Global Automotive Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber Type (Glass Fiber, Carbon Fiber), By Manufacturing Process (Compression Molding, Injection Molding, Resin Transfer Molding), By Application (Exterior, Interior, Powertrain), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Automotive Composites Market Insights Forecasts to 2033

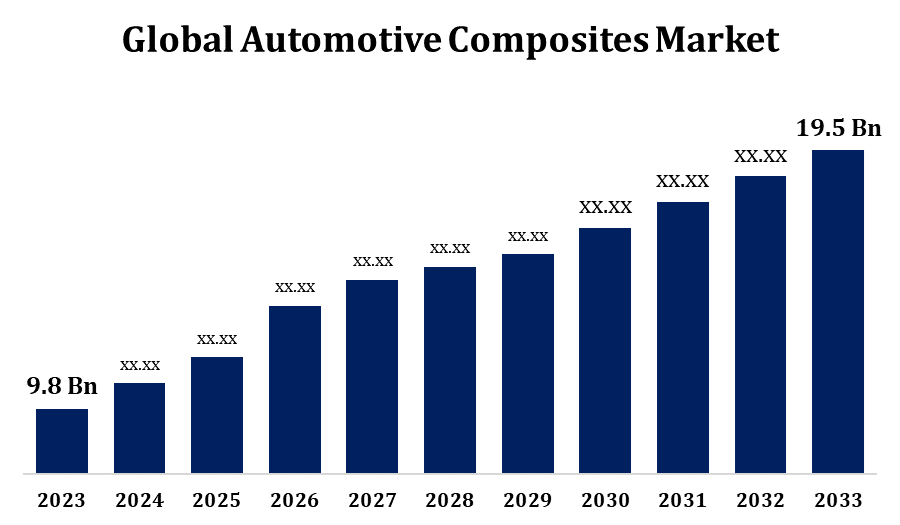

- The Automotive Composites Market was valued at USD 9.8 billion in 2023.

- The Market Size is Growing at a CAGR of 7.12% From 2023 to 2033.

- The Global Automotive Composites Market is expected to reach USD 19.5 billion by 2033.

- Asia Pacific is Expected to Grow the Fastest during the Forecast period.

Get more details on this report -

The Global Automotive Composites Market is expected to reach USD 19.5 billion by 2033, at a CAGR of 7.12% during the forecast period 2023 to 2033.

The automotive composites market is growing rapidly, driven by the need for lightweight, fuel-efficient vehicles with enhanced performance. Composites, which combine materials like carbon fiber, glass fiber, and natural fibers, provide high strength-to-weight ratios and durability, making them ideal for automotive applications. Key sectors benefiting include electric vehicles (EVs), as composites help offset battery weight, improving efficiency. Major car manufacturers are increasingly using composites in structural, interior, and exterior components to meet stringent emissions and safety regulations. However, high production costs and complex manufacturing processes challenge market expansion. Innovations in recycling and bio-based composites offer growth potential, particularly as sustainability concerns rise. Asia-Pacific, North America, and Europe lead in market share, with strong demand from automotive hubs in China, the U.S., and Germany.

Automotive Composites Market Value Chain Analysis

The automotive composites market value chain involves raw material suppliers, composite manufacturers, part fabricators, automotive OEMs, and end-users. Raw materials, such as carbon fiber, glass fiber, and resin, are sourced from chemical suppliers and processed by composite manufacturers into sheets, prepregs, or molded parts. Part fabricators then create specialized components like body panels, structural parts, and interior elements. Automotive OEMs integrate these components into vehicles, leveraging the lightweight, high-strength qualities of composites to enhance fuel efficiency and meet emission standards. In electric vehicles (EVs), composites play a critical role in improving range by reducing weight. As demand for durable, eco-friendly materials grows, the value chain increasingly emphasizes innovation in recycling and bio-based composites to align with sustainability trends, further supporting market expansion.

