Global Automotive Carbon Fiber Composites Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Car and Commercial Vehicle), By Application (Structural Assembly, Powertrain Components, Interiors, and Exteriors), By Production Type (Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Injection Molding, and Compression Molding), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Automotive Carbon Fiber Composites Market Insights Forecasts to 2033

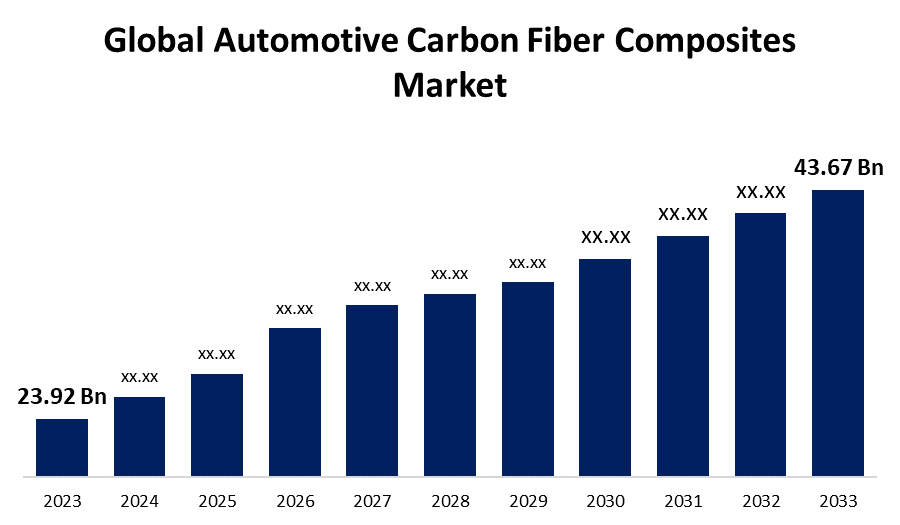

- The Global Automotive Carbon Fiber Composites Market Size was Valued at USD 23.92 Billion in 2023

- The Market Size is Growing at a CAGR of 6.20% from 2023 to 2033

- The Worldwide Automotive Carbon Fiber Composites Market Size is Expected to Reach USD 43.67 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Carbon Fiber Composites Market Size is Anticipated to Exceed USD 43.67 Billion by 2033, Growing at a CAGR of 6.20% from 2023 to 2033.

Market Overview

Carbon fiber, or carbon fiber reinforced polymer (CFRP), is a composite material made from interwoven carbon fibers and reinforced with resin or polymer. This combination results in a remarkably lightweight material, up to five times lighter than steel, while maintaining an impressive strength-to-weight ratio. Automotive carbon fiber composites enhance fuel efficiency and vehicle performance. Due to its design flexibility, carbon fiber can be molded into complex shapes and is beneficial for creating aerodynamic body panels and other intricate design features. Automotive carbon fiber composites improve vehicle performance, efficiency, and manufacturing technology.

The use of automotive carbon fiber composites includes roofs, body panels, and other add-on parts. Initially found in racing cars, it has transitioned into mass production due to its superior properties such as high rigidity, impact energy absorption, low weight, and resistance to corrosion and thermal expansion. Carbon fiber is produced through an intricate process with thermosetting plastics hardened under high pressure and temperature. Although the manufacturing process is currently labor-intensive and costly, ongoing advancements and increased production scales can reduce costs in the future.

Report Coverage

This research report categorizes the market for the global automotive carbon fiber composites based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive carbon fiber composites market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive carbon fiber composites market.

