Global Automotive Anti-Lock Braking System Market Size, Share, and COVID-19 Impact Analysis, By Sub-System Type (Electronic Control Unit, Speed Sensors, Hydraulic Unit, and Others), By Vehicle Type (Passenger Cars, Two-Wheeler, Commercial Vehicles, and Others), By Distribution Channel (OEMs, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Automotive Anti-Lock Braking System Market Insights Forecasts to 2033

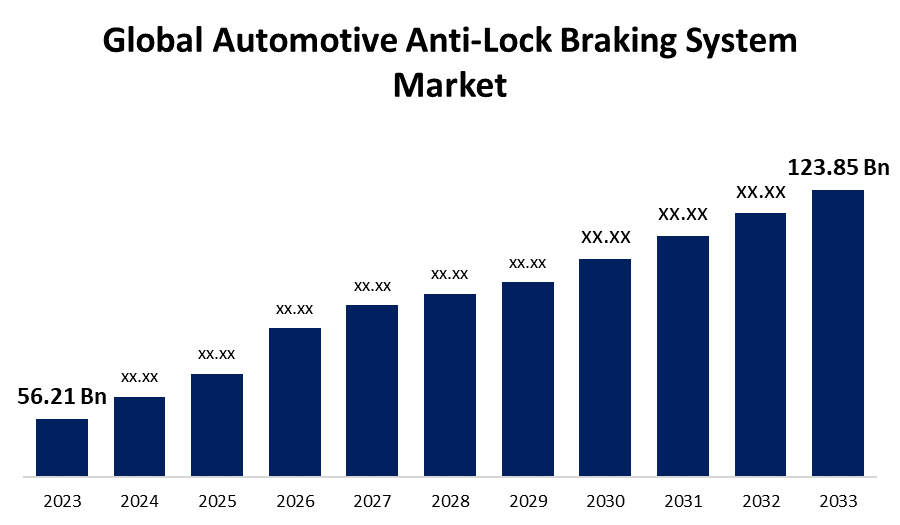

- The Global Automotive Anti-Lock Braking System Market Size was Valued at USD 56.21 Billion in 2023

- The Market Size is Growing at a CAGR of 8.22% from 2023 to 2033

- The Worldwide Automotive Anti-Lock Braking System Market Size is Expected to Reach USD 123.85 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Anti-Lock Braking System Market Size is Anticipated to Exceed USD 123.85 Billion by 2033, Growing at a CAGR of 8.22% from 2023 to 2033.

Market Overview

The anti-lock braking system (ABS) is an advanced active braking system used in automobiles to assist drivers in maintaining control of their vehicles. It permits a vehicle's wheels to maintain dynamic contact with the road surface in response to the driver's braking inputs. It enhances vehicle control and decreases the likelihood of an accident on both dry and slick roads. Automobile manufacturers have equipped their vehicles with anti-lock braking systems (ABS), traction control systems (TCS), electronic brake force distribution (EBD), and electronic stability control (ESC) to provide improved safety features and improve stability, control, and safety over rough terrain. In addition, ABS prevents wheel lock-up, allowing the driver to maintain steering control even under hard braking or on slick roads. It also reduces the chance of skidding and lets the driver safely navigate the vehicle around obstacles and other vehicles. Furthermore, the automotive anti-lock braking system has made travel safer than previously, resulting in a rise in consumer acceptance of ABS-equipped vehicles. The increasing demand for such safety features in automobiles is projected to boost the automotive anti-lock braking system market.

Report Coverage

This research report categorizes the market for the global automotive anti-lock braking system market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive anti-lock braking system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive anti-lock braking system market.

Global Automotive Anti-Lock Braking System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 56.21 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.22% |

| 023 – 2033 Value Projection: | USD 123.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Sub-System Type, By Vehicle Type, By Distribution Channel, By Region |

| Companies covered:: | TRW Automotive, Robert Bosch GMBH, Hyundai Mobis, Denso Corporation, Delphi Automotive Plc, ADVICS Co., Ltd., Autoliv Inc., Aisin Seiki Co., Ltd., Continental Ag, Hitachi Automotive Systems, Ltd., Haldex AB, Nissin Kogyo Co., Jiaozuo, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the key drivers of the ABS industry is the implementation of regulatory standards and safety regulations by governments and regulatory agencies around the world. Recognizing the potential of automotive anti-lock braking systems to improve road safety and avoid accidents, many countries have mandated that vehicles be equipped with this technology. Additionally, in response to the rise in the frequency of fatal road accidents, governments around the world have enacted legislation requiring the installation of car safety features. Countries such as India and France are enacting laws and regulations to enable safety technologies such as anti-lock braking and electronic stability control in their automobiles within a set timeframe. For instance, the Indian government has mandated the installation of safety measures such as automated braking and advanced driving systems in automobiles operating in the country. Furthermore, the automotive industry is primarily driven by increased disposable income, urbanization, improved road infrastructure, and shifting consumer tastes. Furthermore, as more people choose personal vehicles, the demand for safer and more advanced braking systems like ABS is increasing, driving the global automotive anti-lock braking system market growth.

Restraining Factors

The high expenses of installing and maintaining anti-lock braking systems in autos, as well as the variability of raw material prices, are expected to hinder revenue development. The global automotive anti-lock braking system market will be further challenged by the presence of counterfeit parts and their low cost in comparison to genuine manufacturer's parts.

Market Segmentation

The global automotive anti-lock braking system market share is classified into sub-system type, vehicle type, and distribution channel.

