Global Automotive Bushing Market Size, Share, and COVID-19 Impact Analysis, By Application (Suspension, Engine, Chassis, Interior, Exhaust, Transmission), By End-use (Passenger Cars, Commercial Vehicles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Automotive Bushing Market Insights Forecasts to 2033

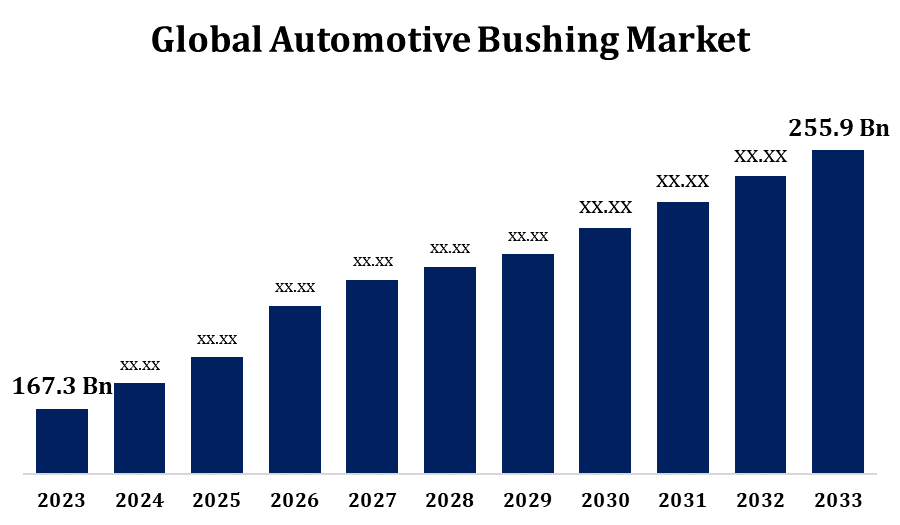

- The Automotive Bushing Market Size Was Valued at USD 167.3 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.34% from 2023 to 2033.

- The Global Automotive Bushing Market Size is Expected to reach USD 255.9 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global Automotive Bushing Market Size is Expected to reach USD 255.9 Billion by 2033, at a CAGR of 4.34% during the Forecast period 2023 to 2033.

The automotive bushing market is a vital segment of the auto components industry, driven by the growing demand for enhanced vehicle comfort, safety, and performance. Bushings, which are vibration isolators, play a crucial role in minimizing noise, road shock, and vibrations, thereby improving the overall driving experience. The market is witnessing growth due to increasing vehicle production, rising adoption of electric vehicles, and advancements in suspension systems. OEMs are focusing on durable and lightweight bushing materials, such as polyurethane and rubber-metal combinations, to meet evolving performance standards. Asia-Pacific dominates the market owing to large-scale automobile manufacturing in countries like China and India. Meanwhile, North America and Europe show steady growth supported by technological innovation and the presence of key automotive manufacturers.

Automotive Bushing Market Value Chain Analysis

The automotive bushing market value chain comprises several interconnected stages, starting with raw material suppliers providing rubber, polyurethane, and metal components. These materials are processed by manufacturers who design and produce various types of bushings, such as suspension and engine mounts. The next stage involves OEMs (original equipment manufacturers) integrating bushings into vehicle assemblies during production. Tier 1 and Tier 2 suppliers play a crucial role in delivering customized solutions to automakers. Aftermarket players also contribute by offering replacement bushings for vehicle maintenance and repair. Distributors and retailers form the final link, ensuring product availability to end-users. Throughout the chain, quality control, cost efficiency, and innovation are emphasized. Technological advancements and strategic collaborations enhance the value chain, ensuring a steady supply of high-performance bushing solutions worldwide.

Automotive Bushing Market Opportunity Analysis

The automotive bushing market presents significant growth opportunities driven by technological advancements and evolving consumer demands. Innovations in active suspension systems and the integration of lightweight, sustainable materials like aluminum and bio-based polymers are enhancing vehicle performance and fuel efficiency. The rising adoption of electric vehicles (EVs) necessitates specialized bushings to accommodate unique weight distributions and performance characteristics. Additionally, increasing consumer expectations for comfort and safety are propelling the demand for high-quality bushings that reduce noise, vibration, and harshness (NVH). Government regulations promoting lightweight and zero-emission vehicles further bolster market growth. Asia-Pacific, particularly countries like China and India, dominates the market due to robust automotive manufacturing and supportive initiatives like India's 'Make in India' program. Overall, the market is poised for expansion, offering lucrative opportunities for manufacturers and suppliers worldwide.