Automotive Carbon Fiber Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 23.92 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.20% |

| 2033 Value Projection: | USD 43.67 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 243 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By Application, By Production Type, By Region |

| Companies covered:: | Toray Industries Inc., Hexcel Corporation, SGL Carbon SE, Teijin Limited, Cytec Industries, ACP Composites Inc., Clearwater Composites LLC, Owens Corning, HITCO Carbon Composites Inc., Mitsubishi Rayon Carbon Fiber and Composites Inc., Polar Manufacturing Limited, Rock West Composites, DowAksa Advanced Composites Holdings BV, Formosa Plastics Corporation, Nippon Graphite Fiber Co. Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The global automotive carbon fiber composites market is experiencing significant growth driven by the increasing demand for lightweight materials within the automotive sector and an emphasis on fuel economy. Carbon fiber offers a good strength-to-weight ratio, almost twice that of conventional metals, and emerges as a highly effective alternative, helpful in vehicle weight reduction, improving fuel efficiency and engine performance. According to the United States Environmental Protection Agency (EPA), the transportation industry in the U.S. accounted for 28% of greenhouse gas (GHG) emissions in 2022, further underscoring the need for more efficient automotive solutions. The appeal of carbon fiber is amplified by emission norms and escalating fuel prices, compelling automakers to adopt innovative materials. Prominent automotive manufacturers such as BMW, Audi, GM, Honda, and Polestar are partnering with carbon fiber producers to streamline mass production and cut costs, meeting the evolving demands of vehicle OEMs, system suppliers, and consumers.

Restraining Factors

The global automotive carbon fiber composites market might face several restraining factors. For instance, due to the COVID-19 pandemic, the sales of automobiles have declined, resulting in reduced demand for automotive composites. Carbon fiber's high cost typically restricts its use to high-end sports cars, luxury vehicles, and high-performance models, as their usage in low-cost vehicles could drastically increase the prices. Repairing it can be challenging and costly because of its intricate structure, and recycling the material is both difficult and energy-intensive.

Market Segmentation

The global automotive carbon fiber composites market share is classified into vehicle type, application, and production type.

- The passenger car segment is expected to hold the largest share of the global automotive carbon fiber composites market during the forecast period.

Based on the vehicle type, the global automotive carbon fiber composites market is divided into passenger cars and commercial vehicles. Among these, the passenger car segment is expected to hold the largest share of the global automotive carbon fiber composites market during the forecast period. This dominance is attributed to the high demand for lightweight materials that enhance fuel efficiency and reduce emissions in personal vehicles. Carbon fiber composites are used in passenger cars due to their superior strength-to-weight ratio, which improves vehicle performance and safety. Additionally, the growing consumer preference for high-performance sports cars and luxury vehicles, which heavily use carbon fiber components drives the demand.

- The exteriors segment is expected to hold the largest share of the global automotive carbon fiber composites market during the forecast period.

Based on the application, the global automotive carbon fiber composites market is divided into structural assembly, powertrain components, interiors, and exteriors. Among these, the exteriors segment is expected to hold the largest share of the global automotive carbon fiber composites market during the forecast period. This segment is driven by the benefits that carbon fiber composites offer in vehicle exterior applications, such as body panels, hoods, and bumpers. The lightweight nature of carbon fiber composites improves vehicle aerodynamics and fuel efficiency, which is crucial for manufacturers looking to meet emission regulations. Additionally, the material's excellent strength and durability provide enhanced safety and longevity for exterior components. Consumer demand for aesthetically pleasing and high-performance vehicles further fuels the use of carbon fiber composites in exteriors, as these materials allow innovative and sleek design possibilities.

- The resin transfer molding segment is expected to grow at the fastest CAGR in the global automotive carbon fiber composites market during the forecast period.

Based on production type, the global automotive carbon fiber composites market is divided into hand layup, resin transfer molding, vacuum infusion processing, injection molding, and compression molding. Among these, the resin transfer molding segment is expected to grow at the fastest CAGR in the global automotive carbon fiber composites market during the forecast period. Resin transfer molding can produce high-strength, lightweight components with complex geometries at a relatively lower cost than other production methods. The process's efficiency in reducing production cycle times makes it attractive for large-scale manufacturing in the automotive industry. Additionally, RTM offers better material properties and superior surface finishes for the aesthetic and functional aspects of automotive components. The increasing adoption of electric vehicles, which require lighter materials for better performance and efficiency, further propels the demand.