- The electronic control units segment is expected to hold the largest share of the global automotive anti-lock braking system market during the forecast period.

Based on the sub-system type, the global automotive anti-lock braking system market is divided into electronic control units, speed sensors, hydraulic units, and others. Among these, the electronic control units segment is expected to hold the largest share of the global automotive anti-lock braking system market during the forecast period. Electronic control units (ECUs) are complex electronic components that collect data from wheel speed sensors and other relevant inputs to predict wheel lock-up and initiate corrective steps such as adjusting brake pressure to prevent skidding. The electronic control unit segment expansion is driven by advanced characteristics such as easy connection, rapid data processing, and efficient ABS functioning in the global automotive anti-lock braking system market.

- The passenger car segment is expected to grow at the fastest CAGR in the global automotive anti-lock braking system market during the forecast period.

Based on the vehicle type, the global automotive anti-lock braking system market is divided into passenger cars, two-wheelers, commercial vehicles, and others. Among these, the passenger car segment is expected to grow at the fastest CAGR in the global automotive anti-lock braking system market during the forecast period. The rising use of passenger vehicles, the rise in the frequency of road accidents, and the implementation of government regulations mandating automobiles to have anti-lock braking systems all contribute to the passenger car segment's growth in the global automotive anti-lock braking system market.

- The OEMs segment is expected to grow at the fastest CAGR in the global automotive anti-lock braking system market during the forecast period.

Based on the distribution channel, the global automotive anti-lock braking system market is divided into OEMs and aftermarket. Among these, the OEMs segment is expected to grow at the fastest CAGR in the global automotive anti-lock braking system market during the forecast period. OEMs refer to installing automotive anti-lock braking systems in vehicles during the production process. Because ABS is acknowledged as a basic safety feature, OEMs are adding it to a variety of vehicles, including passenger cars, commercial vehicles, and motorcycles, driving the OEM segment growth in the global automotive anti-lock braking system market.

Regional Segment Analysis of the Global Automotive Anti-Lock Braking System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global automotive anti-lock braking system market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global automotive anti-lock braking system market over the predicted timeframe. This is due to the strong automotive sector, increased vehicle production, and a growing emphasis on vehicle safety, which are all contributing to market growth. Furthermore, countries such as China, Japan, India, and South Korea are experiencing significant expansion in their automotive sectors, which is increasing demand for automotive anti-lock braking systems. Furthermore, rapid urbanization, rising disposable income, and an expanding middle-class population have resulted in an increase in vehicle ownership, and the growing demand for improved safety features such as automotive anti-lock braking systems is another important growth driver of the automotive anti-lock braking system market in the Asia Pacific area.

Europe is expected to grow at the fastest pace in the global automotive anti-lock braking system market during the forecast period. European countries, notably Germany, France, and the United Kingdom have a large automotive presence and are known for their severe safety requirements, and the early adoption of automotive anti-lock braking system technology contributes to its significant growth in the automotive anti-lock braking system market. Furthermore, in Europe, automotive anti-lock braking system incorporation in vehicles was widespread, stressing sophisticated safety characteristics. automotive anti-lock braking system evolved to support hybrid and electric automobiles. Due to these factors, the automotive anti-lock braking systems market in Europe is expanding rapidly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive anti-lock braking system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TRW Automotive

- Robert Bosch GMBH

- Hyundai Mobis

- Denso Corporation

- Delphi Automotive Plc

- ADVICS Co., Ltd.

- Autoliv Inc.

- Aisin Seiki Co., Ltd.

- Continental Ag

- Hitachi Automotive Systems, Ltd.

- Haldex AB

- Nissin Kogyo Co.

- Jiaozuo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, the production of anti-lock braking systems (ABS) and electronic stability control systems (ESP) for passenger cars commenced at the Itelma LLC facility in Kostroma, and making it the first such facility in Russia. The regional administration's press service informed Interfax about this development.

- In November 2022, Continental AG, an automotive manufacturing business specializing in brake systems, tires, and automotive safety systems, has created a new, fully integrated 2-channel ABS generation that reduces costs and installation space while simplifying OEM production.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive anti-lock braking system market based on the below-mentioned segments:

Global Automotive Anti-Lock Braking System Market, By Sub-System Type

- Electronic Control Unit

- Speed Sensors

- Hydraulic Unit

- Others

Global Automotive Anti-Lock Braking System Market, By Vehicle Type

- Passenger Cars

- Two-Wheeler

- Commercial Vehicles

- Others

Global Automotive Anti-Lock Braking System Market, By Distribution Channel

- OEMs

- Aftermarket

Global Automotive Anti-Lock Braking System Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.Which are the key companies that are currently operating within the market?TRW Automotive, Robert Bosch GMBH, Hyundai Mobis, Denso Corporation, Delphi Automotive Plc, ADVICS Co., Ltd., Autoliv Inc., Aisin Seiki Co., Ltd., Continental Ag, Hitachi Automotive Systems, Ltd., Haldex AB, Nissin Kogyo Co., Jiaozuo, and Others.

-

2.What is the size of the global automotive anti-lock braking system market?The Global Automotive Anti-Lock Braking System Market is expected to grow from USD 56.21 Billion in 2023 to USD 123.85 Billion by 2033, at a CAGR of 8.22% during the forecast period 2023-2033.

-

3.Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global automotive anti-lock braking system market over the predicted timeframe.

Need help to buy this report?