Automotive Composites Market Opportunity Analysis

The automotive composites market offers substantial growth opportunities, driven by the demand for lightweight, fuel-efficient vehicles and increasing electric vehicle (EV) adoption. Composites, such as carbon fiber and glass fiber, help reduce vehicle weight, enhancing fuel efficiency and battery performance in EVs, where range extension is critical. Additionally, stringent global emission regulations push automakers to adopt advanced materials to meet environmental standards without sacrificing performance. Growth in electric, hybrid, and high-performance vehicles has led manufacturers to invest in composite innovation for structural, interior, and exterior applications. Rising interest in sustainability also fuels the development of recyclable and bio-based composites, providing an eco-friendly alternative. Asia-Pacific, North America, and Europe lead in demand, positioning the automotive composites market for continued expansion as the industry shifts toward greener, more efficient vehicles.

Global Automotive Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 9.8 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.12% |

| 2033 Value Projection: | USD 19.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Fiber Type, By Manufacturing Process, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Toray Industries Inc. (Japan), SGL Carbon (Germany), Teijin Limited (Japan), Mitsubishi Chemical Holding Corporation (Japan), Hexcel Corporation (US), Owen Cornings (US), Solvay SA (Belgium), Gurit (Switzerland), UFP Technologies Ltd. (US), Huntsman Corporation (US), Hexion (US), and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Composites Market Dynamics

Rise in demand for lightweight and fuel-efficient vehicles to propel the market growth

The rising demand for lightweight, fuel-efficient vehicles is a key driver of growth in the automotive composites market. As consumers and regulators push for greater fuel efficiency and lower emissions, automotive manufacturers are increasingly turning to composites, such as carbon fiber and glass fiber, which offer high strength-to-weight ratios. Reducing vehicle weight not only improves fuel economy in conventional vehicles but also extends battery range in electric vehicles (EVs), where weight reduction is essential. These materials allow automakers to meet stringent environmental regulations without compromising on vehicle safety or performance. Investments in composite technologies for structural, exterior, and interior applications are helping manufacturers design lighter, more eco-friendly vehicles. With the global automotive industry emphasizing efficiency and sustainability, the use of advanced composites is set to expand significantly.

Restraints & Challenges

The automotive composites market faces several challenges, primarily due to the high costs of raw materials like carbon fiber and advanced resins, which limit accessibility for cost-sensitive manufacturers. Additionally, the complex and labor-intensive processes required to mold and assemble composite parts make large-scale production more expensive and time-consuming compared to traditional materials. Recycling and environmental disposal of certain composites pose further obstacles, especially as sustainability expectations rise. Limited design flexibility and difficulties in integrating composites with other automotive materials can complicate the production process. High-performance composites also require specialized equipment and skilled labor, adding to production costs and limiting adoption. Despite strong growth potential, addressing these issues through advancements in manufacturing processes, recycling technologies, and affordable materials will be critical for wider adoption in the automotive industry.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Composites Market from 2023 to 2033. Stricter fuel economy and emission regulations drive the use of composites, as they offer high strength-to-weight ratios that improve vehicle efficiency without compromising safety. The region's established automotive industry, with key players like Ford, General Motors, and Tesla, is investing in advanced materials, including carbon fiber and glass fiber composites, for vehicle body panels, interiors, and under-the-hood applications. Electric vehicles (EVs) also contribute to demand, as composites help reduce battery weight, increasing EV range. North America’s R&D emphasis on sustainable composites, including recyclable and bio-based materials, supports market growth. With substantial investments and consumer interest in innovative vehicles, the North American market is well-positioned for continued expansion.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Developing countries are major automotive manufacturing hubs, with companies adopting advanced materials to meet regulatory standards for emissions and efficiency. In China, the government’s emphasis on electric vehicle (EV) production is boosting demand for composites, as these materials help reduce vehicle weight and improve battery performance. Japan and South Korea are leveraging composites in luxury and high-performance vehicles to enhance fuel efficiency and reduce emissions. Additionally, the region benefits from lower manufacturing costs, encouraging foreign investments in composite technology. With expanding EV adoption and ongoing advancements in composite manufacturing, Asia-Pacific is poised for substantial market growth in automotive composites.