Regional Segment Analysis of the Global Automotive Carbon Fiber Composites Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

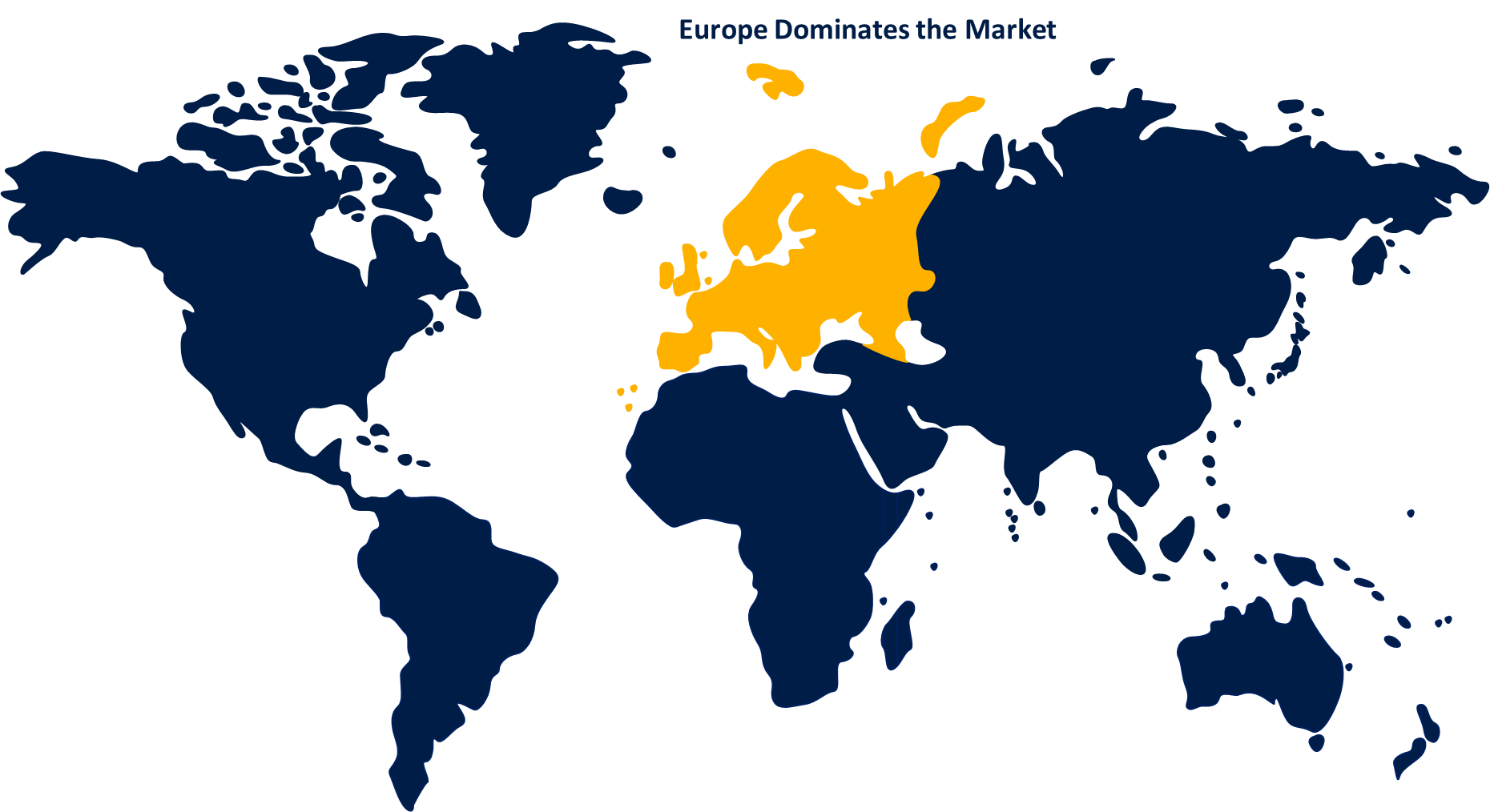

Europe is anticipated to hold the largest share of the global automotive carbon fiber composites market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global automotive carbon fiber composites market over the predicted timeframe. This dominance is driven by strict emission regulations and a strong focus on sustainability, which compels automotive manufacturers to adopt lightweight materials like carbon fiber composites. The presence of major automakers, particularly in countries such as Germany, the U.K., and France, supports market growth through investments in research and development. Additionally, the region's well-established automotive industry ecosystem and funding for innovative materials and green technologies help drive the adoption of carbon fiber composites. The rising consumer demand for high-performance and luxury vehicles, which extensively use carbon fiber composites for their superior strength-to-weight ratio, contributes significantly to market growth.

North America is expected to grow at the fastest pace in the global automotive carbon fiber composites market during the predicted timeframe. The growth is driven by the large automotive industry, increasing investments in advanced materials and manufacturing technologies. North America has a large vehicle modification market supporting this growth. The United States and Canada are leading the charge with significant research and development efforts aimed at reducing vehicle weight to enhance fuel efficiency. Additionally, the growing adoption of electric vehicles (EVs) and high-performance cars, which use carbon fiber composites for better efficiency and durability, further fuels the demand. The presence of several automotive manufacturers also supports the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global automotive carbon fiber composites market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toray Industries Inc.

- Hexcel Corporation

- SGL Carbon SE

- Teijin Limited

- Cytec Industries

- ACP Composites Inc.

- Clearwater Composites LLC

