Global Automotive Foam Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyurethane (PU) Foam, Polyolefin (PO) Foam, Others), By End-use (Passenger Cars, LCV, HCV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Automotive Foam Market Insights Forecasts to 2033

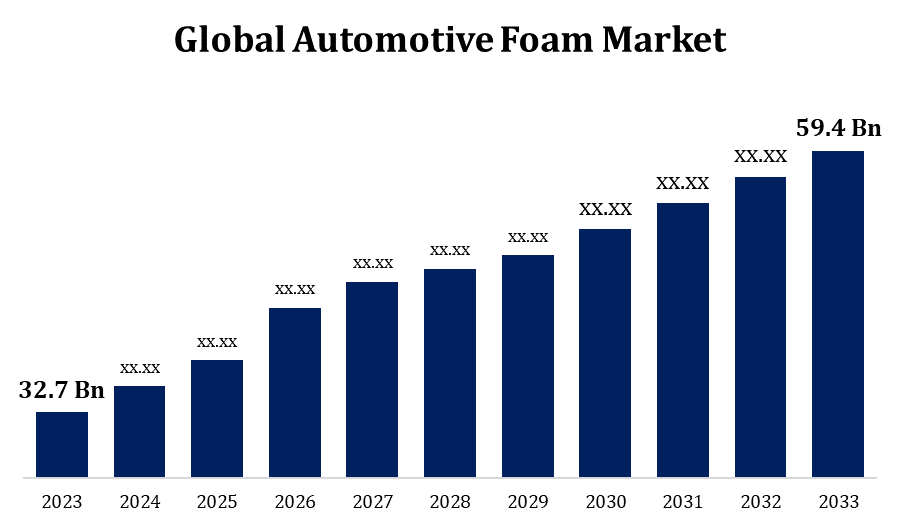

- The Automotive Foam Market Size was valued at USD 32.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.15% from 2023 to 2033.

- The Worldwide Automotive Foam Market Size is expected to reach USD 59.4 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Automotive Foam Market Size is expected to reach USD 59.4 Billion by 2033, at a CAGR of 6.15% during the forecast period 2023 to 2033.

The automotive foam market is a significant segment of the global automotive industry, driven by increasing demand for lightweight materials that improve fuel efficiency and enhance safety. Foams are used in various automotive applications, including seats, headliners, door panels, and insulation, offering benefits such as sound dampening, vibration reduction, and thermal insulation. As the automotive industry shifts towards electric vehicles (EVs), foams are becoming more crucial due to their role in weight reduction and energy efficiency. The market is also influenced by trends in comfort, safety, and environmental sustainability, with manufacturers increasingly focusing on eco-friendly and recyclable foam solutions. Key players are investing in advanced technologies to produce high-performance foams, ensuring a competitive edge in this rapidly evolving market.

Automotive Foam Market Value Chain Analysis

The automotive foam market value chain involves several key stages, from raw material sourcing to end-product manufacturing. It begins with the procurement of raw materials such as polyols, isocyanates, and additives used to create polyurethane, polyethylene, and other foam types. These materials are processed by chemical manufacturers to produce foam formulations tailored for automotive applications. Foam manufacturers then convert these raw materials into specific foam products, such as seat cushions, insulation, and soundproofing materials. These foams are supplied to automotive OEMs (Original Equipment Manufacturers) and tier suppliers, who integrate them into vehicle components. Finally, the finished products reach the consumer market through vehicle sales. Throughout the value chain, innovation and collaboration between manufacturers focus on enhancing foam properties for safety, comfort, and sustainability in automotive design.

Automotive Foam Market Opportunity Analysis

The automotive foam market presents several growth opportunities, driven by evolving consumer preferences, regulatory requirements, and technological advancements. With increasing demand for lightweight materials to enhance fuel efficiency and reduce carbon emissions, foams are becoming integral in the production of electric vehicles (EVs) and hybrids. Innovations in eco-friendly and recyclable foam materials offer a chance to cater to the growing sustainability trend. Additionally, advancements in foam technology, such as the development of high-performance foams with enhanced safety features and comfort, are expanding the market. The rising focus on vehicle soundproofing, insulation, and crash protection further boosts demand. As global automakers shift toward more efficient and eco-conscious manufacturing processes, opportunities for automotive foam suppliers to collaborate on developing advanced materials continue to rise, presenting a promising market trajectory.

Global Automotive Foam Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 32.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.15% |

| 2033 Value Projection: | USD 59.4 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 254 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By End-use, and By Region. |

| Companies covered:: | Johnson Controls., Woodbridge., Lear Corp., Bridgestone Corporation, Armacell, Rogers Communications, BASF SE, Recticel, Vitafoam Nig. PLC, Saint-Gobain, Stepan Company, NGCT Cleansys Pvt. Ltd., ABRO Industries, Inc., BG Products, Inc., Auto Industrial Marine Chemicals, Inc., Dun & Bradstreet, Inc., 3M, Radiator Specialty Company, Cox Industries Inc., CRC INDUSTRIES, and Others |

| Growth Drivers: | Increasing demand for electric vehicles to drive the market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Automotive Foam Market Dynamics

Increasing demand for electric vehicles to drive the market growth

The growing demand for electric vehicles (EVs) is a key driver of the automotive foam market, as these vehicles prioritize lightweight construction and energy efficiency. Foams, particularly polyurethane and polyethylene, are crucial in reducing vehicle weight, improving range, and enhancing energy efficiency. As EVs rely on lightweight materials to maximize battery life and reduce energy consumption, foams are used in components like seats, insulation, soundproofing, and crash protection systems. Additionally, foams provide thermal insulation, crucial for battery management systems in electric vehicles. The shift towards sustainability also encourages the development of eco-friendly foam alternatives, aligning with the automotive industry's goal of reducing carbon emissions. As EV adoption accelerates, the demand for advanced foams, offering both functional and environmental benefits, will continue to drive market growth.