Segmentation Analysis

Insights by Fiber Type

The glass fiber segment accounted for the largest market share over the forecast period 2023 to 2033. Glass fiber composites are widely used in automotive parts, including body panels, interiors, and structural components, where high strength and flexibility are essential. Unlike carbon fiber, glass fiber offers an affordable option that meets the needs of mass-market and mid-range vehicles, enabling manufacturers to enhance fuel efficiency without escalating costs. This material’s adaptability and ease of production have increased its use in electric vehicles (EVs), where weight reduction is critical for extending battery range. As automotive manufacturers strive to meet emission regulations and consumer demand for fuel-efficient vehicles, glass fiber composites are expected to remain a key growth segment in the automotive market.

Insights by Manufacturing Process

The compression molding segment accounted for the largest market share over the forecast period 2023 to 2033. This process is well-suited for large-volume production, enabling automotive manufacturers to meet increasing demands for lightweight materials in a cost-effective way. Compression molding allows the use of various composite materials, including glass and carbon fiber, which provide excellent durability and structural integrity for automotive applications like underbody shields, interior panels, and structural parts. The technique’s relatively low cycle time and high material yield make it attractive for electric vehicles (EVs), where reducing weight is critical for enhancing battery performance. Additionally, advancements in compression molding technology, such as automation, are improving production efficiency, further driving adoption in the automotive sector for both conventional and electric vehicles.

Insights by Application

The exterior segment accounted for the largest market share over the forecast period 2023 to 2033. Composite materials, including carbon fiber and glass fiber, are increasingly used in exterior components like bumpers, hoods, fenders, and panels due to their high strength-to-weight ratio, impact resistance, and corrosion resistance. This demand is especially strong in electric and hybrid vehicles, where weight reduction directly improves range and efficiency. Furthermore, composites offer design flexibility, allowing for complex, aerodynamic shapes that improve vehicle aesthetics and performance. With stringent environmental regulations pushing for lower emissions, automotive manufacturers are investing in advanced composites for exterior applications, positioning this segment for continued growth as they strive to create safer, lighter, and more sustainable vehicles.

Recent Market Developments

- On June 2021, Mitsubishi Chemical Co., Ltd. has announced the creation of a new carbon fiber prepreg designed for use in automotive engine components.

Competitive Landscape

Major players in the market

- Toray Industries Inc. (Japan)

- SGL Carbon (Germany)

- Teijin Limited (Japan)

- Mitsubishi Chemical Holding Corporation (Japan)

- Hexcel Corporation (US)

- Owen Cornings (US)

- Solvay SA (Belgium)

- Gurit (Switzerland)

- UFP Technologies Ltd. (US)

- Huntsman Corporation (US)

- Hexion (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Composites Market, Fiber Type Analysis

- Glass Fiber

- Carbon Fiber

Automotive Composites Market, Manufacturing Process Analysis

- Compression Molding

- Injection Molding

- Resin Transfer Molding

Automotive Composites Market, Application Analysis

- Exterior

- Interior

- Powertrain

Automotive Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Composites Market?The global Automotive Composites Market is expected to grow from USD 9.8 billion in 2023 to USD 19.5 billion by 2033, at a CAGR of 7.12% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Composites Market?Some of the key market players of the market are Toray Industries Inc. (Japan), SGL Carbon (Germany), Teijin Limited (Japan), Mitsubishi Chemical Holding Corporation (Japan), Hexcel Corporation (US), Owen Cornings (US), Solvay SA (Belgium), Gurit (Switzerland), UFP Technologies Ltd. (US), Huntsman Corporation (US), and Hexion (US).

-

3. Which segment holds the largest market share?The exterior segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Composites Market?North America dominates the Automotive Composites Market and has the highest market share.

Need help to buy this report?