- Owens Corning

- HITCO Carbon Composites Inc.

- Mitsubishi Rayon Carbon Fiber and Composites Inc.

- Polar Manufacturing Limited

- Rock West Composites

- DowAksa Advanced Composites Holdings BV

- Formosa Plastics Corporation

- Nippon Graphite Fiber Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Porsche worked with Action Composites to design and manufacture an innovative carbon fiber safety cage option to lightweight one of its series race vehicles, built in a one-shot compression molding process.

- In February 2024, NREL’s recyclable carbon fiber composites made greener with thermoforming. Recycling advancement reduces costs and greenhouse gas emissions of material’s second life by 90% to 95%.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global automotive carbon fiber composites market based on the below-mentioned segments:

Global Automotive Carbon Fiber Composites Market, By Vehicle Type

- Passenger Car

- Commercial Vehicle

Global Automotive Carbon Fiber Composites Market, By Application

- Structural Assembly

- Powertrain Components

- Interiors

- Exteriors

Global Automotive Carbon Fiber Composites Market, By Production Type

- Hand Layup

- Resin Transfer Molding

- Vacuum Infusion Processing

- Injection Molding

- Compression Molding

Global Automotive Carbon Fiber Composites Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Toray Industries Inc., Hexcel Corporation, SGL Carbon SE, Teijin Limited, Cytec Industries, ACP Composites Inc., Clearwater Composites LLC, Owens Corning, HITCO Carbon Composites Inc., Mitsubishi Rayon Carbon Fiber and Composites Inc., Polar Manufacturing Limited, Rock West Composites, DowAksa Advanced Composites Holdings BV, Formosa Plastics Corporation, Nippon Graphite Fiber Co. Ltd., and Others.

-

2. What is the size of the global automotive carbon fiber composites market?The Global Automotive Carbon Fiber Composites Market is expected to grow from USD 23.92 Billion in 2023 to USD 43.67 Billion by 2033, at a CAGR of 6.20% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Europe is anticipated to hold the largest share of the global automotive carbon fiber composites market over the predicted timeframe.

Need help to buy this report?