Global Automotive Aluminum Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Car, LCV, HCV), By Product Type (Cast Aluminum, Rolled Aluminum, Extruded Aluminum), By Application (Powertrain, Chassis & Suspension, Car Body), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Automotive Aluminum Market Insights Forecasts to 2033

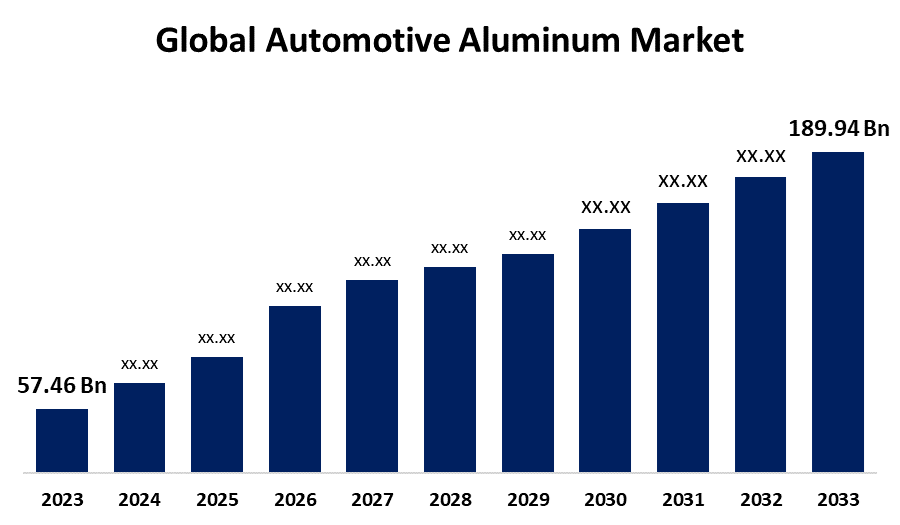

- The Global Automotive Aluminum Market Size was Valued at USD 57.46 Billion in 2023

- The Market Size is Growing at a CAGR of 12.70% from 2023 to 2033

- The Worldwide Automotive Aluminum Market Size is Expected to Reach USD 189.94 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Aluminum Market Size is Anticipated to Exceed USD 189.94 Billion by 2033, Growing at a CAGR of 12.70% from 2023 to 2033.

Market Overview

Aluminum is the most common metal used in automobiles and trucks. It provides better safety and durability along with better fuel efficiency and fewer emissions. Compared to steel, aluminum is much lighter, has a high tensile strength, and is simple to mold. Aluminum is a metal that is widely used in a variety of sectors due to these advantages. Aluminum is quite affordable, so the automotive industry uses a lot of aluminum. Aluminum's greater fuel efficiency is an additional explanation for why it's widely used in auto building. Automobile manufacturers chose aluminum as a sustainable material due to it is easily recyclable. Due to its many advantages, including its high strength, lightweight, ability to be recycled, corrosion resistance, and electrical and thermal conductivity, aluminum is mostly used in the automobile sector. Growing environmental concerns, the need for lightweight materials in the automotive industry, and strict regulatory rules are significant factors driving the increase in market growth. The expansion of the automotive industry is one of the primary drivers of the market's growth, as aluminum's use in both passenger and commercial vehicles has raised demand for the metal.

Report Coverage

This research report categorizes the market for the global automotive aluminum market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive aluminum market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive aluminum market.

Global Automotive Aluminum Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 57.46 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 12.70% |

| 2033 Value Projection: | USD 189.94 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Vehicle Type, By Product Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Aluminum Corporation, BHP Billiton, Alcoa Corporation, UACJ Corporation, Norsk Hydro ASA, Constellium, Rio Tinto Group, Aleris Corporation, Autoneum Holding AG, Dana Limited, ElringKlinger AG, Progress-Werk Oberkirch AG, Kaiser Aluminum, Lorin Industries, and Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid increase in automobile sales and production is driving the growth of the automotive aluminum market. Aluminum is a highly sought-after component for automobiles due to the significant expansion of the number of individuals owning private vehicles, especially in developing nations. The fast-rising demand for electric vehicles and the incorporation of cutting-edge technologies that will provide comfort and safety will be driving the growth of the automotive aluminum market over the projected timeframe. Its broad application is also anticipated to contribute to the overall market expansion because of its qualities, which include high strength, corrosion resistance, recycling, and electrical and thermal conductivity.

Restraining Factors

The price fluctuation of aluminum and its high cost in comparison to steel restrict the growth of the automotive aluminum market. Thus, it is anticipated that more lightweight materials like magnesium and reinforced plastic will damage the industry more significantly. It is expected that rising production costs will hinder the growth of the automotive aluminum market.

