth due to the expansion of the automobile sector and strict regulatory rules for passenger safety.

Covid 19 Impact

The automotive industry has been severely disrupted by the COVID-19 epidemic. A decrease in sales volume and the suspension of manufacturing facilities are the results. In 2020, a fall in the market for both commercial and passenger automobiles is anticipated. Given that car production is directly correlated with the automotive airbags industry, this anticipated drop will be detrimental to the automotive airbags market. The development of automotive airbags will be hampered by a likely reduction in the R&D funding.

Global Automotive Airbags Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 59.5 billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 5.1% |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Position, By Fabric, By Vehicle, By Distribution Channel, By Region, |

| Companies covered:: | ZF Friedrichshafen AG, Aptiv PLC, Autoliv Inc, Robert Bosch, Takata Corporation, DENSO Corporation, Continental AG, Ningbo Joyson Electronic Corp, Hyundai Mobis, Toshiba Corporation |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation

The global automotive airbags market is segmented into Position, Fabric, Vehicle, Distribution Channel, and Region.

Global Automotive Airbags Market, By Position

The global adoption of frontal airbag systems for driver safety by regulatory authorities is expected to fuel the predicted 5.5% growth of the frontal automobile airbags market through 2026. In addition, automakers are introducing car models with dual front airbags, which protect the driver and front-seat passenger.

Global Automotive Airbags Market, By Fabric

Due to the system's improved thermal characteristics, the coated fabric airbag segment holds the majority of the market share. When an accident occurs, the airbags inflate with a much larger volume of air to provide more protection. Passengers may be at greater danger of burning as a result of this circumstance. Additionally, the airbag fabric must be able to endure this heat without tearing. Due to their strong thermal resistance capabilities, thin coatings made of silicone and neoprene will shield fabric from heat.

Global Automotive Airbags Market, By Vehicle

Due to the fact that airbags are now a standard installation in the majority of passenger vehicles, the passenger vehicle segment generated about USD 49 million in income. The adoption of passenger vehicles is being supported by rising disposable income and the availability of simpler financing options. The performance of vehicle safety has been improved by a number of initiatives by the vehicle makers. Dual airbags are a typical feature in the latest vehicle models offered by the manufacturers.

Global Automotive Airbags Market, By Distribution Channel

The dominance of the OEMs in the global market share is due to expanding vehicle production and awareness of vehicle safety. To raise the safety ratings of new vehicle models, the automakers are implementing a number of airbag systems, including frontal, side curtain, and knee airbags. Additionally, airbag systems that deploy more quickly in collisions at high speeds are being developed by industry players. Investment in R&D to create new airbag technologies, including exterior airbags, will open up further chances to increase safety performance and their revenue share.

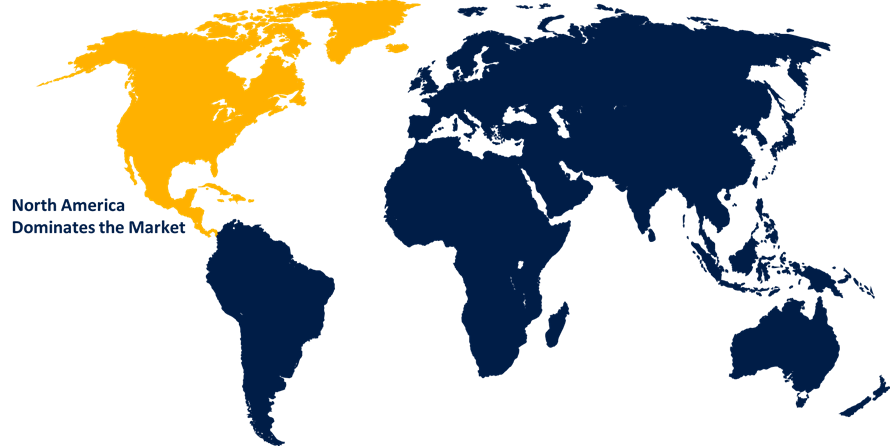

Global Automotive Airbags Market, By Region

Due to strict vehicle safety standards established by transportation authorities throughout the globe, North America accounted for over 18% of revenue in the automotive airbags market in 2019. Since September 1998, it has been required in the United States for passenger cars and light commercial vehicles to have airbags. In addition, the NHTSA has established severe crash tests, such as the Oblique Moving Deformable Barrier (OMDB), which automakers must pass in order to get a 5-star safety certification.

Get more details on this report -

The development of a new airbag module in the region, combined with government-funded safety initiatives, is expected to drive the Europe market to demonstrate significant growth during the projected period. Additionally, because of the growing need for airbags and the increase in car sales, manufacturers of airbag raw materials are investing in the area to build manufacturing facilities.

Recent Developments in Global Automotive Airbags Market

- January 2021: Location controllers were developed by Aptiv PLC, a global technology business that enables the future of mobility. They transport high-speed and dynamic data between sensors and components while separating input/output (I / O) from a car's computer.

- December 2021: The purchase of the Hyundai Autron sector of the conductor has been authorised, according to a statement from Hyundai Mobis' board of directors. Hyundai Mobis and Hyundai Autron executed a transfer agreement for all workers and associated assets after getting the permit. The purchase price was $122 million (KRW 133.2 billion). Hyundai Mobis hopes to broaden its integrated control technology and advance the design, development, and validation of automotive operators with this acquisition.

List of Key Market Players

- ZF Friedrichshafen AG

- Aptiv PLC

- Autoliv Inc

- Robert Bosch

- Takata Corporation

- DENSO Corporation

- Continental AG

- Ningbo Joyson Electronic Corp

- Hyundai Mobis

- Toshiba Corporation

Segmentation

By Position

- Frontal

- Side

- Side curtain

- Knee

By Fabric

- Coated

- Non-Coated

By Vehicle

- Passenger vehicles

- Commercial vehicles

By Distribution Channel

- OEM

- Aftermarket

By Region

North America

- North America, by Country

- U.S.

- Canada

- Mexico

- North America, by Position

- North America, by Fabric

- North America, by Vehicle

- North America, by Distribution Channel

Europe

- Europe, by Country

- Germany

- Russia

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Rest of Europe

- Europe, by Position

- Europe, by Fabric

- Europe, by Vehicle

- Europe, by Distribution Channel

Asia Pacific

- Asia Pacific, by Country

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Rest of Asia Pacific

- Asia Pacific, by Position

- Asia Pacific, by Fabric

- Asia Pacific, by Vehicle

- Asia Pacific, by Distribution Channel

Middle East & Africa

- Middle East & Africa, by Country

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

- Middle East & Africa, by Position

- Middle East & Africa, by Fabric

- Middle East & Africa, by Vehicle

- Middle East & Africa, by Distribution Channel

South America

- South America, by Country

- Brazil

- Argentina

- Colombia

- Rest of South America

- South America, by Position

- South America, by Fabric

- South America, by Vehicle

- South America, by Distribution Channel

Need help to buy this report?