Restraints & Challenges

The high cost of raw materials, such as polyols and isocyanates, can impact production costs, making it difficult for manufacturers to maintain competitive pricing. Additionally, fluctuations in the prices of petroleum-based materials pose a risk to market stability. Regulatory requirements related to sustainability and eco-friendliness are increasing, demanding innovation in the development of recyclable or biodegradable foam solutions. Furthermore, the complexity of integrating new foam technologies into existing automotive production processes can slow down adoption. The market also faces challenges in meeting the growing demand for high-performance foams that balance safety, comfort, and environmental impact, requiring continuous investment in research and development.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Automotive Foam Market from 2023 to 2033. The North American automotive foam market is poised for significant growth, driven by rising demand for lightweight materials, particularly in the production of electric vehicles (EVs) and hybrid cars. The region is home to major automotive manufacturers who are increasingly focused on reducing vehicle weight to improve fuel efficiency and meet stringent environmental regulations. Foam materials, such as polyurethane and polyethylene, are widely used in North American vehicles for insulation, seating, soundproofing, and safety applications. Moreover, the growing trend towards sustainability in the automotive sector has spurred the development of eco-friendly foam solutions. The presence of established automotive OEMs and a strong focus on innovation make North America a key market for advanced automotive foams. As EV adoption accelerates, the demand for high-performance foams will continue to expand in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The rising adoption of EVs in Asia Pacific boosts demand for lightweight materials, including foams, to enhance vehicle range and battery performance. Additionally, the region is seeing a shift towards sustainability, with manufacturers prioritizing eco-friendly and recyclable foam solutions. The growing middle-class population and urbanization are also contributing to increased vehicle sales, further expanding the market. Innovations in foam technologies, such as soundproofing and crash protection, are driving the demand for high-performance foams across the automotive sector.

Segmentation Analysis

Insights by Type

The Polyurethane (PU) foam segment accounted for the largest market share over the forecast period 2023 to 2033. PU foam is widely used in automotive applications, including seats, headliners, door panels, and insulation materials, due to its ability to enhance comfort, reduce noise, and improve energy efficiency. As automotive manufacturers focus on reducing vehicle weight to meet fuel efficiency and emission standards, PU foam is increasingly favored for its lightweight nature. The growing demand for electric vehicles (EVs), which require advanced insulation and lightweight components for better battery performance, further drives the demand for PU foams. Additionally, PU foam's ability to be customized for various applications, including soundproofing and crash protection, is supporting its widespread adoption in the automotive industry.

Insights by End Use

The passenger cars segment accounted for the largest market share over the forecast period 2023 to 2033. The passenger car segment is a significant growth driver in the automotive foam market, fueled by rising consumer demand for enhanced comfort, safety, and fuel efficiency. Foams are integral in various components of passenger vehicles, including seats, door panels, headliners, and insulation, where they provide noise reduction, thermal insulation, and vibration damping. As automakers increasingly focus on reducing vehicle weight for better fuel economy and meeting stringent emission regulations, lightweight foams like polyurethane (PU) and polyethylene are gaining popularity. The growing trend of electric vehicle (EV) adoption also drives the demand for advanced foams in passenger cars, as these vehicles require efficient insulation and lightweight materials for better performance. Additionally, passenger vehicles are increasingly incorporating eco-friendly and high-performance foam materials, supporting the segment's ongoing growth in the automotive foam market.

Recent Market Developments

- In May 2022, King Long United Automotive (SuZhou) Co., Ltd., a prominent bus manufacturer in China, has partnered with BASF SE to develop Elastoflex CE 3651/108, a water-blown polyurethane insulation spray foam.

Competitive Landscape

Major players in the market

- Johnson Controls.

- Woodbridge.

- Lear Corp.

- Bridgestone Corporation

- Armacell

- Rogers Communications

- BASF SE

- Recticel

- Vitafoam Nig. PLC

- Saint-Gobain

- Stepan Company

- NGCT Cleansys Pvt. Ltd.

- ABRO Industries, Inc.

- BG Products, Inc.

- Auto Industrial Marine Chemicals, Inc.

- Dun & Bradstreet, Inc.

- 3M

- Radiator Specialty Company

- Cox Industries Inc.

- CRC INDUSTRIES

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Automotive Foam Market, Type Analysis

- Polyurethane (PU) Foam

- Polyolefin (PO) Foam

- Others

Automotive Foam Market, End Use Analysis

- Passenger Cars

- LCV

- HCV

Automotive Foam Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Automotive Foam Market?The global Automotive Foam Market is expected to grow from USD 32.7 billion in 2023 to USD 59.4 billion by 2033, at a CAGR of 6.15% during the forecast period 2023-2033.

-

2. Who are the key market players of the Automotive Foam Market?Some of the key market players of the market are Johnson Controls., Woodbridge., Lear Corp., Bridgestone Corporation, Armacell, Rogers Communications, BASF SE, Recticel, Vitafoam Nig. PLC, Saint-Gobain, Stepan Company, NGCT Cleansys Pvt. Ltd., ABRO Industries, Inc., BG Products, Inc., Auto Industrial Marine Chemicals, Inc., Dun & Bradstreet, Inc. 3M, Radiator Specialty Company, Cox Industries Inc. and CRC INDUSTRIES.

-

3. Which segment holds the largest market share?The passenger cars segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Automotive Foam Market?North America dominates the Automotive Foam Market and has the highest market share.

Need help to buy this report?