Market Segmentation

The global automotive aluminum market share is classified into vehicle type, product type, and application.

- The passenger cars segment is expected to hold the largest share of the global automotive aluminum market during the forecast period.

Based on the vehicle type, the global automotive aluminum market is divided into passenger cars, LCV, and HCV. Among these, the passenger cars segment is expected to hold the largest share of the global automotive aluminum market during the forecast period. The passenger car is the product of the market growing desire for lightweight, fuel-efficient automobiles. The need for lighter products like passenger cars has increased as a result of higher CO2 emission rules being implemented in nations across the globe. All of these variables have a beneficial effect on the growth of the automotive aluminum market.

- The cast aluminum segment is expected to hold the largest share of the global automotive aluminum market during the forecast period.

Based on the product type, the global automotive aluminum market is divided into cast aluminum, rolled aluminum, and extruded aluminum. Among these, the cast aluminum segment is expected to hold the largest share of the global automotive aluminum market during the forecast period. Compared to other types of aluminum, the cast aluminum segment contributes the most to the automotive aluminum market. An extremely high temperature is applied to a particular kind of aluminum called cast aluminum, which is then molded into the desired shape and allowed to cool to create a broad variety of products. It is used in the automotive sector to create a range of car models and shapes.

- The chassis & suspension segment is expected to hold the largest share of the global automotive aluminum market during the forecast period.

Based on the application, the global automotive aluminum market is divided into powertrain, chassis & suspension, and car body. Among these, the chassis & suspension segment is expected to hold the largest share of the global automotive aluminum market during the forecast period. One of the most important components of an automobile is its chassis. The chassis provides the strength to sustain various vehicle components while maintaining the vehicle's rigidity. Moreover, it ensures little vibrations and noise, minimizing the harshness of the car. The chassis is made of aluminum, which contributes to its durability and lightweight.

Regional Segment Analysis of the Global Automotive Aluminum Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global automotive aluminum market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global automotive aluminum market over the predicted timeframe. North America is anticipated to hold a dominant position in the automobile aluminum market. This is partly because yield strength criteria have been strictly enforced. By improving fuel efficiency in cars, vans, light trucks, and heavy trucks, the U.S. established the CAFÉ Standards to lower energy usage. Due to this, the market in the region has grown more quickly. Growing discretionary money in the region and encouraging government activities, particularly in the region's economic engines, are primarily responsible for growth.

Asia Pacific is expected to grow at the fastest pace in the global automotive aluminum market during the forecast period. With the growing demand for luxury cars in the Asia-Pacific region due to the availability of discretionary cash, the market for automotive aluminum has been growing steadily. The primary drivers of growth in the regional car manufacturing sector are the rising investments in the industry as well as the rising demand for automobiles in nations like China and India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive aluminum market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aluminum Corporation

- BHP Billiton

- Alcoa Corporation

- UACJ Corporation

- Norsk Hydro ASA

- Constellium

- Rio Tinto Group

- Aleris Corporation

- Autoneum Holding AG

- Dana Limited

- ElringKlinger AG

- Progress-Werk Oberkirch AG

- Kaiser Aluminum

- Lorin Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, The Woodside Energy Group Limited (Woodside) and BHP Group (BHP) were pleased to announce that the successful completion of the merging of their petroleum and energy portfolios in 2022 was achieved through the utilization of an all-stock acquisition (merging).

- In March 2022, Chalco, also known as Aluminum Corp. of China Ltd., announced that in 2021, its net income climbed by 564.6%, which was a record high for the company in the previous 14 years. This was made possible, largely, by rising alumina and aluminum prices along with higher output.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive aluminum market based on the below-mentioned segments:

Global Automotive Aluminum Market, By Vehicle Type

- Passenger Car

- LCV

- HCV

Global Automotive Aluminum Market, By Product Type

- Cast Aluminum

- Rolled Aluminum

- Extruded Aluminum

Global Automotive Aluminum Market, By Application

- Powertrain

- Chassis & Suspension

- Car Body

Global Automotive Aluminum Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Aluminum Corporation, BHP Billiton, Alcoa Corporation, UACJ Corporation, Norsk Hydro ASA, Constellium, Rio Tinto Group, Aleris Corporation, Autoneum Holding AG, Dana Limited, ElringKlinger AG, Progress-Werk Oberkirch AG, Kaiser Aluminum, Lorin Industries, and Others.

-

2. What is the size of the global automotive aluminum market?The global automotive aluminum market is expected to grow from USD 57.46 Billion in 2023 to USD 189.94 Billion by 2033, at a CAGR of 12.70% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global automotive aluminum market over the predicted timeframe.

Need help to buy this report?