Global Automotive Bushing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 167.3 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.34% |

| 2033 Value Projection: | USD 255.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Application, By End-use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Federal-Mogul LLC (U.S.), Continental AG (Germany), BOGE Rubbers & Plastics (Damme), Cooper-Standard Holdings Inc. (U.S.), Hyundai Polytech (India), and Nolathane (U.S.), Paulstra SNC (France), SumiRiko AVS Germany GmbH (Germany), Tenneco Inc. (U.S.), Vibracoustic GmbH (Germany) and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Bushing Market Dynamics

Rising Demand for Lightweight Vehicles to Drive Market Expansion

The rising demand for lightweight vehicles is a key factor driving the expansion of the automotive bushing market. As automakers strive to improve fuel efficiency and reduce emissions, they are increasingly adopting lightweight materials in vehicle design. This shift boosts the demand for compatible lightweight bushings that can maintain strength while reducing overall vehicle weight. Advanced bushing materials like polyurethane and rubber-metal composites are gaining popularity due to their durability and performance under reduced weight conditions. Additionally, the surge in electric vehicle production where weight optimization is critical to battery performance is further accelerating market growth. OEMs and suppliers are focusing on developing high-performance bushings tailored for lighter vehicles, supporting both environmental goals and regulatory compliance. This trend is expected to create significant opportunities across global automotive markets.

Restraints & Challenges

The automotive bushing market faces several challenges that could impact its growth trajectory. Fluctuating prices of raw materials like rubber and polyurethane can significantly affect production costs and profit margins. Additionally, the increasing complexity of automotive systems, including the integration of advanced driver assistance systems (ADAS) and autonomous technologies, necessitates the development of specialized bushings, requiring substantial investment in research and development. Compliance with stringent environmental and safety regulations further adds to manufacturing complexities. Moreover, the lack of standardization in bushing specifications across different vehicle models complicates production processes and increases costs.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Bushing Market from 2023 to 2033. The United States plays a key role in this expansion due to its well-established automotive industry and growing consumer preference for SUVs and pickup trucks, which require heavy-duty suspension systems and durable bushings. The region also benefits from a strong aftermarket sector, where aging vehicles and frequent maintenance drive the demand for replacement bushings. Additionally, the increasing adoption of electric vehicles (EVs) is creating new requirements for bushings that can handle unique weight distribution and minimize vibrations. Manufacturers in North America are investing in advanced materials and innovative designs to meet evolving regulatory and performance standards. Overall, technological innovation and a mature automotive ecosystem are supporting market growth in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, Japan, India, and South Korea are at the forefront, with China being the largest automotive market globally. The increasing production of vehicles, especially in the passenger and light commercial segments, is fueling the demand for advanced bushing solutions. Moreover, the rising adoption of electric vehicles (EVs) necessitates specialized bushings to accommodate unique weight distributions and performance characteristics. Technological advancements and a focus on vehicle comfort and safety are further propelling market expansion. Additionally, supportive government policies and initiatives promoting automotive industry growth in countries like India and China are contributing to the market's positive outlook.

Segmentation Analysis

Insights by Application

The suspension segment accounted for the largest market share over the forecast period 2023 to 2033. This growth is fueled by increasing consumer demand for improved ride comfort, handling, and vehicle stability. Suspension bushings play a crucial role in absorbing shocks and reducing vibrations between suspension components, enhancing overall driving experience. The rise in luxury and electric vehicles, which require advanced suspension systems to manage unique weight distributions and performance characteristics, further boosts demand for high-quality bushings. Additionally, technological advancements, such as active suspension systems, necessitate specialized bushings with enhanced durability and performance. Manufacturers are focusing on developing bushings with innovative materials and designs to meet these evolving requirements, ensuring the suspension segment's continued growth in the automotive bushing market.

Insights by End Use

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is due to the increasing consumer demand for enhanced vehicle comfort, safety, and performance. Bushings, essential components in suspension systems, play a crucial role in reducing noise, vibration, and harshness (NVH), thereby improving ride quality. As consumers increasingly prioritize comfort, the demand for high-quality bushings in passenger vehicles rises. Additionally, the global shift towards luxury and premium vehicles, which often feature advanced suspension systems, further drives the need for sophisticated bushing solutions. This trend underscores the importance of bushings in meeting modern consumer expectations for a smooth and comfortable driving experience.

Recent Market Developments

- In February 2023, Vibracoustic, a prominent automotive component manufacturer, has optimized its new chassis bushings for battery-electric vehicles.

Competitive Landscape

Major players in the market

- Federal-Mogul LLC (U.S.)

- Continental AG (Germany)

- BOGE Rubbers & Plastics (Damme)

- Cooper-Standard Holdings Inc. (U.S.)

- Hyundai Polytech (India), and Nolathane (U.S.)

- Paulstra SNC (France)

- SumiRiko AVS Germany GmbH (Germany)

- Tenneco Inc. (U.S.)

- Vibracoustic GmbH (Germany)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Bushing Market, Application Analysis

- Suspension

- Engine

- Chassis

- Interior

- Exhaust

- Transmission

Automotive Bushing Market, End Use Analysis

- Passenger Cars

- Commercial Vehicles

Automotive Bushing Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Bushing Market?The global Automotive Bushing Market is expected to grow from USD 167.3 billion in 2023 to USD 255.9 billion by 2033, at a CAGR of 4.34% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Bushing Market?Some of the key market players of the market are Federal-Mogul LLC (U.S.), Continental AG (Germany), BOGE Rubbers & Plastics (Damme), and Cooper-Standard Holdings Inc. (U.S.). Hyundai Polytech (India), and Nolathane (U.S.). Paulstra SNC (France), SumiRiko AVS Germany GmbH (Germany), Tenneco Inc. (U.S.), and Vibracoustic GmbH (Germany).

-

3. Which segment holds the largest market share?The passenger cars segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?